Oklahoma Form 561 Instructions

Understanding the Oklahoma Form 561 Instructions

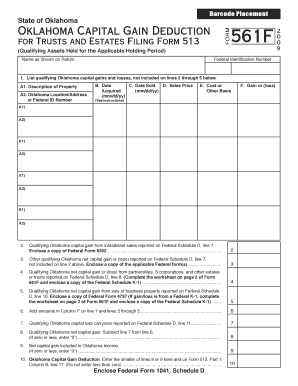

The Oklahoma Form 561 is essential for taxpayers seeking to claim a capital gain deduction. This form provides detailed instructions on how to report capital gains and the necessary documentation required for compliance. It's crucial to understand the specific guidelines outlined in the form to ensure accurate reporting and to maximize potential deductions.

Steps to Complete the Oklahoma Form 561 Instructions

Completing the Oklahoma Form 561 involves several key steps:

- Gather all relevant financial documents, including records of asset purchases and sales.

- Follow the instructions on the form carefully, ensuring that each section is filled out accurately.

- Calculate the capital gains and losses based on the information provided.

- Review the completed form for any errors or omissions before submission.

Eligibility Criteria for the Oklahoma Form 561

To qualify for the capital gain deduction using the Oklahoma Form 561, taxpayers must meet specific eligibility criteria. This includes:

- Ownership of the asset for a minimum period, typically longer than one year.

- Verification that the asset sold was used for personal or business purposes.

- Compliance with state tax regulations regarding capital gains.

Required Documents for the Oklahoma Form 561

When filing the Oklahoma Form 561, certain documents are necessary to support your claim. These include:

- Proof of purchase and sale of the asset, such as receipts or contracts.

- Documentation of any improvements made to the asset that may affect its basis.

- Tax returns from previous years, if applicable, to provide context for the current filing.

Filing Deadlines for the Oklahoma Form 561

Timely filing of the Oklahoma Form 561 is essential to avoid penalties. The typical deadline aligns with the federal tax filing date, which is usually April 15. However, taxpayers should verify any changes or extensions that may apply for the current tax year.

Form Submission Methods for the Oklahoma Form 561

Taxpayers have several options for submitting the Oklahoma Form 561. These methods include:

- Filing electronically through approved tax software that supports state forms.

- Mailing a completed paper form to the designated Oklahoma tax authority address.

- In-person submission at local tax offices, if available.

Legal Use of the Oklahoma Form 561 Instructions

The Oklahoma Form 561 is legally sanctioned for use in claiming capital gain deductions. It is important for taxpayers to follow the instructions precisely to ensure compliance with state tax laws. Misuse or incorrect filing can lead to penalties or denial of deductions.

Quick guide on how to complete oklahoma form 561 instructions

Effortlessly Prepare Oklahoma Form 561 Instructions on Any Device

Digital document management has become increasingly popular among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with everything necessary to create, modify, and eSign your documents swiftly without delays. Manage Oklahoma Form 561 Instructions on any platform with the airSlate SignNow apps for Android or iOS and simplify any document-driven process today.

Effortlessly Modify and eSign Oklahoma Form 561 Instructions

- Obtain Oklahoma Form 561 Instructions and click on Get Form to begin.

- Utilize our provided tools to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and is legally equivalent to a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you want to send your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device. Modify and eSign Oklahoma Form 561 Instructions and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oklahoma form 561 instructions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ok capital gain deduction?

The ok capital gain deduction refers to a tax benefit that allows individuals to reduce their taxable income by deducting certain capital gains. This deduction can signNowly lower your tax liability, making it an essential consideration for investors and property owners. Understanding how to leverage the ok capital gain deduction can enhance your financial strategy.

-

How can airSlate SignNow help with documents related to ok capital gain deduction?

airSlate SignNow provides a seamless platform for sending and eSigning documents that pertain to the ok capital gain deduction. With our user-friendly interface, you can easily manage the necessary paperwork, ensuring compliance and accuracy. This efficiency can save you time and reduce stress during tax season.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing tax documents related to the ok capital gain deduction. These features ensure that your documents are organized and accessible, making it easier to prepare for tax filings. Additionally, our platform supports collaboration, allowing multiple parties to review and sign documents.

-

Is airSlate SignNow cost-effective for small businesses looking to utilize ok capital gain deduction?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses aiming to utilize the ok capital gain deduction. Our pricing plans are flexible and cater to various business sizes, ensuring that you can access essential eSigning features without breaking the bank. This affordability allows you to focus on maximizing your deductions and improving your bottom line.

-

Can I integrate airSlate SignNow with other financial software for managing ok capital gain deduction?

Absolutely! airSlate SignNow integrates seamlessly with various financial software, making it easier to manage documents related to the ok capital gain deduction. This integration allows for streamlined workflows, ensuring that all your financial data is in one place. By connecting your tools, you can enhance productivity and accuracy in your tax preparation process.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including those for the ok capital gain deduction, offers numerous benefits. You gain access to a secure and efficient platform that simplifies the eSigning process, reduces paperwork, and enhances collaboration. These advantages can lead to faster turnaround times and improved compliance with tax regulations.

-

How does airSlate SignNow ensure the security of documents related to ok capital gain deduction?

airSlate SignNow prioritizes the security of your documents, including those related to the ok capital gain deduction. Our platform employs advanced encryption and secure storage solutions to protect sensitive information. Additionally, we comply with industry standards to ensure that your data remains confidential and secure throughout the signing process.

Get more for Oklahoma Form 561 Instructions

Find out other Oklahoma Form 561 Instructions

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF