ND 1NR Tax Calculation for Nonresidents and Part Year Residents ND 1NR Tax Calculation for Nonresidents and Part Year Residents Form

Understanding the ND 1NR Tax Calculation for Nonresidents and Part-Year Residents

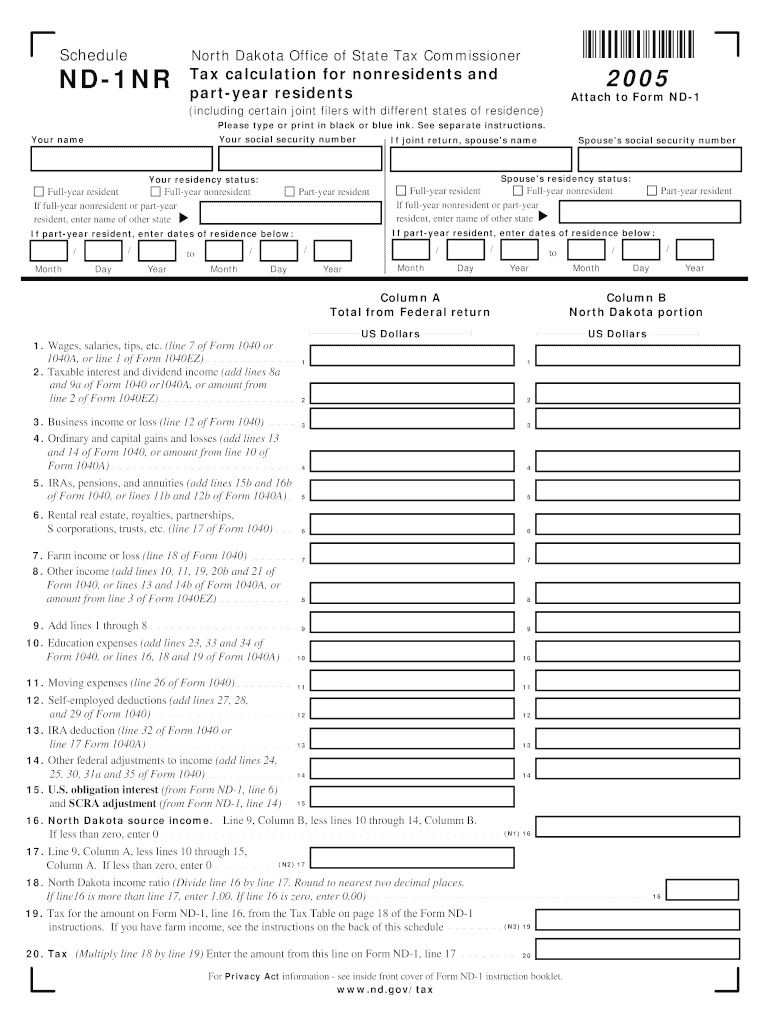

The ND 1NR Tax Calculation for Nonresidents and Part-Year Residents is a specific form used by individuals who do not reside in North Dakota for the entire tax year or who have moved in or out of the state during the year. This form helps determine the appropriate tax liability based on income earned while in North Dakota. It is essential for ensuring compliance with state tax regulations and accurately reflecting the income earned in the state.

How to Use the ND 1NR Tax Calculation for Nonresidents and Part-Year Residents

To effectively use the ND 1NR Tax Calculation, individuals should gather all relevant income documentation, including W-2 forms and any 1099s. The form requires taxpayers to report income earned in North Dakota and to apply the appropriate tax rates. Users should carefully follow the instructions provided with the form, ensuring that all calculations are accurate to avoid potential issues with state tax authorities.

Steps to Complete the ND 1NR Tax Calculation for Nonresidents and Part-Year Residents

Completing the ND 1NR Tax Calculation involves several steps:

- Gather all necessary documents, including income statements and any deductions applicable to your situation.

- Fill out the personal information section, ensuring accuracy in reporting your residency status.

- Calculate the total income earned in North Dakota and report it in the designated section.

- Apply any applicable deductions and credits to determine your taxable income.

- Use the provided tax tables to calculate the tax owed based on your taxable income.

- Review the completed form for accuracy before submission.

Required Documents for the ND 1NR Tax Calculation

When preparing to fill out the ND 1NR Tax Calculation, taxpayers should have the following documents on hand:

- W-2 forms from employers for income earned in North Dakota.

- 1099 forms for any additional income sources.

- Documentation for any deductions or credits you plan to claim.

- Personal identification information, including Social Security numbers.

Filing Deadlines for the ND 1NR Tax Calculation

It is crucial to be aware of the filing deadlines associated with the ND 1NR Tax Calculation. Typically, the deadline for submitting this form aligns with the federal tax filing deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should verify specific dates each year to ensure timely filing and avoid penalties.

Penalties for Non-Compliance with the ND 1NR Tax Calculation

Failure to comply with the ND 1NR Tax Calculation requirements can result in penalties from the state tax authorities. These penalties may include fines, interest on unpaid taxes, and potential legal action for failure to file. It is essential for nonresidents and part-year residents to accurately complete and submit the form to avoid these consequences.

Quick guide on how to complete nd 1nr tax calculation for nonresidents and part year residents nd 1nr tax calculation for nonresidents and part year residents

Complete [SKS] seamlessly on any gadget

Online document management has become increasingly favored by both enterprises and individuals. It serves as an ideal eco-conscious alternative to conventional printed and signed paperwork, allowing you to locate the needed form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your files swiftly and without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to ND 1NR Tax Calculation For Nonresidents And Part year Residents ND 1NR Tax Calculation For Nonresidents And Part year Residents

Create this form in 5 minutes!

How to create an eSignature for the nd 1nr tax calculation for nonresidents and part year residents nd 1nr tax calculation for nonresidents and part year residents

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ND 1NR Tax Calculation For Nonresidents And Part year Residents?

ND 1NR Tax Calculation For Nonresidents And Part year Residents refers to the process of determining tax obligations for individuals who do not reside in North Dakota for the entire year. This calculation is essential for ensuring compliance with state tax laws and accurately reporting income earned within the state.

-

How can airSlate SignNow assist with ND 1NR Tax Calculation For Nonresidents And Part year Residents?

airSlate SignNow provides a streamlined platform for managing documents related to ND 1NR Tax Calculation For Nonresidents And Part year Residents. Users can easily send, sign, and store tax-related documents, ensuring that all necessary paperwork is organized and accessible.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSignature capabilities, and automated workflows that simplify the ND 1NR Tax Calculation For Nonresidents And Part year Residents process. These tools help users save time and reduce errors in their tax documentation.

-

Is airSlate SignNow cost-effective for small businesses handling ND 1NR Tax Calculation For Nonresidents And Part year Residents?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses managing ND 1NR Tax Calculation For Nonresidents And Part year Residents. With flexible pricing plans, businesses can choose a package that fits their budget while still accessing essential features.

-

Can airSlate SignNow integrate with other accounting software for tax calculations?

Absolutely! airSlate SignNow can integrate seamlessly with various accounting software, enhancing the efficiency of ND 1NR Tax Calculation For Nonresidents And Part year Residents. This integration allows for easy data transfer and ensures that all tax-related information is synchronized across platforms.

-

What are the benefits of using airSlate SignNow for ND 1NR Tax Calculation For Nonresidents And Part year Residents?

Using airSlate SignNow for ND 1NR Tax Calculation For Nonresidents And Part year Residents offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform simplifies the entire process, allowing users to focus on their core business activities.

-

How secure is airSlate SignNow for handling sensitive tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive tax documents related to ND 1NR Tax Calculation For Nonresidents And Part year Residents. Users can trust that their information is safe and secure throughout the document management process.

Get more for ND 1NR Tax Calculation For Nonresidents And Part year Residents ND 1NR Tax Calculation For Nonresidents And Part year Residents

- Test requisition form cytogenetic laboratories iu health

- Member information king county

- Teamcare disability form

- Dsh form 2015 2019

- Manulife claim 2015 2019 form

- Amazon short term disability 2014 2019 form

- Authorization for the use ampamp disclosure of protected health form

- 095forropvccuritibanosrepete doc form

Find out other ND 1NR Tax Calculation For Nonresidents And Part year Residents ND 1NR Tax Calculation For Nonresidents And Part year Residents

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed