F 1120 2017

Understanding the F-1120 Form

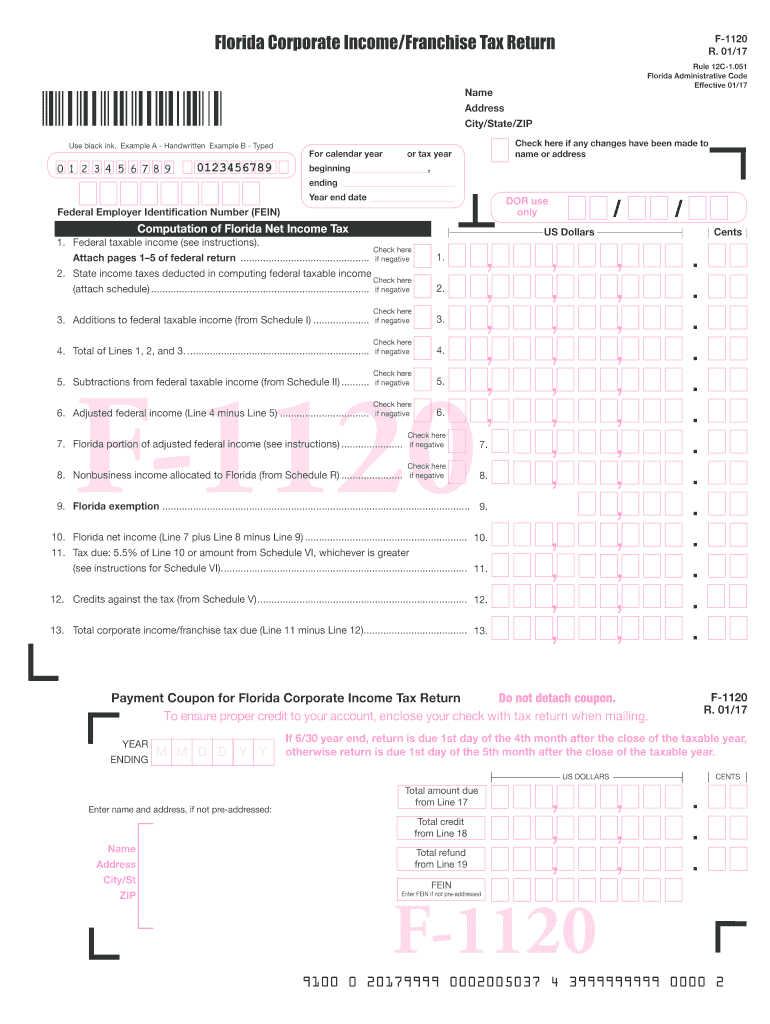

The F-1120 form, also known as the Florida Corporate Income Tax Return, is essential for corporations operating in Florida. This form is used to report income, calculate taxes owed, and ensure compliance with state tax regulations. It is important for businesses to accurately complete this form to avoid penalties and ensure proper tax reporting. The F-1120 plays a crucial role in the financial health of a corporation, as it directly impacts tax liabilities and overall business operations.

Steps to Complete the F-1120

Completing the F-1120 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, balance sheets, and any supporting documentation for deductions. Next, fill out the form with precise information regarding your corporation's income, expenses, and tax credits. Pay careful attention to the calculations, as errors can lead to delays or penalties. Finally, review the completed form thoroughly before submission to ensure all information is correct and complete.

Filing Deadlines and Important Dates

Corporations must adhere to specific deadlines when submitting the F-1120. Typically, the return is due on the first day of the fourth month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the return is due by April 1. It is crucial for businesses to be aware of these deadlines to avoid late fees and maintain good standing with the state. Additionally, extensions may be available, but they must be requested before the original due date.

Required Documents for the F-1120

When preparing to file the F-1120, certain documents are required to support the information reported on the form. These include financial statements, tax identification numbers, and any documentation related to deductions or credits claimed. Corporations should also have records of previous tax returns and any correspondence with the Florida Department of Revenue. Having these documents organized and readily available will facilitate a smoother filing process.

Form Submission Methods

The F-1120 can be submitted through various methods, including online, by mail, or in person. Online submission is often the most efficient option, allowing for quicker processing and confirmation of receipt. If opting for mail, ensure that the form is sent to the correct address and consider using a trackable mailing service. In-person submissions can be made at designated Florida Department of Revenue offices, providing an opportunity to address any immediate questions or concerns.

Legal Use of the F-1120

Utilizing the F-1120 form is legally required for corporations operating in Florida that meet certain income thresholds. Compliance with state tax laws is essential to avoid penalties and legal issues. The form must be completed accurately and truthfully, as any misrepresentation can lead to serious consequences, including audits and fines. Understanding the legal implications of the F-1120 is vital for maintaining corporate integrity and compliance.

Quick guide on how to complete f 1120 2017 2019 form

Your assistance manual on how to prepare your F 1120

If you’re curious about how to finalize and dispatch your F 1120, here are a few simple guidelines to facilitate tax processing.

To begin, all you need to do is register your airSlate SignNow account to alter how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that allows you to modify, generate, and finalize your tax documents effortlessly. Utilizing its editor, you can toggle between text, check boxes, and electronic signatures and return to amend answers as necessary. Optimize your tax handling with advanced PDF editing, electronic signing, and easy sharing options.

Complete the following steps to finalize your F 1120 in just minutes:

- Set up your account and start working on PDFs within minutes.

- Browse our catalog to locate any IRS tax form; explore different versions and schedules.

- Click Obtain form to access your F 1120 in our editor.

- Populate the necessary fields with your details (text, numbers, check marks).

- Utilize the Signature Tool to insert your legally-recognized electronic signature (if required).

- Examine your document and correct any errors.

- Save modifications, print your copy, dispatch it to your recipient, and download it to your device.

Refer to this manual to submit your taxes electronically with airSlate SignNow. Please be aware that filing on paper can increase return errors and delay refunds. Certainly, before e-filing your taxes, verify the IRS website for submission guidelines in your region.

Create this form in 5 minutes or less

Find and fill out the correct f 1120 2017 2019 form

FAQs

-

What are the good ways to fill out 1120 form if my business is inactive?

While you might not have been “active” throughout the year, by filing a “no activity” return you may be throwing away potential deductions! Most businesses (even unprofitable ones) will have some form of expenses – think tax prep fees, taxes, filing fees, home office, phone, etc. Don’t miss out on your chance to preserve these valuable deductions. You can carry these forward to more profitable years by using the Net Operating Loss Carry-forward rules. But you must report them to take advantage of this break. If you honestly did not have any expenses or income during the tax year, simply file form 1120 by the due date (no later than 2 and one half months after the close of the business tax year – March 15 for calendar year businesses). Complete sections A-E on the front page of the return and make sure you sign the bottom – that’s it!

-

How do I fill out a 1120 tax report?

If you are not sophisticated with taxes, DON'T try this form. You can get yourself in a lot of trouble. Get a good CPA or EA. The time and effort it will take you to figure this thing out is not worth it. If you value your time at more than the minimum wage, you will save time and money by hiring a professional.

-

How should one fill out Form 1120 for a company with no activity and no income and that has not issued shares?

You put all zeros in for revenue and expenses. Even though the corporation has not formally issued shares, someone or several individuals or entities own the common stock of the corporation and you need to report anyone who owns more than 20% of the corporation.

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out a CLAT 2019 application form?

Hi thereFirst of all, let me tell you some important points:CLAT 2019 has gone OFFLINE this yearBut the application forms for CLAT 2019 have to be filled ONLINEThe payment of the application fees also should be made onlineNow, kindly note the important dates:Note the details regarding the application fees:Here, if you want the Previous Year Question papers, Rs.500 would be added to the application fees.Apart from this, there would be bank transaction charges added to the application fees.The application fees is non-refundable.Note one important point here that before you fill the application form, check for your eligibility.To know the complete details of filling the application form along with other information like the eligibility - in terms of age, educational qualification, list of NLUs participating and the seats offered under each category, CLAT Reservation policies, CLAT exam pattern, marking scheme, syllabus, important documents required to be kept ready before filling the form, kindly go to the link below:How to fill CLAT 2019 Application form? Registration OPEN | All you need to knowTo know how to prepare for one of the very important section of CLAT exam, GK and Current Affairs, kindly go to the link below:How to prepare GK & Current Affairs for CLAT 2019To practice, daily MCQs on Current Affairs, kindly go to the link below:#CLAT2019 | #AILET2019 | #DULLB2019 | GK and Current Affairs Series: 5 in 10 Series: Day 12For any other queries, kindly write to us at mailateasyway@gmail.comThanks & Regards!

-

How do I fill out the NEET 2019 application form?

Expecting application form of NEET2019 will be same as that of NEET2018, follow the instructions-For Feb 2019 Exam:EventsDates (Announced)Release of application form-1st October 2018Application submission last date-31st October 2018Last date to pay the fee-Last week of October 2018Correction Window Open-1st week of November 2018Admit card available-1st week of January 2019Exam date-3rd February to 17th February 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of March 2019Counselling begins-2nd week of June 2019For May 2019 Exam:EventsDates (Announced)Application form Release-2nd week of March 2019Application submission last date-2nd week of April 2019Last date to pay the fee-2nd week of April 2019Correction Window Open-3rd week of April 2019Admit card available-1st week of May 2019Exam date-12th May to 26th May 2019Answer key & OMR release-Within a week after examAnnouncement of result-1st week of June 2019Counselling begins-2nd week of June 2019NEET 2019 Application FormCandidates should fill the application form as per the instructions given in the information bulletin. Below we are providing NEET 2019 application form details:The application form will be issued through online mode only.No application will be entertained through offline mode.NEET UG registration 2019 will be commenced from the 1st October 2018 (Feb Exam) & second week of March 2018 (May Exam).Candidates should upload the scanned images of recent passport size photograph and signature.After filling the application form completely, a confirmation page will be generated. Download it.There will be no need to send the printed confirmation page to the board.Application Fee:General and OBC candidates will have to pay Rs. 1400/- as an application fee.The application fee for SC/ST and PH candidates will be Rs. 750/-.Fee payment can be done through credit/debit card, net banking, UPI and e-wallet.Service tax will also be applicable.CategoryApplication FeeGeneral/OBC-1400/-SC/ST/PH-750/-Step 1: Fill the Application FormGo the official portal of the conducting authority (Link will be given above).Click on “Apply Online” link.A candidate has to read all the instruction and then click on “Proceed to Apply Online NEET (UG) 2019”.Step 1.1: New RegistrationFill the registration form carefully.Candidates have to fill their name, Mother’s Name, Father’s Name, Category, Date of Birth, Gender, Nationality, State of Eligibility (for 15% All India Quota), Mobile Number, Email ID, Aadhaar card number, etc.After filling all the details, two links will be given “Preview &Next” and “Reset”.If candidate satisfied with the filled information, then they have to click on “Next”.After clicking on Next Button, the information submitted by the candidate will be displayed on the screen. If information correct, click on “Next” button, otherwise go for “Back” button.Candidates may note down the registration number for further procedure.Now choose the strong password and re enter the password.Choose security question and feed answer.Enter the OTP would be sent to your mobile number.Submit the button.Step 1.2: Login & Application Form FillingLogin with your Registration Number and password.Fill personal details.Enter place of birth.Choose the medium of question paper.Choose examination centres.Fill permanent address.Fill correspondence address.Fill Details (qualification, occupation, annual income) of parents and guardians.Choose the option for dress code.Enter security pin & click on save & draft.Now click on preview and submit.Now, review your entries.Then. click on Final Submit.Step 2: Upload Photo and SignatureStep 2 for images upload will be appeared on screen.Now, click on link for Upload photo & signature.Upload the scanned images.Candidate should have scanned images of his latest Photograph (size of 10 Kb to 100 Kb.Signature(size of 3 Kb to 20 Kb) in JPEG format only.Step 3: Fee PaymentAfter uploading the images, candidate will automatically go to the link for fee payment.A candidate has to follow the instruction & submit the application fee.Choose the Bank for making payment.Go for Payment.Candidate can pay the fee through Debit/Credit Card/Net Banking/e-wallet (CSC).Step 4: Take the Printout of Confirmation PageAfter the fee payment, a candidate may take the printout of the confirmation page.Candidates may keep at least three copies of the confirmation page.Note:Must retain copy of the system generated Self Declaration in respect of candidates from J&K who have opted for seats under 15% All India Quota.IF any queries, feel free to comment..best of luck

Create this form in 5 minutes!

How to create an eSignature for the f 1120 2017 2019 form

How to create an eSignature for your F 1120 2017 2019 Form online

How to make an electronic signature for your F 1120 2017 2019 Form in Chrome

How to generate an eSignature for signing the F 1120 2017 2019 Form in Gmail

How to make an electronic signature for the F 1120 2017 2019 Form right from your smart phone

How to create an electronic signature for the F 1120 2017 2019 Form on iOS devices

How to generate an electronic signature for the F 1120 2017 2019 Form on Android

People also ask

-

What is the F 1120 form, and how can airSlate SignNow help with it?

The F 1120 form is a crucial document for C corporations to report their income, gains, losses, deductions, and credits to the IRS. airSlate SignNow simplifies the process by allowing businesses to eSign and send the F 1120 form effortlessly, ensuring compliance and efficiency in tax filing.

-

Is airSlate SignNow suitable for filing the F 1120 form?

Yes, airSlate SignNow is an excellent tool for filing the F 1120 form. It provides a straightforward interface for preparing and eSigning your documents, making it easier for businesses to manage their tax obligations without hassle.

-

What features does airSlate SignNow offer for handling the F 1120 form?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, all tailored to streamline the handling of the F 1120 form. These tools help ensure that your submission is efficient and meets all necessary compliance standards.

-

How much does it cost to use airSlate SignNow for the F 1120 form?

The pricing for airSlate SignNow is competitive and designed to be cost-effective for businesses of all sizes. You can choose from various subscription plans based on your needs, which makes it affordable to manage the F 1120 form and other document workflows.

-

Can I integrate airSlate SignNow with other software for the F 1120 form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and document management software, enhancing your workflow for the F 1120 form. This integration allows for easy data import and export, making tax preparation more efficient.

-

What are the benefits of using airSlate SignNow for the F 1120 form?

Using airSlate SignNow for the F 1120 form provides numerous benefits, including streamlined document preparation, enhanced security for sensitive information, and reduced turnaround time. These advantages help businesses focus more on their operations while ensuring that tax filings are completed accurately.

-

Is airSlate SignNow compliant with IRS requirements for the F 1120 form?

Yes, airSlate SignNow is compliant with IRS requirements for eSigning and submitting forms like the F 1120. The platform ensures that all signatures are legally binding and that your documents are securely stored and transmitted.

Get more for F 1120

- Electronic clearing service credit clearing real time gross settlementrtgs msmedibangalore gov form

- Dane drifters form

- Ares registration form arrl arrl

- Helium trampoline park form

- Unemployment declaration letter sample form

- Legal separation contract template form

- Legal service contract template form

- Legally bind contract template form

Find out other F 1120

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online

- eSign Oregon Doctors LLC Operating Agreement Mobile

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement