Form 2248, Electronic Funds Transfer EFT Debit Application Mi

What is the Form 2248, Electronic Funds Transfer EFT Debit Application in Michigan?

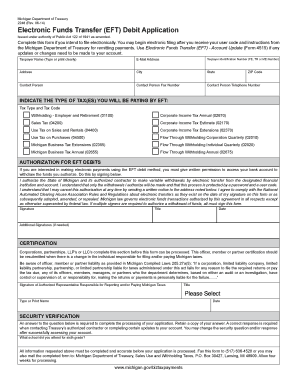

The Form 2248, also known as the Electronic Funds Transfer (EFT) Debit Application, is a crucial document used in Michigan for facilitating electronic payments. This form enables individuals and businesses to authorize the state to withdraw funds directly from their bank accounts for various obligations, such as tax payments or other state fees. By using this form, taxpayers can streamline their payment processes, ensuring timely and secure transactions without the need for paper checks.

Steps to Complete the Form 2248, Electronic Funds Transfer EFT Debit Application in Michigan

Completing the Form 2248 involves several straightforward steps:

- Begin by downloading the form from the appropriate state website or obtaining a physical copy.

- Fill in your personal or business information, including your name, address, and contact details.

- Provide your bank account information, including the account number and routing number, ensuring accuracy to avoid payment issues.

- Indicate the type of payments you wish to authorize, such as tax payments or other state fees.

- Sign and date the form to validate your authorization.

After completing the form, it is essential to review all entries for accuracy before submission.

How to Obtain the Form 2248, Electronic Funds Transfer EFT Debit Application in Michigan

The Form 2248 can be obtained through several methods:

- Visit the official Michigan government website where forms are available for download.

- Request a physical copy from your local tax office or financial institution.

- Contact state agencies that handle tax payments for assistance in acquiring the form.

Ensure that you are using the most current version of the form to avoid any complications during the submission process.

Key Elements of the Form 2248, Electronic Funds Transfer EFT Debit Application in Michigan

The Form 2248 contains several critical elements that must be completed accurately:

- Personal or Business Information: This includes your name, address, and contact details.

- Bank Account Details: Accurate routing and account numbers are essential for processing payments.

- Payment Authorization: Specify the types of payments you are authorizing for electronic withdrawal.

- Signature: Your signature confirms your authorization for the state to withdraw funds.

Each of these elements plays a vital role in ensuring that your application is processed smoothly and efficiently.

Legal Use of the Form 2248, Electronic Funds Transfer EFT Debit Application in Michigan

The legal use of the Form 2248 is governed by state regulations regarding electronic payments. By submitting this form, you grant the state permission to withdraw specified amounts from your bank account. It is important to understand that this authorization remains in effect until you revoke it in writing. Compliance with all state laws regarding electronic funds transfers is essential to avoid potential penalties or issues with your payments.

Form Submission Methods for the Form 2248 in Michigan

The completed Form 2248 can be submitted through various methods:

- Online Submission: Some state agencies may allow for electronic submission through secure portals.

- Mail: You can send the completed form to the designated state office via postal mail.

- In-Person: Delivering the form directly to your local tax office can ensure it is received promptly.

Choose the submission method that best fits your needs and ensure that you follow any specific guidelines provided by the state agency.

Quick guide on how to complete form 2248 electronic funds transfer eft debit application mi

Complete Form 2248, Electronic Funds Transfer EFT Debit Application Mi effortlessly on any device

Online document management has become popular with businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Manage Form 2248, Electronic Funds Transfer EFT Debit Application Mi on any device using the airSlate SignNow Android or iOS applications and simplify any document-related operation today.

The easiest way to modify and eSign Form 2248, Electronic Funds Transfer EFT Debit Application Mi without hassle

- Locate Form 2248, Electronic Funds Transfer EFT Debit Application Mi and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Form 2248, Electronic Funds Transfer EFT Debit Application Mi and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2248 electronic funds transfer eft debit application mi

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Michigan electronic funds transfer?

Michigan electronic funds transfer refers to the digital process of transferring money electronically within Michigan. This method allows businesses and individuals to send and receive funds quickly and securely, eliminating the need for paper checks. Utilizing airSlate SignNow, you can streamline your document signing and payment processes, making Michigan electronic funds transfer more efficient.

-

How does airSlate SignNow facilitate Michigan electronic funds transfer?

airSlate SignNow simplifies Michigan electronic funds transfer by integrating eSignature capabilities with payment processing. Users can send documents for signature and include payment options, ensuring that funds are transferred electronically upon completion. This seamless integration enhances the overall efficiency of financial transactions in Michigan.

-

What are the benefits of using airSlate SignNow for Michigan electronic funds transfer?

Using airSlate SignNow for Michigan electronic funds transfer offers numerous benefits, including faster transaction times and reduced paperwork. The platform's user-friendly interface allows for easy document management and signing, which can signNowly improve your business operations. Additionally, it enhances security and compliance, ensuring that your financial transactions are protected.

-

Is there a cost associated with Michigan electronic funds transfer through airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow for Michigan electronic funds transfer, but it is designed to be cost-effective. Pricing varies based on the features and volume of transactions you require. By choosing airSlate SignNow, you can access a range of pricing plans that cater to different business needs while ensuring a high return on investment.

-

What features does airSlate SignNow offer for Michigan electronic funds transfer?

airSlate SignNow offers a variety of features for Michigan electronic funds transfer, including customizable templates, automated workflows, and secure eSignatures. These features help streamline the process of sending and signing documents while ensuring that funds are transferred electronically. Additionally, the platform provides tracking and reporting tools to monitor your transactions.

-

Can airSlate SignNow integrate with other financial software for Michigan electronic funds transfer?

Yes, airSlate SignNow can integrate with various financial software solutions to enhance Michigan electronic funds transfer capabilities. This integration allows for seamless data transfer and improved workflow efficiency. By connecting with your existing systems, you can automate processes and reduce manual entry, making transactions faster and more reliable.

-

How secure is Michigan electronic funds transfer with airSlate SignNow?

Security is a top priority for airSlate SignNow when it comes to Michigan electronic funds transfer. The platform employs advanced encryption and security protocols to protect sensitive financial information. Additionally, compliance with industry standards ensures that your transactions are safe and secure, giving you peace of mind when conducting business.

Get more for Form 2248, Electronic Funds Transfer EFT Debit Application Mi

Find out other Form 2248, Electronic Funds Transfer EFT Debit Application Mi

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online