To GARNISHMENT Form

What is the TO GARNISHMENT

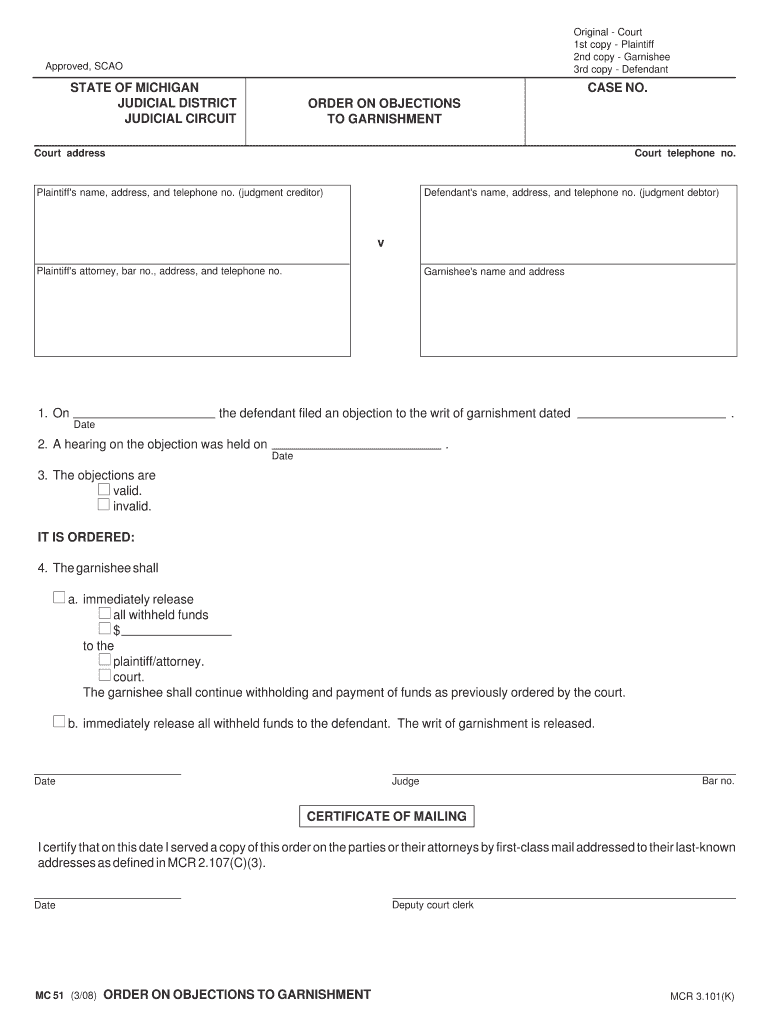

The TO GARNISHMENT form is a legal document used in the United States to initiate the process of garnishing an individual's wages or bank account to satisfy a debt. This form is typically filed by a creditor who has obtained a court judgment against the debtor. The garnishment allows the creditor to collect a portion of the debtor's earnings directly from their employer or financial institution, ensuring that the debt is paid. Understanding the purpose and implications of this form is essential for both creditors and debtors to navigate the legal landscape effectively.

Steps to complete the TO GARNISHMENT

Completing the TO GARNISHMENT form involves several important steps to ensure compliance with legal requirements. Here is a general outline of the process:

- Gather necessary information: Collect details such as the debtor's name, address, and social security number, as well as the creditor's information.

- Obtain a court judgment: Ensure that you have a valid court judgment against the debtor, as this is required to initiate garnishment.

- Fill out the form: Accurately complete the TO GARNISHMENT form, providing all required details and ensuring that the information is clear and legible.

- File the form with the court: Submit the completed form to the appropriate court, along with any required filing fees.

- Serve the form: Deliver a copy of the filed TO GARNISHMENT form to the debtor's employer or financial institution, following local rules for service of process.

Legal use of the TO GARNISHMENT

The legal use of the TO GARNISHMENT form is governed by state and federal laws. This form must be used in accordance with the Fair Debt Collection Practices Act, which protects consumers from abusive debt collection practices. Additionally, each state has specific regulations regarding the maximum amount that can be garnished from wages, the types of debts that can be collected through garnishment, and the procedures that must be followed. It is important for creditors to understand these laws to ensure that the garnishment process is conducted legally and ethically.

Who Issues the Form

The TO GARNISHMENT form is typically issued by the court where the creditor obtained the judgment against the debtor. It may also be available through state or local government websites that provide legal forms. In some cases, creditors may need to consult with an attorney to ensure that they are using the correct version of the form and that it complies with local legal requirements. Understanding the source of the form is crucial for ensuring its validity and effectiveness in the garnishment process.

Penalties for Non-Compliance

Failure to comply with the regulations surrounding the TO GARNISHMENT form can result in significant penalties for creditors. Non-compliance may lead to the dismissal of the garnishment action, potential fines, and even legal repercussions. Additionally, creditors may face challenges in collecting the owed debt if they do not follow proper procedures. Debtors may also have grounds to dispute the garnishment if they believe it was initiated improperly. Therefore, it is vital for creditors to adhere strictly to the legal guidelines when using this form.

Examples of using the TO GARNISHMENT

There are various scenarios in which the TO GARNISHMENT form may be utilized. For instance, a creditor may use this form to collect unpaid credit card debt, medical bills, or student loans. In each case, the creditor must have a valid court judgment to initiate the garnishment process. Additionally, the form can be used in different contexts, such as garnishing wages from an employer or seizing funds from a bank account. Understanding these examples can help both creditors and debtors navigate the garnishment process more effectively.

Quick guide on how to complete to garnishment

Complete TO GARNISHMENT effortlessly on any gadget

Virtual document management has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the suitable form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage TO GARNISHMENT on any device with airSlate SignNow Android or iOS applications and streamline any document-based task today.

How to edit and eSign TO GARNISHMENT with ease

- Obtain TO GARNISHMENT and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the files or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you prefer to send your document, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign TO GARNISHMENT and ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process to send documents for TO GARNISHMENT using airSlate SignNow?

To send documents for TO GARNISHMENT using airSlate SignNow, simply upload your document, add the necessary signers, and customize the signing order. The platform ensures that all parties can easily eSign the documents, making the process seamless and efficient. You can track the signing status in real-time.

-

How does airSlate SignNow enhance the TO GARNISHMENT process?

airSlate SignNow enhances the TO GARNISHMENT process by streamlining document preparation and eSigning. With features like templates and automated workflows, it saves time and reduces errors, ensuring that important documents are completed accurately. This efficiency can signNowly improve your business operations.

-

Is airSlate SignNow a cost-effective solution for TO GARNISHMENT?

Yes, airSlate SignNow is a cost-effective solution for TO GARNISHMENT, offering various pricing plans to fit different business needs. The platform eliminates the need for printing and mailing documents, which can save signNow costs over time. Additionally, the ease of use means less time is spent managing paperwork.

-

What features does airSlate SignNow offer for TO GARNISHMENT?

airSlate SignNow offers a variety of features optimized for TO GARNISHMENT, including document templates, customizable branding, and secure storage. The platform also provides advanced signing tools and audit trails to ensure compliance and security. These features collectively enhance document management efficiency.

-

Can airSlate SignNow integrate with other applications for TO GARNISHMENT?

Absolutely, airSlate SignNow can integrate with various applications for TO GARNISHMENT, including CRM and project management tools. This integration capability allows for easier synchronization of data and documents across platforms, enhancing productivity. You can streamline your workflow by connecting with tools you already use.

-

What benefits can businesses expect from using airSlate SignNow for TO GARNISHMENT?

Businesses can expect several benefits from using airSlate SignNow for TO GARNISHMENT, including faster turnaround times on documents and improved accuracy with eSignatures. Additionally, the platform promotes better collaboration among team members and reduces the likelihood of document loss. These benefits contribute to overall operational efficiency.

-

Is there customer support available for TO GARNISHMENT-related queries?

Yes, airSlate SignNow offers comprehensive customer support for TO GARNISHMENT-related queries. Users can access a knowledge base, live chat, and email support to assist them with any issues or questions they may have. This support ensures you can maximize the platform's capabilities effectively.

Get more for TO GARNISHMENT

- U s bankruptcy courtselectronic bankruptcy notic form

- Your name utah state courts utcourts form

- Statement supporting motion for form

- Storage agreement form

- Smoothie king franchises inc international headquarters form

- Loan agreement template form

- Lease pet form

- Pa road widening agreement with hauler form

Find out other TO GARNISHMENT

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free