Schedule ND 1 FA Calculation of Tax under 3 Year Averaging Method for Elected Farm Income Schedule ND 1 FA Calculation of Tax Un Form

Understanding the Schedule ND 1 FA Calculation of Tax Under 3 Year Averaging Method for Elected Farm Income

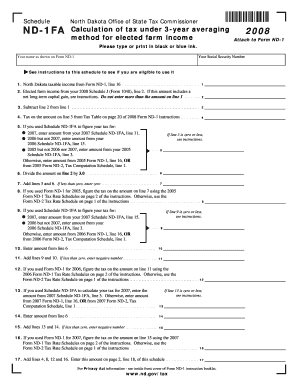

The Schedule ND 1 FA is a specific tax form used by farmers in the United States to calculate their tax liability using the three-year averaging method for elected farm income. This method allows farmers to average their income over three years, which can help smooth out income fluctuations due to varying crop yields and market conditions. The form is essential for those who qualify for this averaging method, as it provides a more accurate representation of their taxable income.

How to Use the Schedule ND 1 FA Calculation of Tax Under 3 Year Averaging Method for Elected Farm Income

Using the Schedule ND 1 FA involves several steps to ensure accurate calculations. First, gather all necessary financial records related to your farm income for the past three years. This includes income from crop sales, livestock, and any other farm-related earnings. Next, complete the form by entering your income figures, deductions, and any applicable credits. It's important to follow the instructions carefully to ensure compliance with IRS regulations and to maximize potential tax benefits.

Steps to Complete the Schedule ND 1 FA Calculation of Tax Under 3 Year Averaging Method for Elected Farm Income

Completing the Schedule ND 1 FA requires a systematic approach:

- Collect income statements from the last three years.

- Determine your elected farm income for each year.

- Calculate the average income over the three years.

- Fill out the form with the averaged income and any deductions.

- Review the completed form for accuracy before submission.

Key Elements of the Schedule ND 1 FA Calculation of Tax Under 3 Year Averaging Method for Elected Farm Income

Key elements of the Schedule ND 1 FA include the following:

- Income Reporting: Accurate reporting of all farm income is crucial.

- Deductions: Identify eligible deductions that can reduce taxable income.

- Averaging Method: Understand how to apply the three-year averaging method correctly.

- Filing Requirements: Be aware of the specific filing requirements and deadlines associated with this form.

IRS Guidelines for Schedule ND 1 FA Calculation of Tax Under 3 Year Averaging Method for Elected Farm Income

The IRS provides specific guidelines for completing the Schedule ND 1 FA. These guidelines outline eligibility criteria, the calculation process, and required documentation. It is essential to refer to the most recent IRS publications related to farm income averaging to ensure compliance. Staying updated on any changes in tax laws or regulations is also important for accurate reporting.

Filing Deadlines for the Schedule ND 1 FA Calculation of Tax Under 3 Year Averaging Method for Elected Farm Income

Filing deadlines for the Schedule ND 1 FA typically align with the general tax filing deadlines for individuals and businesses. Generally, farmers must file their tax returns by April 15 of the following year. However, extensions may be available under certain circumstances. It is advisable to check the IRS website or consult a tax professional for the most current deadlines and any potential changes.

Quick guide on how to complete schedule nd 1 fa calculation of tax under 3 year averaging method for elected farm income schedule nd 1 fa calculation of tax

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly common among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate forms and securely keep them online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without hassle. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to alter and eSign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, whether it's through email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] to ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule ND 1 FA Calculation Of Tax Under 3 Year Averaging Method For Elected Farm Income Schedule ND 1 FA Calculation Of Tax Un

Create this form in 5 minutes!

How to create an eSignature for the schedule nd 1 fa calculation of tax under 3 year averaging method for elected farm income schedule nd 1 fa calculation of tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule ND 1 FA Calculation Of Tax Under 3 Year Averaging Method For Elected Farm Income?

The Schedule ND 1 FA Calculation Of Tax Under 3 Year Averaging Method For Elected Farm Income is a tax form used by farmers to calculate their tax liability based on an averaging method over three years. This method helps in smoothing out income fluctuations, making tax obligations more manageable. Understanding this calculation is crucial for farmers looking to optimize their tax strategy.

-

How can airSlate SignNow assist with the Schedule ND 1 FA Calculation?

airSlate SignNow provides an efficient platform for managing and eSigning documents related to the Schedule ND 1 FA Calculation Of Tax Under 3 Year Averaging Method For Elected Farm Income. With its user-friendly interface, users can easily prepare, send, and sign necessary tax documents. This streamlines the process, ensuring compliance and accuracy in tax filings.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the Schedule ND 1 FA Calculation Of Tax Under 3 Year Averaging Method For Elected Farm Income. These features enhance efficiency and ensure that all documents are handled securely and professionally. Additionally, users can collaborate in real-time, making the process even smoother.

-

Is airSlate SignNow cost-effective for farmers needing tax solutions?

Yes, airSlate SignNow is designed to be a cost-effective solution for farmers needing assistance with the Schedule ND 1 FA Calculation Of Tax Under 3 Year Averaging Method For Elected Farm Income. The platform offers various pricing plans to accommodate different budgets, ensuring that all users can access essential features without overspending. This affordability makes it an attractive option for small to medium-sized farming operations.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow can be integrated with various accounting and tax preparation software, enhancing the workflow for the Schedule ND 1 FA Calculation Of Tax Under 3 Year Averaging Method For Elected Farm Income. This integration allows users to import and export data seamlessly, reducing manual entry and minimizing errors. Such compatibility ensures a more streamlined tax preparation process.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the Schedule ND 1 FA Calculation Of Tax Under 3 Year Averaging Method For Elected Farm Income, offers numerous benefits. Users can enjoy faster turnaround times, improved accuracy, and enhanced security for sensitive information. Additionally, the platform's ease of use means that even those with limited tech skills can navigate the system effectively.

-

How secure is airSlate SignNow for handling tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect documents like the Schedule ND 1 FA Calculation Of Tax Under 3 Year Averaging Method For Elected Farm Income. Users can trust that their sensitive tax information is safeguarded against unauthorized access. Regular security audits and updates further enhance the platform's reliability.

Get more for Schedule ND 1 FA Calculation Of Tax Under 3 Year Averaging Method For Elected Farm Income Schedule ND 1 FA Calculation Of Tax Un

Find out other Schedule ND 1 FA Calculation Of Tax Under 3 Year Averaging Method For Elected Farm Income Schedule ND 1 FA Calculation Of Tax Un

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple

- Can I eSignature New York Bulk Sale Agreement

- How Do I Electronic signature Tennessee Web Hosting Agreement

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast