Form North Dakota Office of State Tax Commissioner 60 ES Purpose S Corporation Estimated Tax Payment How to Make Payment Complet

Understanding the Form North Dakota Office Of State Tax Commissioner 60 ES

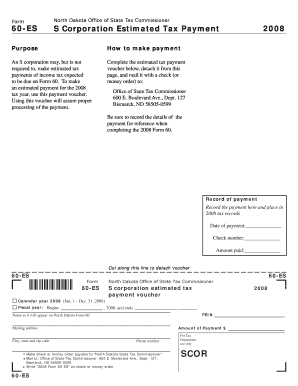

The Form North Dakota Office Of State Tax Commissioner 60 ES is specifically designed for S Corporations to report their estimated tax payments. This form is essential for businesses to comply with state tax regulations, ensuring that they make timely payments to avoid penalties. It serves as a voucher for estimated tax payments, which are typically required quarterly. Proper completion of this form is crucial for maintaining good standing with the state tax authority.

Steps to Complete the Form North Dakota Office Of State Tax Commissioner 60 ES

Completing the Form 60 ES involves several steps to ensure accuracy and compliance. First, gather all necessary financial information related to your S Corporation's income and expenses. Next, fill out the form with the estimated tax amount based on your projected income for the year. Be sure to include your business name, address, and federal identification number. After completing the form, detach the payment voucher from the main document, and prepare your check or money order for the estimated tax payment. Finally, mail both the voucher and payment to the designated address provided on the form.

How to Obtain the Form North Dakota Office Of State Tax Commissioner 60 ES

The Form North Dakota Office Of State Tax Commissioner 60 ES can be obtained directly from the North Dakota Office of State Tax Commissioner’s website or by contacting their office. It is also available at various tax preparation offices and financial institutions across the state. Ensure you have the most current version of the form to avoid any issues with your estimated tax payments.

Legal Use of the Form North Dakota Office Of State Tax Commissioner 60 ES

Using the Form 60 ES is a legal requirement for S Corporations in North Dakota that expect to owe tax. This form allows businesses to report their estimated tax liabilities and make payments accordingly. Failure to use this form properly may result in penalties or interest on unpaid taxes. It is important to follow all instructions and guidelines provided by the North Dakota Office of State Tax Commissioner to ensure compliance with state tax laws.

Filing Deadlines for the Form North Dakota Office Of State Tax Commissioner 60 ES

Filing deadlines for the Form 60 ES typically align with the quarterly estimated tax payment schedule. S Corporations are generally required to submit their estimated payments by the 15th day of the fourth, sixth, ninth, and twelfth months of their fiscal year. It is crucial to keep track of these dates to avoid late fees and ensure timely compliance with state tax obligations.

Form Submission Methods for the Form North Dakota Office Of State Tax Commissioner 60 ES

The Form North Dakota Office Of State Tax Commissioner 60 ES can be submitted via mail. After completing the form and preparing your payment, detach the voucher and send it along with your check or money order to the specified address. Currently, electronic submission options may not be available for this form, so ensure that you send your payment well before the deadline to avoid delays.

Quick guide on how to complete form north dakota office of state tax commissioner 60 es purpose s corporation estimated tax payment how to make payment

Prepare [SKS] seamlessly on any gadget

Digital document management has gained traction among companies and individuals. It serves as an ideal environmentally-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage [SKS] on any gadget using airSlate SignNow Android or iOS applications and streamline any document-based workflow today.

How to edit and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Select important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you would like to send your form, via email, text message (SMS), invitation link, or download it to your computer.

No more worries about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form North Dakota Office Of State Tax Commissioner 60 ES Purpose S Corporation Estimated Tax Payment How To Make Payment Complet

Create this form in 5 minutes!

How to create an eSignature for the form north dakota office of state tax commissioner 60 es purpose s corporation estimated tax payment how to make payment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form North Dakota Office Of State Tax Commissioner 60 ES Purpose S Corporation Estimated Tax Payment?

The Form North Dakota Office Of State Tax Commissioner 60 ES Purpose S Corporation Estimated Tax Payment is a document used by S Corporations in North Dakota to report and pay estimated taxes. This form helps ensure that businesses comply with state tax regulations and avoid penalties. Completing this form accurately is crucial for maintaining good standing with the state.

-

How do I make a payment using the Form North Dakota Office Of State Tax Commissioner 60 ES?

To make a payment using the Form North Dakota Office Of State Tax Commissioner 60 ES, complete the estimated tax payment voucher provided on the form. Detach it from the page and mail it along with a check or money order to the designated address. This process ensures that your payment is properly recorded and applied to your tax account.

-

What are the benefits of using airSlate SignNow for tax payment documentation?

Using airSlate SignNow for tax payment documentation streamlines the process of sending and eSigning important forms like the Form North Dakota Office Of State Tax Commissioner 60 ES. It provides a secure, easy-to-use platform that saves time and reduces errors. Additionally, it allows for quick access to documents, ensuring you meet all deadlines efficiently.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses. Pricing varies based on the features and number of users you need. Investing in this service can save you time and reduce the hassle of managing tax documents like the Form North Dakota Office Of State Tax Commissioner 60 ES.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow offers integrations with various software solutions that can enhance your tax management process. This includes accounting software and document management systems, allowing you to seamlessly handle forms like the Form North Dakota Office Of State Tax Commissioner 60 ES. Integrating these tools can improve efficiency and accuracy in your tax-related tasks.

-

What features does airSlate SignNow offer for managing tax forms?

airSlate SignNow provides features such as eSigning, document tracking, and secure storage, which are essential for managing tax forms like the Form North Dakota Office Of State Tax Commissioner 60 ES. These features help ensure that your documents are signed and submitted on time, reducing the risk of penalties. The platform is user-friendly, making it accessible for all business sizes.

-

How can airSlate SignNow help me avoid penalties related to tax payments?

By using airSlate SignNow, you can ensure that your Form North Dakota Office Of State Tax Commissioner 60 ES is completed and submitted accurately and on time. The platform's reminders and tracking features help you stay organized and aware of deadlines. This proactive approach signNowly reduces the risk of incurring penalties for late or incorrect tax payments.

Get more for Form North Dakota Office Of State Tax Commissioner 60 ES Purpose S Corporation Estimated Tax Payment How To Make Payment Complet

Find out other Form North Dakota Office Of State Tax Commissioner 60 ES Purpose S Corporation Estimated Tax Payment How To Make Payment Complet

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile