Missouri Tax Registration Form 2018

What is the Missouri Tax Registration Form

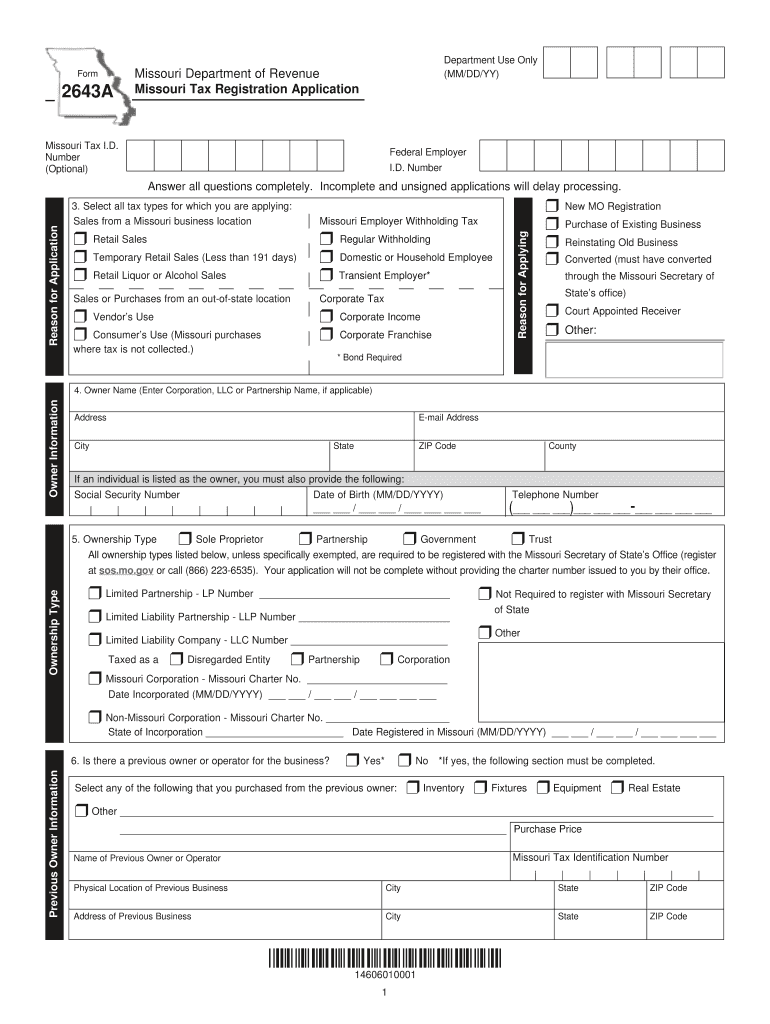

The Missouri Tax Registration Form is an essential document for businesses operating within the state. This form is used to register for various state taxes, including sales tax, withholding tax, and corporate income tax. By completing this form, businesses provide the necessary information to the Missouri Department of Revenue, allowing them to comply with state tax regulations. It is crucial for both new and existing businesses to ensure they are properly registered to avoid penalties and ensure smooth operations.

Steps to complete the Missouri Tax Registration Form

Completing the Missouri Tax Registration Form involves several straightforward steps. First, gather all required information, such as your business name, address, and federal Employer Identification Number (EIN). Next, accurately fill out the form, ensuring that all sections are completed, including details about the type of business entity and the specific taxes for which you are registering. After completing the form, review it for accuracy and completeness before submitting it to the appropriate state department. Finally, retain a copy for your records to ensure compliance and for future reference.

How to obtain the Missouri Tax Registration Form

The Missouri Tax Registration Form can be obtained through the Missouri Department of Revenue's official website. The form is available in a downloadable format, allowing businesses to print and complete it at their convenience. Additionally, businesses can request a physical copy by contacting the department directly. It is advisable to ensure that you are using the most current version of the form to comply with any recent updates or changes in tax regulations.

Required Documents

When filling out the Missouri Tax Registration Form, certain documents may be required to support your application. These typically include your federal Employer Identification Number (EIN), business formation documents (such as Articles of Incorporation for corporations), and any relevant licenses or permits specific to your business type. Having these documents ready will facilitate a smoother registration process and help ensure that your application is complete and accurate.

Form Submission Methods

The completed Missouri Tax Registration Form can be submitted through various methods. Businesses have the option to file the form electronically via the Missouri Department of Revenue’s online portal, which is often the fastest method. Alternatively, the form can be mailed to the designated address provided on the form or submitted in person at a local department office. Each submission method has its own processing times, so it is important to choose the one that best fits your needs.

Penalties for Non-Compliance

Failing to complete and submit the Missouri Tax Registration Form can result in significant penalties for businesses. These penalties may include fines, interest on unpaid taxes, and potential legal action. Additionally, businesses that operate without proper registration may face difficulties in obtaining necessary permits or licenses. To avoid these consequences, it is essential for businesses to ensure timely and accurate registration with the Missouri Department of Revenue.

Quick guide on how to complete missouri tax registration 2018 2019 form

Your assistance manual on how to prepare your Missouri Tax Registration Form

If you’re wondering how to generate and submit your Missouri Tax Registration Form, here are a few straightforward instructions on how to simplify tax filing.

To begin, you simply need to establish your airSlate SignNow account to transform how you handle documentation online. airSlate SignNow is an incredibly user-friendly and powerful document solution that enables you to edit, create, and finalize your tax forms with ease. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures, and revisit your entries to make corrections where necessary. Enhance your tax management with advanced PDF editing, eSigning, and seamless sharing.

Follow these instructions to finalize your Missouri Tax Registration Form in just a few minutes:

- Set up your account and start working on PDFs within minutes.

- Access our library to find any IRS tax form; browse through various versions and schedules.

- Click Get form to open your Missouri Tax Registration Form in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Utilize the Sign Tool to add your legally-binding eSignature (if required).

- Review your document and rectify any mistakes.

- Save changes, print your version, send it to your recipient, and download it to your device.

Utilize this guide to file your taxes electronically with airSlate SignNow. Please be aware that filing on paper can lead to increased errors and delays in refunds. Of course, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct missouri tax registration 2018 2019 form

FAQs

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

I had done my board of Studies registration for CA foundation in July 2018, however didn’t fill the exam form. So what do I need to do to give the may 2019 attempt?

Fortunately, there is still time to register for CA Foundation examination. The date of examination, as well as the last date for registration for CA Foundation examination will be announced shortly.So, dont worry. If you are determined, you can appear for CA Foundation examination scheduled in May 2019.The last date of 31st December 2018 for CA Foundation examination scheduled in May 2019, is only for registration for CA Foundation course.

-

How do I fill out the ICSI registration form?

Online Registration for CS Foundation | Executive | ProfessionalCheck this site

Create this form in 5 minutes!

How to create an eSignature for the missouri tax registration 2018 2019 form

How to generate an eSignature for your Missouri Tax Registration 2018 2019 Form in the online mode

How to create an electronic signature for your Missouri Tax Registration 2018 2019 Form in Google Chrome

How to make an electronic signature for putting it on the Missouri Tax Registration 2018 2019 Form in Gmail

How to create an eSignature for the Missouri Tax Registration 2018 2019 Form from your smart phone

How to make an eSignature for the Missouri Tax Registration 2018 2019 Form on iOS devices

How to make an electronic signature for the Missouri Tax Registration 2018 2019 Form on Android

People also ask

-

What is the Missouri Tax Registration Form and why do I need it?

The Missouri Tax Registration Form is a critical document required for businesses to register for state taxes in Missouri. Completing this form is essential for compliance with state laws and to obtain the necessary permits to operate legally. Without it, your business may face penalties or issues with tax authorities.

-

How can airSlate SignNow help with the Missouri Tax Registration Form?

AirSlate SignNow simplifies the process of completing and submitting the Missouri Tax Registration Form by allowing users to fill, sign, and send documents electronically. Our platform ensures that your documents are securely managed and easily accessible, saving you time during the registration process. This efficiency can help you focus on other important aspects of launching your business.

-

Is there a cost associated with using airSlate SignNow for the Missouri Tax Registration Form?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs. These plans provide you with unlimited access to eSigning capabilities, including streamlined completion of the Missouri Tax Registration Form. Investing in our service can enhance your efficiency and ensure compliance at a reasonable cost.

-

What benefits does airSlate SignNow offer for signing the Missouri Tax Registration Form?

With airSlate SignNow, you can easily eSign your Missouri Tax Registration Form, reducing the time spent on paperwork drastically. The platform ensures that all signatures are legally binding and securely stored, providing peace of mind during the registration process. Additionally, you can track document status in real-time, improving transparency in your business operations.

-

Can I integrate airSlate SignNow with other software for my Missouri Tax Registration Form?

Absolutely! airSlate SignNow offers seamless integrations with various software applications, allowing you to streamline your workflow when handling the Missouri Tax Registration Form. Whether integrating with CRM tools, document management systems, or accounting software, our solution enhances your overall productivity and simplifies tax compliance.

-

How long does it take to complete the Missouri Tax Registration Form using airSlate SignNow?

Completing the Missouri Tax Registration Form with airSlate SignNow is expedited, typically taking only a few minutes. Our intuitive interface and guided steps allow you to fill out the form accurately and efficiently. Once completed, you can submit it immediately, ensuring that your business's tax registration is handled promptly.

-

Is airSlate SignNow secure for handling the Missouri Tax Registration Form?

Yes, airSlate SignNow prioritizes your security and ensures that all transactions involving the Missouri Tax Registration Form are encrypted. Our platform complies with industry standards for data protection, providing a safe environment for managing sensitive business information. You can confidently handle your registration knowing that your data is well-protected.

Get more for Missouri Tax Registration Form

- E scrip transcript request faulkner state community college faulknerstate form

- Ui form 37nc

- Form tsp 17 122010

- Boe400lrr form

- Sec 1 statement of financial interests rev 0114 pdf state ethics phila form

- Division of water and waste management site registration application dep wv form

- Folsom biz certificate online form

- Building permit owner builder declaration form

Find out other Missouri Tax Registration Form

- Can I eSign Hawaii High Tech Document

- How Can I eSign Hawaii High Tech Document

- How Do I eSign Hawaii High Tech Document

- Can I eSign Hawaii High Tech Word

- How Can I eSign Hawaii High Tech Form

- How Do I eSign New Mexico Healthcare / Medical Word

- How To eSign Washington High Tech Presentation

- Help Me With eSign Vermont Healthcare / Medical PPT

- How To eSign Arizona Lawers PDF

- How To eSign Utah Government Word

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF