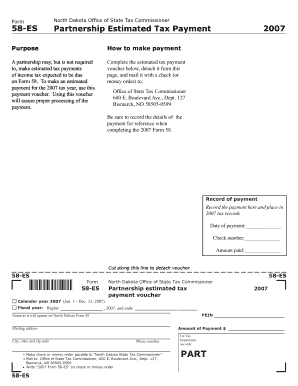

Form 58 ES Partnership Estimated Tax Payment Form 58 ES Partnership Estimated Tax Payment Nd

What is the Form 58 ES Partnership Estimated Tax Payment?

The Form 58 ES Partnership Estimated Tax Payment is a tax form used by partnerships in the United States to report and remit estimated tax payments to the state. This form is essential for partnerships that expect to owe tax of a certain amount during the tax year. By using this form, partnerships can ensure they meet their tax obligations and avoid penalties associated with underpayment. It is specifically designed for partnerships, which are business entities where two or more individuals share ownership and profits.

Steps to Complete the Form 58 ES Partnership Estimated Tax Payment

Completing the Form 58 ES Partnership Estimated Tax Payment involves several key steps:

- Gather necessary financial information, including income, deductions, and credits.

- Calculate the estimated tax liability for the year based on projected income.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the form by the specified due date to avoid penalties.

How to Obtain the Form 58 ES Partnership Estimated Tax Payment

The Form 58 ES Partnership Estimated Tax Payment can be obtained directly from the state’s tax authority website or office. Many states provide downloadable versions of their tax forms, which can be printed and filled out manually. Additionally, some tax preparation software may include this form, allowing users to fill it out electronically. It is important to ensure that you are using the most current version of the form to comply with state regulations.

Filing Deadlines / Important Dates

Partnerships must adhere to specific filing deadlines for the Form 58 ES Partnership Estimated Tax Payment. Typically, estimated tax payments are due quarterly, with deadlines falling on the fifteenth day of the fourth, sixth, ninth, and twelfth months of the tax year. It is crucial for partnerships to mark these dates on their calendars to avoid late fees and penalties. Checking the state’s tax authority website for any updates or changes to these deadlines is also advisable.

Legal Use of the Form 58 ES Partnership Estimated Tax Payment

The legal use of the Form 58 ES Partnership Estimated Tax Payment is to ensure compliance with state tax laws regarding estimated tax payments. Partnerships are required to file this form if they expect to owe a certain amount in taxes. Failing to file or pay estimated taxes can result in penalties, interest, and other legal repercussions. Therefore, understanding the legal implications of this form is essential for maintaining good standing with tax authorities.

Key Elements of the Form 58 ES Partnership Estimated Tax Payment

The Form 58 ES Partnership Estimated Tax Payment includes several key elements that are important for accurate completion:

- Partnership Information: This section requires the name, address, and tax identification number of the partnership.

- Estimated Tax Calculation: Partnerships must provide an estimate of their expected tax liability for the year.

- Payment Information: This includes details on how much is being paid and the payment method.

- Signature: The form must be signed by an authorized representative of the partnership to validate the submission.

Quick guide on how to complete form 58 es partnership estimated tax payment form 58 es partnership estimated tax payment nd

Effortlessly Prepare [SKS] on Any Device

Web-based document management has gained signNow traction among companies and individuals. It serves as an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

Steps to Alter and eSign [SKS] with Ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign feature, which takes just moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 58 ES Partnership Estimated Tax Payment Form 58 ES Partnership Estimated Tax Payment Nd

Create this form in 5 minutes!

How to create an eSignature for the form 58 es partnership estimated tax payment form 58 es partnership estimated tax payment nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 58 ES Partnership Estimated Tax Payment Form 58 ES Partnership Estimated Tax Payment Nd?

The Form 58 ES Partnership Estimated Tax Payment Form 58 ES Partnership Estimated Tax Payment Nd is a tax form used by partnerships in North Dakota to report estimated tax payments. This form helps ensure that partnerships meet their tax obligations throughout the year, avoiding penalties for underpayment.

-

How can airSlate SignNow help with the Form 58 ES Partnership Estimated Tax Payment?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending the Form 58 ES Partnership Estimated Tax Payment Form 58 ES Partnership Estimated Tax Payment Nd. Our solution streamlines the process, making it faster and more efficient for businesses to manage their tax documentation.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers flexible pricing plans that cater to different business needs, including options for individuals and teams. By choosing our service, you can efficiently manage the Form 58 ES Partnership Estimated Tax Payment Form 58 ES Partnership Estimated Tax Payment Nd at a competitive price, ensuring you stay compliant without breaking the bank.

-

Are there any integrations available for airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, including popular accounting and document management software. This allows users to easily access and manage the Form 58 ES Partnership Estimated Tax Payment Form 58 ES Partnership Estimated Tax Payment Nd alongside their other business tools.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as electronic signatures, document templates, and real-time tracking for all your tax documents, including the Form 58 ES Partnership Estimated Tax Payment Form 58 ES Partnership Estimated Tax Payment Nd. These features enhance efficiency and ensure that your documents are processed quickly and securely.

-

How secure is airSlate SignNow for handling sensitive tax information?

Security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your sensitive information, including the Form 58 ES Partnership Estimated Tax Payment Form 58 ES Partnership Estimated Tax Payment Nd, ensuring that your data remains confidential and secure.

-

Can I access airSlate SignNow from any device?

Absolutely! airSlate SignNow is designed to be accessible from any device with an internet connection. Whether you're using a desktop, tablet, or smartphone, you can easily manage the Form 58 ES Partnership Estimated Tax Payment Form 58 ES Partnership Estimated Tax Payment Nd on the go.

Get more for Form 58 ES Partnership Estimated Tax Payment Form 58 ES Partnership Estimated Tax Payment Nd

Find out other Form 58 ES Partnership Estimated Tax Payment Form 58 ES Partnership Estimated Tax Payment Nd

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney