Bulletin 12 Remitting Nonresident Broker Premium Taxes Form

Understanding Bulletin 12 Remitting Nonresident Broker Premium Taxes

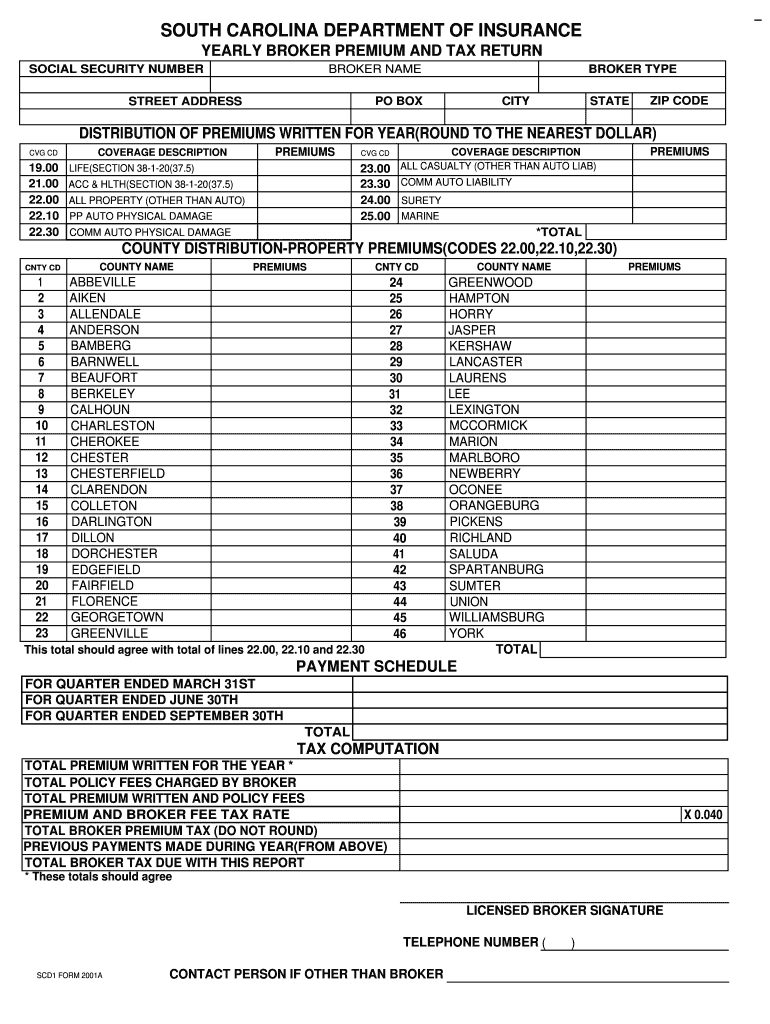

The Bulletin 12 Remitting Nonresident Broker Premium Taxes is a crucial document for businesses engaging with nonresident brokers. This bulletin outlines the requirements for remitting premium taxes associated with insurance transactions involving nonresident brokers. It helps ensure compliance with state regulations and provides clarity on tax obligations, making it essential for businesses operating in the insurance sector.

Steps to Complete the Bulletin 12 Remitting Nonresident Broker Premium Taxes

Completing the Bulletin 12 involves several key steps:

- Gather all necessary information regarding the nonresident broker and the premiums involved.

- Review state-specific regulations to ensure compliance with local tax laws.

- Fill out the required sections of the bulletin accurately, providing all relevant details.

- Calculate the total premium taxes owed based on the guidelines provided in the bulletin.

- Submit the completed bulletin along with any required payments by the specified deadlines.

Legal Use of the Bulletin 12 Remitting Nonresident Broker Premium Taxes

The legal use of Bulletin 12 is vital for businesses to avoid penalties and ensure compliance with tax laws. This document serves as an official record of premium tax remittances and must be completed in accordance with state regulations. Businesses should retain copies of submitted bulletins for their records, as they may be required for audits or compliance checks.

Filing Deadlines and Important Dates

Timely filing is critical when remitting nonresident broker premium taxes. Each state may have different deadlines, so it is important to check local regulations. Generally, businesses should be aware of the following:

- Quarterly filing deadlines for premium tax remittances.

- Annual reconciliation deadlines, if applicable.

- Any specific dates for submitting amended bulletins if corrections are needed.

Required Documents for Submission

When submitting the Bulletin 12, certain documents may be required to support the information provided. These documents can include:

- Proof of payment for the premium taxes owed.

- Documentation of the insurance transactions involving nonresident brokers.

- Any additional forms required by the state for tax compliance.

Penalties for Non-Compliance

Failure to comply with the requirements outlined in Bulletin 12 can result in significant penalties. Common consequences include:

- Monetary fines based on the amount of unpaid taxes.

- Interest charges on late payments.

- Potential legal action for repeated non-compliance.

Examples of Using the Bulletin 12 Remitting Nonresident Broker Premium Taxes

Understanding practical applications of Bulletin 12 can help businesses navigate their tax obligations. For example:

- A company that uses a nonresident broker for an insurance policy must complete the bulletin to report premiums paid.

- Businesses engaging multiple nonresident brokers should ensure each transaction is documented and reported accurately.

Quick guide on how to complete bulletin 12 remitting nonresident broker premium taxes

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal environmentally friendly substitute to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you require to create, modify, and electronically sign your documents quickly without delays. Handle [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

An Easy Way to Modify and Electronically Sign [SKS]

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your electronic signature using the Sign feature, which only takes a few seconds and carries the same legal validity as a traditional signature in ink.

- Review the details and click the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Modify and electronically sign [SKS] to facilitate exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Bulletin 12 Remitting Nonresident Broker Premium Taxes

Create this form in 5 minutes!

How to create an eSignature for the bulletin 12 remitting nonresident broker premium taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Bulletin 12 Remitting Nonresident Broker Premium Taxes?

Bulletin 12 Remitting Nonresident Broker Premium Taxes provides guidelines for nonresident brokers on how to remit premium taxes effectively. Understanding this bulletin is crucial for compliance and avoiding penalties. airSlate SignNow can help streamline the documentation process related to these tax remittances.

-

How can airSlate SignNow assist with Bulletin 12 Remitting Nonresident Broker Premium Taxes?

airSlate SignNow offers an easy-to-use platform that simplifies the process of eSigning and sending documents related to Bulletin 12 Remitting Nonresident Broker Premium Taxes. Our solution ensures that all necessary forms are completed accurately and submitted on time, reducing the risk of errors.

-

What are the pricing options for using airSlate SignNow for Bulletin 12 Remitting Nonresident Broker Premium Taxes?

airSlate SignNow provides flexible pricing plans tailored to meet the needs of businesses handling Bulletin 12 Remitting Nonresident Broker Premium Taxes. Our cost-effective solutions ensure that you only pay for the features you need, making it accessible for businesses of all sizes.

-

What features does airSlate SignNow offer for managing Bulletin 12 Remitting Nonresident Broker Premium Taxes?

Our platform includes features such as customizable templates, automated workflows, and secure cloud storage, all designed to facilitate Bulletin 12 Remitting Nonresident Broker Premium Taxes. These features help ensure that your documents are organized and easily accessible whenever needed.

-

Are there any integrations available with airSlate SignNow for Bulletin 12 Remitting Nonresident Broker Premium Taxes?

Yes, airSlate SignNow integrates seamlessly with various applications and software that can assist in managing Bulletin 12 Remitting Nonresident Broker Premium Taxes. This allows for a more streamlined workflow, enabling you to connect your existing tools and enhance productivity.

-

What benefits does airSlate SignNow provide for businesses dealing with Bulletin 12 Remitting Nonresident Broker Premium Taxes?

Using airSlate SignNow for Bulletin 12 Remitting Nonresident Broker Premium Taxes offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance. Our platform helps businesses save time and resources while ensuring that all tax-related documents are handled correctly.

-

Is airSlate SignNow secure for handling sensitive documents related to Bulletin 12 Remitting Nonresident Broker Premium Taxes?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that all documents related to Bulletin 12 Remitting Nonresident Broker Premium Taxes are protected. Our platform employs advanced encryption and security measures to safeguard your sensitive information.

Get more for Bulletin 12 Remitting Nonresident Broker Premium Taxes

Find out other Bulletin 12 Remitting Nonresident Broker Premium Taxes

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free