Schedule K 1 Form 58 Partner's Share of ND Income Loss Nd

What is the Schedule K-1 Form 58 Partner's Share of ND Income Loss?

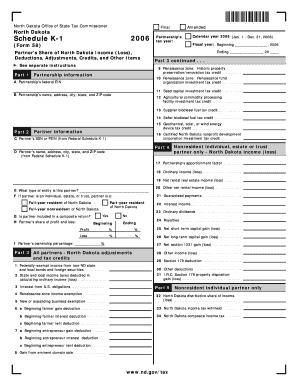

The Schedule K-1 Form 58 is a tax document used in North Dakota to report a partner's share of income, deductions, and credits from a partnership. This form is essential for partners in partnerships, allowing them to accurately report their income on their individual tax returns. The information provided on this form helps the IRS and state tax authorities understand the financial activities of partnerships and ensure proper tax compliance.

How to Use the Schedule K-1 Form 58 Partner's Share of ND Income Loss

To use the Schedule K-1 Form 58, partners must first receive the completed form from the partnership. Once received, partners should carefully review the information for accuracy, including their share of income, losses, and any deductions. This information must then be reported on the partner's individual tax return, typically on Form 1040. It is crucial to keep a copy of the K-1 for personal records and future reference.

Steps to Complete the Schedule K-1 Form 58 Partner's Share of ND Income Loss

Completing the Schedule K-1 Form 58 involves several steps:

- Gather necessary information, including partnership details and financial records.

- Fill out the partner's identifying information, such as name, address, and tax identification number.

- Report the partner's share of income, losses, and deductions as provided by the partnership.

- Ensure all calculations are accurate and align with the partnership's financial statements.

- Distribute the completed form to each partner and retain copies for the partnership's records.

Legal Use of the Schedule K-1 Form 58 Partner's Share of ND Income Loss

The Schedule K-1 Form 58 is legally required for partnerships operating in North Dakota. It serves as an official record of a partner's financial involvement in the partnership and ensures compliance with state tax laws. Failure to provide accurate information on this form can lead to penalties or audits by tax authorities.

Key Elements of the Schedule K-1 Form 58 Partner's Share of ND Income Loss

Key elements of the Schedule K-1 Form 58 include:

- Partner's name and tax identification number.

- Partnership's name and tax identification number.

- Details of the partner's share of income, losses, and deductions.

- Information regarding distributions made to the partner.

- Any credits or other tax attributes that the partner may claim.

Filing Deadlines / Important Dates

Partners must be aware of important filing deadlines related to the Schedule K-1 Form 58. Typically, the partnership must provide the K-1 to partners by March 15 of the following tax year. Partners should ensure they file their individual tax returns by April 15, incorporating the information from their K-1 forms to avoid penalties for late filing.

Quick guide on how to complete schedule k 1 form 58 partner39s share of nd income loss nd

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among both organizations and individuals. It offers an ideal sustainable alternative to conventional printed and signed documents, enabling you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage [SKS] on any device using the airSlate SignNow apps available for Android or iOS and enhance any document-related process today.

How to Alter and eSign [SKS] Effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal legitimacy as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require new document copies to be printed. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Modify and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule K 1 Form 58 Partner's Share Of ND Income Loss Nd

Create this form in 5 minutes!

How to create an eSignature for the schedule k 1 form 58 partner39s share of nd income loss nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule K 1 Form 58 Partner's Share Of ND Income Loss?

The Schedule K 1 Form 58 Partner's Share Of ND Income Loss is a tax document used by partnerships in North Dakota to report each partner's share of income, deductions, and credits. This form is essential for partners to accurately report their income on their individual tax returns. Understanding this form can help ensure compliance with state tax regulations.

-

How can airSlate SignNow help with the Schedule K 1 Form 58 Partner's Share Of ND Income Loss?

airSlate SignNow provides a streamlined solution for sending and eSigning the Schedule K 1 Form 58 Partner's Share Of ND Income Loss. Our platform simplifies the document management process, allowing partners to collaborate efficiently and ensure timely submissions. With our user-friendly interface, you can easily manage your tax documents.

-

What are the pricing options for using airSlate SignNow for tax documents?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including those requiring the Schedule K 1 Form 58 Partner's Share Of ND Income Loss. Our plans are designed to be cost-effective, ensuring that you get the best value for your document management needs. You can choose from monthly or annual subscriptions based on your usage.

-

Are there any integrations available with airSlate SignNow for tax preparation software?

Yes, airSlate SignNow integrates seamlessly with various tax preparation software, making it easier to manage the Schedule K 1 Form 58 Partner's Share Of ND Income Loss. These integrations allow for smooth data transfer and enhanced workflow efficiency. You can connect your existing tools to streamline your tax document processes.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers a range of features tailored for managing tax documents like the Schedule K 1 Form 58 Partner's Share Of ND Income Loss. Key features include eSigning, document templates, and secure cloud storage. These tools help ensure that your documents are organized, accessible, and compliant with tax regulations.

-

How secure is airSlate SignNow for handling sensitive tax documents?

Security is a top priority at airSlate SignNow, especially when handling sensitive tax documents like the Schedule K 1 Form 58 Partner's Share Of ND Income Loss. Our platform employs advanced encryption and security protocols to protect your data. You can trust that your documents are safe and secure while using our services.

-

Can I track the status of my Schedule K 1 Form 58 Partner's Share Of ND Income Loss with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your Schedule K 1 Form 58 Partner's Share Of ND Income Loss in real-time. You will receive notifications when documents are viewed, signed, or completed, ensuring you stay informed throughout the process. This feature enhances accountability and transparency.

Get more for Schedule K 1 Form 58 Partner's Share Of ND Income Loss Nd

Find out other Schedule K 1 Form 58 Partner's Share Of ND Income Loss Nd

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT

- How Do I eSign Alaska Car Dealer Form

- How To eSign California Car Dealer Form

- Can I eSign Colorado Car Dealer Document

- How Can I eSign Colorado Car Dealer Document

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT