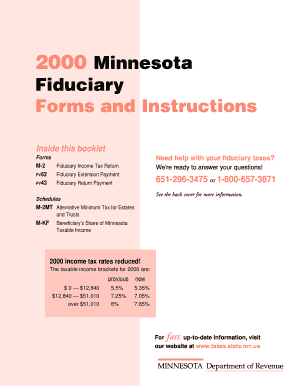

Minnesota Fiduciary Forms and Instructions Revenue State Mn

What is the Minnesota Fiduciary Forms And Instructions Revenue State Mn

The Minnesota Fiduciary Forms and Instructions are essential documents used for reporting income and managing the financial affairs of estates, trusts, and guardianships in Minnesota. These forms guide fiduciaries—such as executors, trustees, and guardians—in fulfilling their legal obligations to report income, distribute assets, and handle tax responsibilities. They ensure compliance with state regulations and help maintain transparency in financial dealings.

How to use the Minnesota Fiduciary Forms And Instructions Revenue State Mn

To effectively use the Minnesota Fiduciary Forms and Instructions, it is important to first identify the specific form required for your situation, such as the estate tax return or trust income tax return. Each form comes with detailed instructions outlining the necessary steps for completion. Carefully read these instructions to ensure that all required information is accurately provided. After filling out the forms, review them for completeness before submission to avoid delays or penalties.

Steps to complete the Minnesota Fiduciary Forms And Instructions Revenue State Mn

Completing the Minnesota Fiduciary Forms involves several key steps:

- Gather all necessary documents, including financial statements, tax records, and identification information.

- Identify the correct form based on the fiduciary's role and the type of entity (e.g., estate or trust).

- Follow the instructions carefully, filling in all required fields accurately.

- Review the completed form for any errors or missing information.

- Submit the form by the specified deadline, ensuring it is sent to the correct address.

Key elements of the Minnesota Fiduciary Forms And Instructions Revenue State Mn

Key elements of the Minnesota Fiduciary Forms include personal identification information, details about the fiduciary's relationship to the estate or trust, and a comprehensive account of income and expenses. Additionally, the forms require the disclosure of assets and liabilities, as well as any distributions made to beneficiaries. Understanding these elements is crucial for accurate reporting and compliance with state laws.

Filing Deadlines / Important Dates

Filing deadlines for the Minnesota Fiduciary Forms vary depending on the type of form being submitted. Generally, fiduciary tax returns must be filed by the 15th day of the fourth month following the end of the tax year. It is essential to be aware of these deadlines to avoid penalties and ensure timely compliance. Keeping a calendar of important dates can help fiduciaries manage their responsibilities effectively.

Required Documents

When completing the Minnesota Fiduciary Forms, certain documents are required to support the information provided. These typically include:

- Financial statements from the estate or trust.

- Tax identification numbers for the fiduciary and the entity.

- Records of income generated by the estate or trust.

- Documentation of any distributions made to beneficiaries.

Having these documents ready will facilitate a smoother completion process and ensure compliance with state requirements.

Quick guide on how to complete minnesota fiduciary forms and instructions revenue state mn

Complete [SKS] with ease on any device

Digital document management has become increasingly favored by both companies and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to adjust and electronically sign [SKS] effortlessly

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark signNow sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you wish to deliver your form, via email, text message (SMS), or a shareable link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device of your choosing. Edit and electronically sign [SKS] to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Minnesota Fiduciary Forms And Instructions Revenue State Mn

Create this form in 5 minutes!

How to create an eSignature for the minnesota fiduciary forms and instructions revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Minnesota Fiduciary Forms And Instructions Revenue State Mn?

Minnesota Fiduciary Forms And Instructions Revenue State Mn are official documents required for fiduciaries to report income and manage estates in Minnesota. These forms ensure compliance with state regulations and help streamline the fiduciary process. Understanding these forms is crucial for effective estate management.

-

How can airSlate SignNow help with Minnesota Fiduciary Forms And Instructions Revenue State Mn?

airSlate SignNow provides an easy-to-use platform for electronically signing and sending Minnesota Fiduciary Forms And Instructions Revenue State Mn. Our solution simplifies the document management process, allowing fiduciaries to focus on their responsibilities without the hassle of paper forms. This efficiency can save time and reduce errors.

-

What is the pricing structure for using airSlate SignNow for Minnesota Fiduciary Forms And Instructions Revenue State Mn?

airSlate SignNow offers competitive pricing plans tailored to meet the needs of businesses handling Minnesota Fiduciary Forms And Instructions Revenue State Mn. Our plans are designed to be cost-effective, ensuring you get the best value for your document management needs. You can choose from monthly or annual subscriptions based on your usage.

-

Are there any integrations available for airSlate SignNow with other software for Minnesota Fiduciary Forms And Instructions Revenue State Mn?

Yes, airSlate SignNow integrates seamlessly with various software applications to enhance your workflow for Minnesota Fiduciary Forms And Instructions Revenue State Mn. These integrations allow you to connect with popular tools like Google Drive, Dropbox, and CRM systems, making document management more efficient. This connectivity ensures that you can access and manage your forms easily.

-

What are the benefits of using airSlate SignNow for Minnesota Fiduciary Forms And Instructions Revenue State Mn?

Using airSlate SignNow for Minnesota Fiduciary Forms And Instructions Revenue State Mn offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick eSigning and tracking of documents, ensuring that you stay compliant with state regulations. Additionally, the user-friendly interface makes it accessible for all users.

-

Is airSlate SignNow secure for handling Minnesota Fiduciary Forms And Instructions Revenue State Mn?

Absolutely! airSlate SignNow prioritizes security, ensuring that your Minnesota Fiduciary Forms And Instructions Revenue State Mn are protected. We utilize advanced encryption and security protocols to safeguard your documents and personal information. You can trust that your sensitive data is in safe hands.

-

Can I customize Minnesota Fiduciary Forms And Instructions Revenue State Mn using airSlate SignNow?

Yes, airSlate SignNow allows you to customize Minnesota Fiduciary Forms And Instructions Revenue State Mn to meet your specific needs. You can add fields, adjust layouts, and include your branding to ensure that the forms reflect your organization’s identity. This customization helps in creating a professional appearance for your documents.

Get more for Minnesota Fiduciary Forms And Instructions Revenue State Mn

- Cuny heo evaluation form

- Instrumental and terminal values worksheet form

- The care for oregon sm nursing loan program form

- Mspn proposal usf system university of south florida form

- Request for incident records form

- Contact us sf state graduate programs san francisco state form

- Sfsubox form

- Staff fee waiver job related application fee waiver form

Find out other Minnesota Fiduciary Forms And Instructions Revenue State Mn

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy