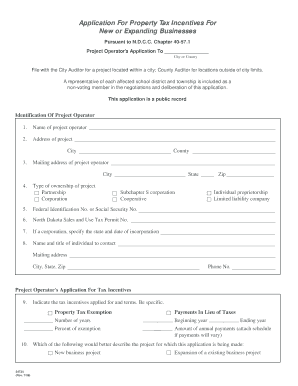

Application for Property Tax Incentives for New or Expanding Businesses Form

What is the Application For Property Tax Incentives For New Or Expanding Businesses

The Application For Property Tax Incentives For New Or Expanding Businesses is a formal request submitted by businesses seeking tax relief on property taxes. This application is designed to encourage economic growth by providing financial incentives to new or expanding businesses. By reducing property tax burdens, local governments aim to stimulate job creation and investment in their communities. The application typically requires detailed information about the business, including its location, size, and the nature of its expansion or new operations.

Eligibility Criteria

To qualify for the property tax incentives, businesses must meet specific eligibility criteria set by local jurisdictions. Generally, these criteria may include:

- Establishment of a new business or expansion of an existing business within the area.

- Creation of a certain number of jobs within a specified timeframe.

- Investment in property improvements or new construction that meets minimum thresholds.

- Compliance with local zoning and regulatory requirements.

It is essential for applicants to review the specific criteria applicable in their state or locality to ensure compliance and increase the chances of approval.

Steps to Complete the Application For Property Tax Incentives For New Or Expanding Businesses

Completing the application involves several key steps:

- Gather necessary documentation, including business plans, financial statements, and proof of property ownership or lease agreements.

- Fill out the application form accurately, ensuring all required fields are completed.

- Provide detailed information about the intended use of the property and how it aligns with local economic development goals.

- Submit the application by the designated deadline, ensuring that all supporting documents are included.

Following these steps carefully can help streamline the approval process and enhance the likelihood of receiving the incentives.

Required Documents

When applying for property tax incentives, businesses typically need to submit various documents to support their application. Commonly required documents include:

- Completed application form.

- Business plan outlining the objectives and strategies of the new or expanding business.

- Financial statements demonstrating the business's stability and projected growth.

- Evidence of property ownership or lease agreements.

- Job creation projections and timelines.

Compiling these documents in advance can facilitate a smoother application process and help avoid delays.

Form Submission Methods

Businesses can typically submit the Application For Property Tax Incentives through various methods, depending on local regulations. Common submission methods include:

- Online submission through the local government’s official website.

- Mailing the completed application to the designated office.

- In-person submission at local government offices.

It is advisable to confirm the preferred submission method with the local authority to ensure compliance with their requirements.

Application Process & Approval Time

The application process for property tax incentives generally involves several stages:

- Submission of the application and supporting documents.

- Review by the local government or designated agency.

- Potential follow-up for additional information or clarification.

- Notification of approval or denial, often accompanied by an explanation.

The approval time can vary significantly based on the jurisdiction and the complexity of the application, typically ranging from a few weeks to several months. Businesses should plan accordingly to align their timelines with the application process.

Quick guide on how to complete application for property tax incentives for new or expanding businesses

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the suitable format and securely keep it online. airSlate SignNow provides all the resources you need to create, alter, and electronically sign your documents rapidly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and Electronically Sign [SKS] with Ease

- Find [SKS] and click Get Form to start.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you prefer to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign [SKS] to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Application For Property Tax Incentives For New Or Expanding Businesses

Create this form in 5 minutes!

How to create an eSignature for the application for property tax incentives for new or expanding businesses

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Application For Property Tax Incentives For New Or Expanding Businesses?

The Application For Property Tax Incentives For New Or Expanding Businesses is a formal request that allows eligible businesses to receive tax benefits. This application helps reduce the financial burden on businesses looking to grow or establish themselves in a new area. By utilizing this application, businesses can take advantage of signNow savings on property taxes.

-

How can airSlate SignNow assist with the Application For Property Tax Incentives For New Or Expanding Businesses?

airSlate SignNow streamlines the process of submitting the Application For Property Tax Incentives For New Or Expanding Businesses by providing an easy-to-use platform for document management. Our solution allows businesses to eSign and send documents securely, ensuring that all necessary paperwork is completed efficiently. This can signNowly speed up the approval process for tax incentives.

-

What are the benefits of using airSlate SignNow for my application process?

Using airSlate SignNow for your Application For Property Tax Incentives For New Or Expanding Businesses offers numerous benefits, including enhanced efficiency and reduced paperwork. Our platform allows for quick eSigning and document tracking, which can help you stay organized and meet deadlines. Additionally, our cost-effective solution ensures that you can manage your applications without breaking the bank.

-

Are there any costs associated with the Application For Property Tax Incentives For New Or Expanding Businesses?

While the application itself may not have a direct cost, there are often fees associated with processing and submitting the Application For Property Tax Incentives For New Or Expanding Businesses. However, using airSlate SignNow can help minimize costs related to document management and eSigning. Our affordable pricing plans ensure that you can manage your applications efficiently without incurring excessive expenses.

-

What features does airSlate SignNow offer for managing my application?

airSlate SignNow offers a variety of features to assist with the Application For Property Tax Incentives For New Or Expanding Businesses, including customizable templates, secure eSigning, and real-time document tracking. These features allow you to create, send, and manage your applications seamlessly. Additionally, our user-friendly interface makes it easy for businesses of all sizes to navigate the application process.

-

Can I integrate airSlate SignNow with other tools for my application process?

Yes, airSlate SignNow offers integrations with various tools and platforms to enhance your experience while managing the Application For Property Tax Incentives For New Or Expanding Businesses. You can connect with popular CRM systems, cloud storage services, and other business applications to streamline your workflow. This integration capability ensures that all your documents and data are easily accessible and organized.

-

How does airSlate SignNow ensure the security of my application documents?

Security is a top priority at airSlate SignNow. We implement advanced encryption protocols and secure access controls to protect your documents related to the Application For Property Tax Incentives For New Or Expanding Businesses. Our platform complies with industry standards to ensure that your sensitive information remains confidential and secure throughout the application process.

Get more for Application For Property Tax Incentives For New Or Expanding Businesses

- O a f 4 application 2005 2019 form

- Petroleum industry guiding principles 2008 2019 form

- Educational improvement grant application nbta form

- Statement of delivery form 23

- Frm 0292 2012 2019 form

- Statutory declaration of common law union instruction guide 2014 2019 form

- Alberta annual commercial vehicle inspection worksheet 2018 2019 form

- Worker complaint of discriminatory action form 57w1 use this form to explain your complaint to us

Find out other Application For Property Tax Incentives For New Or Expanding Businesses

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online