Schedule M 1MT MINNESOTA Department of Revenue Attachment Sequence #4 Alternative Minimum Tax Your Last Name Social Security Num Form

Understanding the Schedule M 1MT MINNESOTA Department Of Revenue Attachment Sequence #4

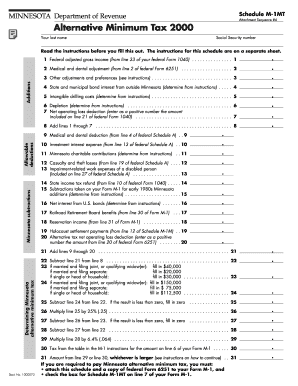

The Schedule M 1MT is a form used by residents of Minnesota to report their Alternative Minimum Tax (AMT) obligations. This tax applies to individuals whose income exceeds certain thresholds, requiring them to calculate their tax liability differently than under the standard tax system. The form includes essential information such as your last name and Social Security number, ensuring that your tax records are accurately linked to your identity. Understanding this form is crucial for compliance with state tax regulations.

Steps to Complete the Schedule M 1MT

Completing the Schedule M 1MT involves several key steps:

- Gather necessary documents, including your previous tax returns and any supporting financial statements.

- Carefully read the instructions provided with the form to understand the requirements and calculations needed.

- Fill out your personal information, including your last name and Social Security number, in the designated fields.

- Calculate your Alternative Minimum Tax using the guidelines specified in the instructions, ensuring accuracy in your figures.

- Review your completed form for any errors before submission.

Obtaining the Schedule M 1MT

The Schedule M 1MT can be obtained through the Minnesota Department of Revenue's official website. You can download a PDF version of the form, which can be filled out digitally or printed for manual completion. Additionally, local tax offices may provide physical copies of the form upon request. Ensure you have the most recent version to comply with current tax laws.

Key Elements of the Schedule M 1MT

Several key elements are crucial when filling out the Schedule M 1MT:

- Personal Information: This includes your last name, Social Security number, and other identifying details.

- Income Calculation: Accurate reporting of your income is essential to determine your AMT liability.

- Exemptions and Deductions: Understanding which exemptions and deductions apply to your situation can significantly impact your tax calculation.

- Tax Computation: The form requires specific calculations to determine your AMT, which may differ from your regular tax calculations.

Legal Use of the Schedule M 1MT

The Schedule M 1MT is a legally mandated form for Minnesota residents subject to the Alternative Minimum Tax. Proper completion and submission of this form are essential to comply with state tax laws. Failing to file or incorrectly reporting information may result in penalties or additional tax liabilities. It is advisable to consult with a tax professional if you have questions regarding your specific situation.

Filing Deadlines for the Schedule M 1MT

Filing deadlines for the Schedule M 1MT typically align with the general state tax filing deadlines. Taxpayers should check the Minnesota Department of Revenue’s official announcements for specific dates each tax year. Timely submission is crucial to avoid penalties and ensure that your tax obligations are met without complications.

Quick guide on how to complete schedule m 1mt minnesota department of revenue attachment sequence 4 alternative minimum tax your last name social security

Effortlessly prepare [SKS] on any device

Web-based document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without hold-ups. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to initiate the process.

- Utilize the tools available to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule M 1MT MINNESOTA Department Of Revenue Attachment Sequence #4 Alternative Minimum Tax Your Last Name Social Security Num

Create this form in 5 minutes!

How to create an eSignature for the schedule m 1mt minnesota department of revenue attachment sequence 4 alternative minimum tax your last name social security

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Schedule M 1MT MINNESOTA Department Of Revenue Attachment Sequence #4 Alternative Minimum Tax?

Schedule M 1MT MINNESOTA Department Of Revenue Attachment Sequence #4 Alternative Minimum Tax is a form used to calculate your alternative minimum tax in Minnesota. It is essential to fill this out accurately to ensure compliance with state tax regulations. Make sure to include your last name and Social Security number as instructed.

-

How can airSlate SignNow help me with Schedule M 1MT MINNESOTA Department Of Revenue Attachment Sequence #4?

airSlate SignNow provides an easy-to-use platform for sending and eSigning documents, including tax forms like Schedule M 1MT MINNESOTA Department Of Revenue Attachment Sequence #4. Our solution streamlines the process, ensuring that you can complete and submit your forms efficiently while maintaining compliance.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers various pricing plans to suit different needs. Our cost-effective solution allows you to manage and eSign documents, including Schedule M 1MT MINNESOTA Department Of Revenue Attachment Sequence #4, without breaking the bank. Check our website for detailed pricing information.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage. These tools make it easier to manage your tax documents, including Schedule M 1MT MINNESOTA Department Of Revenue Attachment Sequence #4, ensuring you have everything you need at your fingertips.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software. This allows you to streamline your workflow when dealing with forms like Schedule M 1MT MINNESOTA Department Of Revenue Attachment Sequence #4, making the process more efficient.

-

What are the benefits of using airSlate SignNow for my tax forms?

Using airSlate SignNow for your tax forms, including Schedule M 1MT MINNESOTA Department Of Revenue Attachment Sequence #4, offers numerous benefits. You can save time, reduce errors, and ensure compliance with state regulations, all while enjoying a user-friendly interface.

-

How do I get started with airSlate SignNow for my tax documents?

Getting started with airSlate SignNow is simple! Sign up for an account on our website, and you can begin uploading and managing your tax documents, including Schedule M 1MT MINNESOTA Department Of Revenue Attachment Sequence #4, right away. Our platform is designed to be intuitive and user-friendly.

Get more for Schedule M 1MT MINNESOTA Department Of Revenue Attachment Sequence #4 Alternative Minimum Tax Your Last Name Social Security Num

- 3g mobile repairs book in form

- Nastf bond application form

- How to edit report card templates form

- Stanley steemer hardwood process form

- Owner surrender form dog

- Mega sports camp registration form for ages 4 12

- Form for voluntary surrender of motor vehicle

- Relief society presidency meeting agenda form

Find out other Schedule M 1MT MINNESOTA Department Of Revenue Attachment Sequence #4 Alternative Minimum Tax Your Last Name Social Security Num

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed

- eSign Michigan Car Dealer Operating Agreement Mobile

- Can I eSign Mississippi Car Dealer Resignation Letter