ND 1NR Internet Fillable Form

What is the ND 1NR Internet Fillable

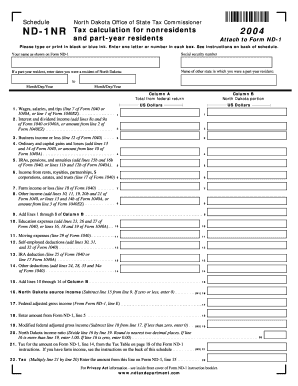

The ND 1NR Internet Fillable form is a specific tax document used by non-resident individuals who earn income in North Dakota. This form allows taxpayers to report their income and calculate the appropriate state tax owed. It is designed to streamline the filing process, making it easier for users to submit their information electronically. The Internet Fillable version ensures that the form can be completed online, reducing the need for paper forms and manual submissions.

How to use the ND 1NR Internet Fillable

Using the ND 1NR Internet Fillable form involves several straightforward steps. First, access the form through a compatible web browser. Once opened, you can fill in the required fields, which include personal information, income details, and deductions. The form is designed to guide you through the process, with prompts and instructions available for each section. After completing the form, review all entries for accuracy before submitting it electronically. Make sure to save a copy for your records.

Steps to complete the ND 1NR Internet Fillable

Completing the ND 1NR Internet Fillable form can be broken down into clear steps:

- Open the form in a web browser.

- Enter your personal information, including your name, address, and Social Security number.

- Report your income from North Dakota sources in the designated section.

- Include any applicable deductions or credits.

- Review the completed form for any errors or omissions.

- Submit the form electronically through the designated submission method.

Legal use of the ND 1NR Internet Fillable

The ND 1NR Internet Fillable form is legally recognized by the state of North Dakota for tax reporting purposes. Non-resident individuals who earn income in the state are required to use this form to comply with state tax laws. Filing the form accurately and on time is essential to avoid penalties. It is advisable to consult with a tax professional if you have questions regarding your specific tax situation or the legal implications of filing this form.

Filing Deadlines / Important Dates

Filing deadlines for the ND 1NR Internet Fillable form typically align with the federal tax deadlines. Generally, the form must be submitted by April 15 for the previous tax year. If you require additional time, you may file for an extension, but it is crucial to understand that any taxes owed must still be paid by the original deadline to avoid interest and penalties. Always check for any changes to deadlines that may occur due to state regulations or special circumstances.

Required Documents

To complete the ND 1NR Internet Fillable form, you will need several key documents:

- Your Social Security number or Individual Taxpayer Identification Number (ITIN).

- Documentation of income earned in North Dakota, such as W-2 forms or 1099 forms.

- Records of any deductions or credits you plan to claim.

- Previous year’s tax return for reference, if applicable.

Form Submission Methods (Online / Mail / In-Person)

The ND 1NR Internet Fillable form can be submitted electronically, which is the most efficient method. After completing the form online, you can submit it directly through the designated electronic filing system. Alternatively, if you prefer, you can print the completed form and mail it to the appropriate tax authority in North Dakota. In-person submissions are generally not required, but you may visit local tax offices for assistance if needed.

Quick guide on how to complete nd 1nr internet fillable

Effortlessly complete [SKS] on any device

Managing documents online has become increasingly popular among companies and individuals alike. It serves as an excellent environmentally friendly alternative to traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

Efficiently modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes just seconds and has the same legal validity as a conventional handwritten signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method of sharing the form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] to ensure outstanding communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nd 1nr internet fillable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ND 1NR Internet Fillable?

ND 1NR Internet Fillable is a digital form designed for easy completion and submission online. It allows users to fill out necessary information electronically, streamlining the process of document management. With airSlate SignNow, you can create, send, and eSign ND 1NR Internet Fillable forms effortlessly.

-

How much does it cost to use ND 1NR Internet Fillable with airSlate SignNow?

The pricing for using ND 1NR Internet Fillable with airSlate SignNow varies based on the subscription plan you choose. We offer flexible pricing options that cater to businesses of all sizes, ensuring you get the best value for your needs. Visit our pricing page for detailed information on plans and features.

-

What features are included with ND 1NR Internet Fillable?

ND 1NR Internet Fillable includes features such as customizable templates, electronic signatures, and secure document storage. Additionally, users can track the status of their forms and receive notifications upon completion. These features enhance efficiency and ensure a smooth workflow.

-

What are the benefits of using ND 1NR Internet Fillable?

Using ND 1NR Internet Fillable offers numerous benefits, including time savings, reduced paperwork, and improved accuracy. It allows users to complete forms from anywhere, at any time, making it a convenient solution for busy professionals. Moreover, it enhances collaboration by enabling multiple users to access and sign documents simultaneously.

-

Can ND 1NR Internet Fillable be integrated with other software?

Yes, ND 1NR Internet Fillable can be seamlessly integrated with various software applications, enhancing its functionality. airSlate SignNow supports integrations with popular tools like Google Drive, Salesforce, and more. This allows users to streamline their workflows and manage documents more effectively.

-

Is ND 1NR Internet Fillable secure?

Absolutely! ND 1NR Internet Fillable is designed with security in mind. airSlate SignNow employs advanced encryption and compliance measures to protect your data and ensure that your documents are safe from unauthorized access. You can trust that your information is secure while using our platform.

-

How can I get started with ND 1NR Internet Fillable?

Getting started with ND 1NR Internet Fillable is easy! Simply sign up for an account on the airSlate SignNow website, choose your plan, and start creating your fillable forms. Our user-friendly interface and helpful resources will guide you through the process, making it simple to begin.

Get more for ND 1NR Internet Fillable

Find out other ND 1NR Internet Fillable

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple