Form 60 EXT S Corporation Extension Payment State of North Nd

Understanding Form 60 EXT S Corporation Extension Payment in North Dakota

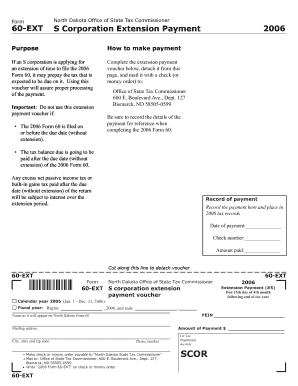

Form 60 EXT is a crucial document for S Corporations in North Dakota seeking an extension for their tax payment obligations. This form allows businesses to request additional time to file their state tax returns while ensuring that any estimated tax payments due are submitted on time. It is essential for maintaining compliance with state tax regulations and avoiding penalties.

Steps to Complete Form 60 EXT for S Corporations

Completing Form 60 EXT involves several important steps:

- Gather necessary information, including the S Corporation's federal identification number and financial details.

- Accurately calculate the estimated tax liability for the fiscal year.

- Fill out the form with the required details, ensuring all sections are completed correctly.

- Review the form for accuracy and completeness before submission.

- Submit the form by the due date to avoid penalties.

Obtaining Form 60 EXT in North Dakota

Form 60 EXT can be obtained directly from the North Dakota Office of State Tax Commissioner’s website. It is available in a downloadable PDF format, allowing businesses to print and fill it out manually. Alternatively, businesses may also contact the tax office for assistance in acquiring the form.

Key Elements of Form 60 EXT

Understanding the key elements of Form 60 EXT is vital for proper completion. The form typically includes:

- The S Corporation's name and address.

- The federal identification number.

- Estimated tax payment amounts.

- Signature of an authorized representative.

Each section must be filled out accurately to ensure that the extension request is processed smoothly.

Filing Deadlines for Form 60 EXT

Timely filing of Form 60 EXT is critical. The form must be submitted by the original due date of the S Corporation's tax return to qualify for the extension. Failure to file on time may result in penalties and interest on unpaid taxes. It is advisable to check the specific deadlines each tax year, as they may vary.

Legal Use of Form 60 EXT

Form 60 EXT serves a legal function by allowing S Corporations to comply with state tax laws while managing their filing schedules. It provides a formal request for an extension, which is recognized by the state tax authority. Proper use of this form helps mitigate risks associated with late filings and potential penalties.

Quick guide on how to complete form 60 ext s corporation extension payment state of north nd

Prepare [SKS] effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS apps and simplify any document-related task today.

How to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns over missing or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 60 EXT S Corporation Extension Payment State Of North Nd

Create this form in 5 minutes!

How to create an eSignature for the form 60 ext s corporation extension payment state of north nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 60 EXT S Corporation Extension Payment State Of North Nd?

The Form 60 EXT S Corporation Extension Payment State Of North Nd is a document used by S Corporations in North Dakota to request an extension for filing their state tax returns. This form allows businesses to extend their payment deadline, ensuring compliance with state tax regulations while avoiding penalties.

-

How can airSlate SignNow help with the Form 60 EXT S Corporation Extension Payment State Of North Nd?

airSlate SignNow provides an efficient platform for electronically signing and sending the Form 60 EXT S Corporation Extension Payment State Of North Nd. Our user-friendly interface simplifies the process, allowing businesses to manage their tax documents quickly and securely.

-

What are the pricing options for using airSlate SignNow for Form 60 EXT S Corporation Extension Payment State Of North Nd?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling the Form 60 EXT S Corporation Extension Payment State Of North Nd. Our plans are cost-effective, ensuring that you get the best value for your document management and eSigning needs.

-

Are there any features specifically designed for handling Form 60 EXT S Corporation Extension Payment State Of North Nd?

Yes, airSlate SignNow includes features such as customizable templates, automated reminders, and secure storage that are ideal for managing the Form 60 EXT S Corporation Extension Payment State Of North Nd. These features streamline the process and enhance compliance with state regulations.

-

Can I integrate airSlate SignNow with other software for managing Form 60 EXT S Corporation Extension Payment State Of North Nd?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and tax software, making it easy to manage the Form 60 EXT S Corporation Extension Payment State Of North Nd alongside your existing tools. This integration helps maintain workflow efficiency and accuracy.

-

What are the benefits of using airSlate SignNow for Form 60 EXT S Corporation Extension Payment State Of North Nd?

Using airSlate SignNow for the Form 60 EXT S Corporation Extension Payment State Of North Nd provides numerous benefits, including time savings, enhanced security, and improved compliance. Our platform ensures that your documents are handled efficiently, reducing the risk of errors and delays.

-

Is airSlate SignNow secure for submitting Form 60 EXT S Corporation Extension Payment State Of North Nd?

Yes, airSlate SignNow prioritizes security and compliance, ensuring that your Form 60 EXT S Corporation Extension Payment State Of North Nd is submitted safely. We utilize advanced encryption and secure storage to protect your sensitive information throughout the signing process.

Get more for Form 60 EXT S Corporation Extension Payment State Of North Nd

Find out other Form 60 EXT S Corporation Extension Payment State Of North Nd

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile