Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return or Claim for Refund Spanish Version

Understanding the Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version

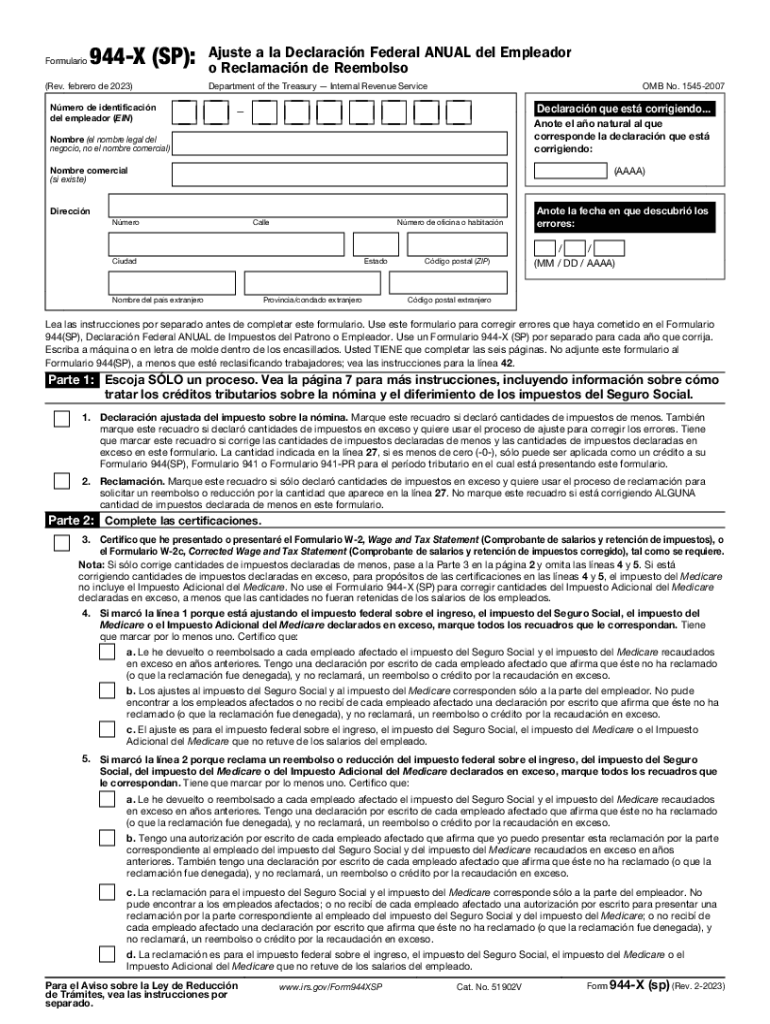

The Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version is a critical document for employers in the United States. This form is specifically designed for those who need to make adjustments to their previously filed Form 944. It allows employers to correct errors related to their annual federal tax return or to claim a refund for overpayments. The Spanish version ensures accessibility for Spanish-speaking employers, facilitating accurate reporting and compliance with federal tax regulations.

Steps to Complete the Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version

Completing the Form 944 X SP Rev February requires careful attention to detail. Here are the essential steps:

- Gather all relevant financial records, including previous Form 944 submissions and any supporting documentation.

- Clearly indicate the specific lines being corrected and provide the correct amounts in the designated spaces.

- Include a detailed explanation of the adjustments being made. This helps the IRS understand the reasons for the changes.

- Review the completed form for accuracy before submission to avoid further complications.

How to Obtain the Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version

Employers can obtain the Form 944 X SP Rev February from the IRS website or through authorized tax professionals. The form is available in a downloadable PDF format, making it easy to access and print. Additionally, employers may request a copy directly from the IRS if needed.

Key Elements of the Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version

Several key elements are essential when filling out the Form 944 X SP Rev February:

- Employer Identification Number (EIN): This unique number identifies the employer and must be included on the form.

- Tax Period: Clearly state the tax period for which the adjustments are being made.

- Corrected Amounts: Provide the accurate amounts for wages, taxes withheld, and any other relevant figures.

- Explanation of Changes: A concise explanation is necessary to clarify the adjustments made.

Filing Deadlines and Important Dates for the Form 944 X SP Rev February

Timely submission of the Form 944 X SP Rev February is crucial to avoid penalties. Generally, the form must be filed within three years from the original due date of the Form 944 or within two years from the date the tax was paid, whichever is later. Employers should keep track of these deadlines to ensure compliance with IRS regulations.

Legal Use of the Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version

The Form 944 X SP Rev February is legally recognized by the IRS as the appropriate method for employers to correct errors on their annual tax returns. It is essential for employers to use this form to maintain compliance with federal tax laws. Failure to do so may result in penalties or additional scrutiny from the IRS.

Quick guide on how to complete form 944 x sp rev february adjusted employers annual federal tax return or claim for refund spanish version 643592916

Complete Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version effortlessly on any device

Web-based document management has gained traction among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate template and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version on any device using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version with ease

- Find Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version and click on Get Form to begin.

- Use the tools we offer to fill in your form.

- Highlight important parts of the documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or missing documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version and ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 944 x sp rev february adjusted employers annual federal tax return or claim for refund spanish version 643592916

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version?

The Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version is a tax form used by employers to correct errors on their annual federal tax return. This version is specifically designed for Spanish-speaking users, ensuring accessibility and understanding. It allows employers to claim refunds or make adjustments to their previously filed returns.

-

How can airSlate SignNow help with the Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version?

airSlate SignNow provides a streamlined platform for electronically signing and sending the Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version. Our user-friendly interface simplifies the process, making it easy for employers to manage their tax documents efficiently. With airSlate SignNow, you can ensure compliance and accuracy in your tax filings.

-

Is there a cost associated with using airSlate SignNow for the Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of businesses of all sizes. Our plans are designed to be cost-effective while providing comprehensive features for managing documents like the Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version?

airSlate SignNow offers features such as electronic signatures, document templates, and real-time tracking for the Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version. These tools enhance efficiency and ensure that your documents are processed quickly and securely. Additionally, our platform supports collaboration, allowing multiple users to work on the same document.

-

Can I integrate airSlate SignNow with other software for the Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easy to incorporate the Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version into your existing workflows. Whether you use accounting software or CRM systems, our integrations help streamline your document management process.

-

What are the benefits of using airSlate SignNow for the Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version?

Using airSlate SignNow for the Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are signed and sent quickly, minimizing delays in tax processing. Additionally, the electronic format helps reduce the risk of errors and lost documents.

-

Is airSlate SignNow secure for handling the Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version?

Yes, airSlate SignNow prioritizes security and compliance when handling sensitive documents like the Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version. Our platform employs advanced encryption and security protocols to protect your data. You can trust that your information is safe and secure while using our services.

Get more for Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version

Find out other Form 944 X SP Rev February Adjusted Employers ANNUAL Federal Tax Return Or Claim For Refund Spanish Version

- How To Electronic signature South Carolina Legal Lease Agreement

- How Can I Electronic signature South Carolina Legal Quitclaim Deed

- Electronic signature South Carolina Legal Rental Lease Agreement Later

- Electronic signature South Carolina Legal Rental Lease Agreement Free

- How To Electronic signature South Dakota Legal Separation Agreement

- How Can I Electronic signature Tennessee Legal Warranty Deed

- Electronic signature Texas Legal Lease Agreement Template Free

- Can I Electronic signature Texas Legal Lease Agreement Template

- How To Electronic signature Texas Legal Stock Certificate

- How Can I Electronic signature Texas Legal POA

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free