INCOME WITHHOLDING for SUPPORT INCOME WITHHOLDING 2017

What is the Income Withholding for Support?

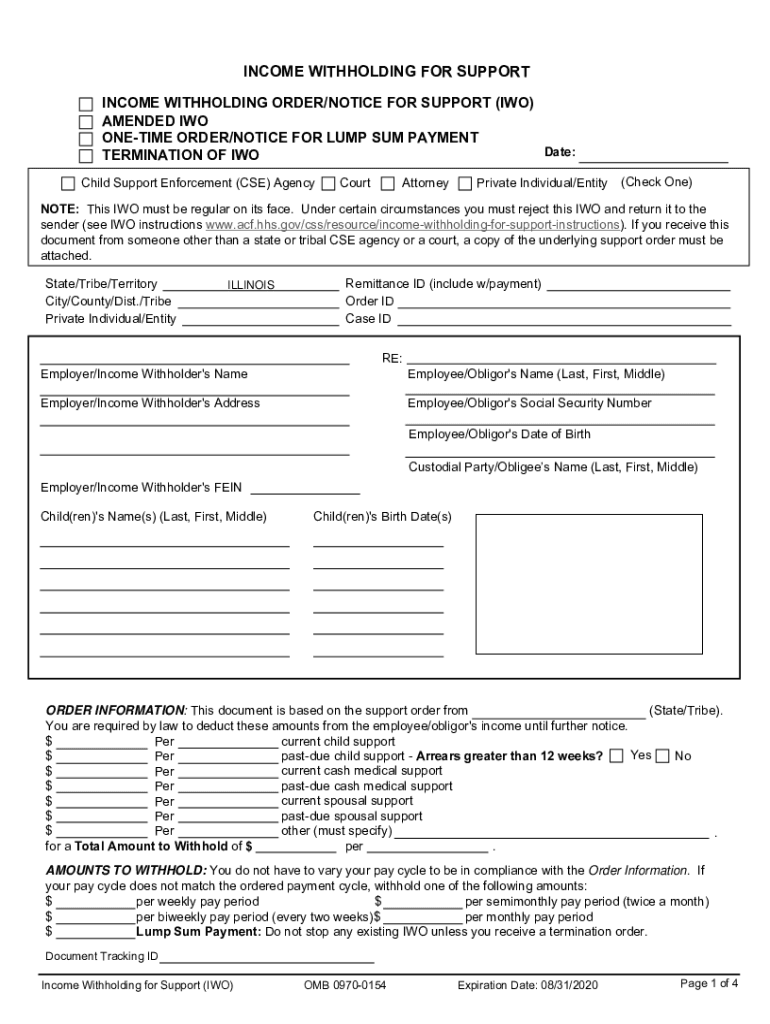

The Income Withholding for Support is a legal document used primarily in the United States to collect child support or spousal support directly from an individual's wages. This form is typically initiated by a court order or a support enforcement agency. It ensures that payments are made consistently and on time, reducing the likelihood of missed payments. The form is designed to streamline the process of withholding funds from a paycheck, allowing for automatic deductions to be sent to the recipient.

How to Use the Income Withholding for Support

To use the Income Withholding for Support, the employer must receive a completed and signed form from the court or support enforcement agency. Once received, the employer is responsible for implementing the withholding process. This involves deducting the specified amount from the employee's paycheck and sending it to the designated support recipient. Employers must ensure compliance with both federal and state regulations regarding the withholding amounts and timelines.

Steps to Complete the Income Withholding for Support

Completing the Income Withholding for Support involves several key steps:

- Obtain the form from the appropriate court or agency.

- Fill in the necessary details, including the employee's information and the amount to be withheld.

- Sign the form to validate it.

- Submit the completed form to the employer and keep a copy for personal records.

Employers should also review the form to ensure all information is accurate before processing the withholding.

Legal Use of the Income Withholding for Support

The Income Withholding for Support is legally binding once issued by a court or authorized agency. It is crucial for employers and employees to understand their rights and responsibilities under this legal framework. Employers must comply with the withholding order promptly and accurately, while employees should be aware that failure to comply with support obligations can lead to legal consequences, including wage garnishment and other enforcement actions.

Key Elements of the Income Withholding for Support

Several key elements are essential to the Income Withholding for Support, including:

- The name and address of the employee.

- The name and address of the recipient of the support.

- The amount to be withheld from each paycheck.

- The frequency of payments.

- Any applicable court or agency information.

These elements ensure that the withholding process is clear and that all parties involved understand their obligations.

State-Specific Rules for the Income Withholding for Support

Each state in the U.S. may have specific rules and regulations regarding the Income Withholding for Support. These can include variations in the form itself, the amount that can be withheld, and the procedures for submitting the form. It is essential for both employers and employees to familiarize themselves with their state’s laws to ensure compliance and avoid potential penalties.

Quick guide on how to complete income withholding for support income withholding

Easily Prepare INCOME WITHHOLDING FOR SUPPORT INCOME WITHHOLDING on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, allowing you to find the right form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle INCOME WITHHOLDING FOR SUPPORT INCOME WITHHOLDING on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Best Method to Edit and eSign INCOME WITHHOLDING FOR SUPPORT INCOME WITHHOLDING Effortlessly

- Obtain INCOME WITHHOLDING FOR SUPPORT INCOME WITHHOLDING and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize signNow sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a traditional wet signature.

- Review all the information and press the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow fulfills all your document management needs within a few clicks from any device of your choosing. Edit and eSign INCOME WITHHOLDING FOR SUPPORT INCOME WITHHOLDING and ensure outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income withholding for support income withholding

Create this form in 5 minutes!

How to create an eSignature for the income withholding for support income withholding

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is INCOME WITHHOLDING FOR SUPPORT INCOME WITHHOLDING?

INCOME WITHHOLDING FOR SUPPORT INCOME WITHHOLDING refers to the legal process of deducting a portion of an individual's income to fulfill child support obligations. This ensures that payments are made consistently and on time, providing financial stability for dependents.

-

How does airSlate SignNow facilitate INCOME WITHHOLDING FOR SUPPORT INCOME WITHHOLDING?

airSlate SignNow streamlines the process of managing INCOME WITHHOLDING FOR SUPPORT INCOME WITHHOLDING by allowing users to create, send, and eSign necessary documents quickly. This reduces paperwork and enhances compliance with legal requirements, making it easier for businesses and individuals to manage their obligations.

-

What are the pricing options for using airSlate SignNow for INCOME WITHHOLDING FOR SUPPORT INCOME WITHHOLDING?

airSlate SignNow offers flexible pricing plans tailored to different business needs, including options for managing INCOME WITHHOLDING FOR SUPPORT INCOME WITHHOLDING. Each plan provides access to essential features that help streamline document management and eSigning processes.

-

What features does airSlate SignNow provide for INCOME WITHHOLDING FOR SUPPORT INCOME WITHHOLDING?

Key features of airSlate SignNow for INCOME WITHHOLDING FOR SUPPORT INCOME WITHHOLDING include customizable templates, automated workflows, and secure eSigning capabilities. These features help ensure that all documents are processed efficiently and securely, meeting legal standards.

-

Can airSlate SignNow integrate with other software for INCOME WITHHOLDING FOR SUPPORT INCOME WITHHOLDING?

Yes, airSlate SignNow offers integrations with various software applications, enhancing its functionality for INCOME WITHHOLDING FOR SUPPORT INCOME WITHHOLDING. This allows users to connect their existing systems, improving workflow efficiency and data management.

-

What are the benefits of using airSlate SignNow for INCOME WITHHOLDING FOR SUPPORT INCOME WITHHOLDING?

Using airSlate SignNow for INCOME WITHHOLDING FOR SUPPORT INCOME WITHHOLDING provides numerous benefits, including increased efficiency, reduced errors, and enhanced compliance. The platform's user-friendly interface makes it accessible for all users, ensuring that obligations are met without hassle.

-

Is airSlate SignNow secure for handling INCOME WITHHOLDING FOR SUPPORT INCOME WITHHOLDING documents?

Absolutely, airSlate SignNow prioritizes security for all documents related to INCOME WITHHOLDING FOR SUPPORT INCOME WITHHOLDING. The platform employs advanced encryption and security protocols to protect sensitive information, ensuring that all transactions are safe and compliant with regulations.

Get more for INCOME WITHHOLDING FOR SUPPORT INCOME WITHHOLDING

- Eg 13 b form

- I 20 consent form for f1 international students california state www20 csueastbay

- Dhsr 4204 form

- Eyewash station log sheet form

- What is captcha in indian army website form

- Handbook for custodial parents texas form

- Adr 104 rejection of award and request for trial after attorney client fee arbitration judicial council forms

- N12 notice to end your tenancy because the landlord form

Find out other INCOME WITHHOLDING FOR SUPPORT INCOME WITHHOLDING

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement