Form 60 EXT S Corporation Extension Payment Form 60 EXT S Corporation Extension Payment Nd

What is the Form 60 EXT S Corporation Extension Payment?

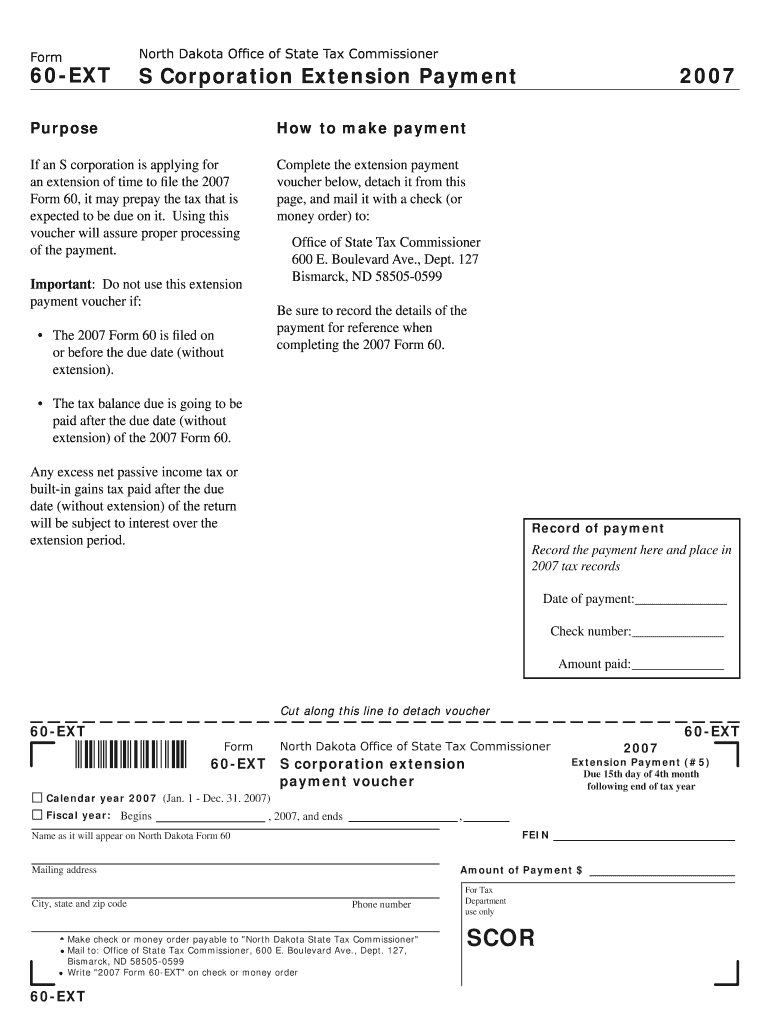

The Form 60 EXT S Corporation Extension Payment is a tax form used by S corporations in the United States to request an extension for filing their tax returns. This form allows businesses to delay their tax filing deadline while ensuring that any taxes owed are paid on time. By submitting this form, S corporations can avoid penalties for late filing and maintain compliance with IRS regulations. It is essential for businesses to understand the implications of this form and its role in the overall tax filing process.

Steps to Complete the Form 60 EXT S Corporation Extension Payment

Completing the Form 60 EXT requires careful attention to detail to ensure accuracy and compliance. Here are the key steps involved:

- Gather necessary financial information, including income, deductions, and credits.

- Enter the corporation's name, address, and Employer Identification Number (EIN) in the designated fields.

- Calculate the estimated tax liability for the year, ensuring to include any applicable credits.

- Indicate the amount of payment being submitted with the form.

- Review the completed form for accuracy before submission.

How to Obtain the Form 60 EXT S Corporation Extension Payment

The Form 60 EXT can be obtained through various means. It is available on the official IRS website, where taxpayers can download and print the form. Additionally, many tax preparation software programs include this form as part of their offerings. Businesses may also consult with tax professionals who can provide guidance and ensure that the form is filled out correctly.

Filing Deadlines for the Form 60 EXT S Corporation Extension Payment

Timely submission of the Form 60 EXT is crucial for avoiding penalties. The IRS typically requires that this form be filed by the original due date of the S corporation's tax return. For most S corporations, this date falls on March 15 of each year. If the deadline is missed, the corporation may face penalties, making it essential to adhere to these timelines.

Legal Use of the Form 60 EXT S Corporation Extension Payment

The Form 60 EXT is legally recognized by the IRS as a valid request for an extension of time to file an S corporation tax return. By submitting this form, corporations affirm their intent to comply with federal tax laws while providing themselves additional time to prepare their returns. It is important for businesses to understand that while this form extends the filing deadline, it does not extend the time to pay any taxes owed.

Penalties for Non-Compliance with the Form 60 EXT S Corporation Extension Payment

Failure to file the Form 60 EXT by the deadline can result in significant penalties for S corporations. The IRS imposes fines for late filing, which can accumulate over time. Additionally, if taxes owed are not paid by the original due date, interest may accrue on the unpaid balance. Understanding these potential consequences can help businesses prioritize timely compliance with their tax obligations.

Quick guide on how to complete form 60 ext s corporation extension payment form 60 ext s corporation extension payment nd

Manage [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign [SKS] without hassle

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal weight as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign [SKS] to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form 60 EXT S Corporation Extension Payment Form 60 EXT S Corporation Extension Payment Nd

Create this form in 5 minutes!

How to create an eSignature for the form 60 ext s corporation extension payment form 60 ext s corporation extension payment nd

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 60 EXT S Corporation Extension Payment Form 60 EXT S Corporation Extension Payment Nd?

The Form 60 EXT S Corporation Extension Payment Form 60 EXT S Corporation Extension Payment Nd is a document used by S Corporations in North Dakota to request an extension for filing their tax returns. This form allows businesses to manage their tax obligations effectively while ensuring compliance with state regulations.

-

How can airSlate SignNow help with the Form 60 EXT S Corporation Extension Payment?

airSlate SignNow provides a streamlined platform for businesses to easily fill out, sign, and submit the Form 60 EXT S Corporation Extension Payment Form 60 EXT S Corporation Extension Payment Nd. Our user-friendly interface simplifies the process, making it quick and efficient for S Corporations to handle their extension payments.

-

What are the pricing options for using airSlate SignNow for Form 60 EXT S Corporation Extension Payment?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Whether you are a small business or a large corporation, you can choose a plan that fits your budget while ensuring you have access to the necessary tools for managing the Form 60 EXT S Corporation Extension Payment Form 60 EXT S Corporation Extension Payment Nd.

-

Are there any features specifically designed for managing Form 60 EXT S Corporation Extension Payment?

Yes, airSlate SignNow includes features such as document templates, eSignature capabilities, and secure storage that are specifically designed to assist with the Form 60 EXT S Corporation Extension Payment Form 60 EXT S Corporation Extension Payment Nd. These features help ensure that your documents are completed accurately and stored securely.

-

What benefits does airSlate SignNow provide for S Corporations using the Form 60 EXT?

Using airSlate SignNow for the Form 60 EXT S Corporation Extension Payment Form 60 EXT S Corporation Extension Payment Nd offers numerous benefits, including time savings, reduced paperwork, and enhanced compliance. Our platform allows for quick document turnaround, ensuring that your extension payments are submitted on time.

-

Can I integrate airSlate SignNow with other software for managing Form 60 EXT?

Absolutely! airSlate SignNow offers integrations with various accounting and business management software, making it easy to manage the Form 60 EXT S Corporation Extension Payment Form 60 EXT S Corporation Extension Payment Nd alongside your existing tools. This integration helps streamline your workflow and enhances productivity.

-

Is it secure to use airSlate SignNow for Form 60 EXT S Corporation Extension Payment?

Yes, security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your data while you complete the Form 60 EXT S Corporation Extension Payment Form 60 EXT S Corporation Extension Payment Nd. You can trust that your sensitive information is safe with us.

Get more for Form 60 EXT S Corporation Extension Payment Form 60 EXT S Corporation Extension Payment Nd

Find out other Form 60 EXT S Corporation Extension Payment Form 60 EXT S Corporation Extension Payment Nd

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney