Individual Income Forms State of North Dakota

What is the Individual Income Forms State Of North Dakota

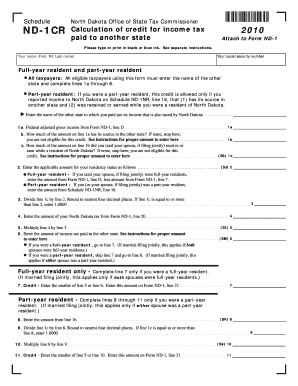

The Individual Income Forms for the State of North Dakota are essential documents used by residents to report their income and calculate their state tax obligations. These forms are typically required for filing state income taxes and include various schedules and attachments that detail income sources, deductions, and credits. Understanding these forms is crucial for ensuring compliance with state tax laws and for accurately reporting financial information.

How to obtain the Individual Income Forms State Of North Dakota

Residents can obtain the Individual Income Forms for North Dakota through several methods. The most straightforward way is to visit the North Dakota Office of State Tax Commissioner’s official website, where forms can be downloaded in PDF format. Additionally, forms may be available at local tax offices, libraries, or community centers. Some tax preparation services also provide these forms as part of their offerings.

Steps to complete the Individual Income Forms State Of North Dakota

Completing the Individual Income Forms involves several steps to ensure accuracy and compliance. First, gather all necessary documentation, including W-2s, 1099s, and records of any other income. Next, fill out the primary form, ensuring that all personal information is correct. After reporting income, apply any eligible deductions and credits. Finally, review the completed form for errors before submitting it either electronically or by mail, depending on your preference.

Filing Deadlines / Important Dates

It is vital to be aware of the filing deadlines for the Individual Income Forms in North Dakota. Typically, the deadline for submitting state income tax returns aligns with the federal deadline, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Residents should also note any specific deadlines for estimated tax payments or extensions to avoid penalties.

Required Documents

To accurately complete the Individual Income Forms, several documents are required. These include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income sources, such as interest or dividends

- Documentation for deductions, such as mortgage interest or property taxes

- Social Security numbers for all individuals listed on the form

Having these documents ready will streamline the process and help ensure that all income and deductions are reported accurately.

Penalties for Non-Compliance

Failure to file the Individual Income Forms or inaccuracies in reporting can result in penalties imposed by the state of North Dakota. These penalties may include fines, interest on unpaid taxes, and potential legal action. It is essential for residents to file their forms accurately and on time to avoid these consequences. Understanding the importance of compliance can help individuals maintain good standing with state tax authorities.

Quick guide on how to complete individual income forms state of north dakota

Easily prepare Individual Income Forms State Of North Dakota on any device

Digital document management has gained traction among organizations and individuals alike. It serves as a perfect eco-friendly substitute for traditional printed and signed papers, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to swiftly create, modify, and electronically sign your documents without delays. Manage Individual Income Forms State Of North Dakota seamlessly on any platform using the airSlate SignNow Android or iOS applications and streamline your document-related processes today.

The easiest way to modify and eSign Individual Income Forms State Of North Dakota effortlessly

- Locate Individual Income Forms State Of North Dakota and select Get Form to initiate the process.

- Utilize the provided tools to complete your form.

- Highlight important sections of the documents or obscure sensitive information using features that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method of delivering the form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Individual Income Forms State Of North Dakota to ensure clear communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the individual income forms state of north dakota

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Individual Income Forms State Of North Dakota?

Individual Income Forms State Of North Dakota are tax documents required for residents to report their income to the state. These forms help ensure compliance with state tax laws and facilitate the accurate calculation of taxes owed. Using airSlate SignNow, you can easily eSign and send these forms securely.

-

How can airSlate SignNow help with Individual Income Forms State Of North Dakota?

airSlate SignNow simplifies the process of managing Individual Income Forms State Of North Dakota by allowing users to eSign documents electronically. This not only saves time but also enhances security and reduces the risk of errors. With our platform, you can streamline your tax filing process effortlessly.

-

What features does airSlate SignNow offer for Individual Income Forms State Of North Dakota?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for Individual Income Forms State Of North Dakota. These tools help users manage their tax documents efficiently and ensure that all necessary signatures are obtained promptly. Additionally, our platform is user-friendly, making it accessible for everyone.

-

Is there a cost associated with using airSlate SignNow for Individual Income Forms State Of North Dakota?

Yes, airSlate SignNow offers various pricing plans to cater to different needs, including options for individuals and businesses handling Individual Income Forms State Of North Dakota. Our plans are designed to be cost-effective, providing excellent value for the features offered. You can choose a plan that best fits your requirements.

-

Can I integrate airSlate SignNow with other software for Individual Income Forms State Of North Dakota?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, making it easy to manage Individual Income Forms State Of North Dakota alongside your existing tools. This integration capability enhances your workflow and ensures that all your documents are in one place, improving efficiency.

-

What are the benefits of using airSlate SignNow for Individual Income Forms State Of North Dakota?

Using airSlate SignNow for Individual Income Forms State Of North Dakota offers numerous benefits, including increased efficiency, enhanced security, and reduced paper usage. Our platform allows for quick eSigning and document management, which can signNowly speed up the tax filing process. Additionally, you can access your documents from anywhere, making it convenient for busy individuals.

-

How secure is airSlate SignNow for handling Individual Income Forms State Of North Dakota?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your Individual Income Forms State Of North Dakota. Our platform ensures that your sensitive information remains confidential and secure throughout the signing process. You can trust us to handle your documents with the utmost care.

Get more for Individual Income Forms State Of North Dakota

Find out other Individual Income Forms State Of North Dakota

- How To eSign Presentation for Sales Teams

- eSign PPT for Sales Teams Easy

- eSign PPT for Sales Teams Safe

- eSignature Word for HR Easy

- eSignature Word for HR Safe

- eSignature Document for HR Online

- How To eSignature Word for HR

- eSignature Document for HR Free

- eSignature Document for HR Fast

- eSignature Form for HR Online

- eSignature Document for HR Safe

- eSignature Form for HR Mobile

- eSignature Presentation for HR Online

- eSignature PPT for HR Online

- eSignature Presentation for HR Computer

- eSignature PPT for HR Computer

- eSignature PPT for HR Mobile

- eSignature PPT for HR Now

- eSignature Form for HR Now

- eSignature Presentation for HR Now