Schedule M1CRN Credit for Nonresident Partners on Taxes Paid to Home State Form

What is the Schedule M1CRN Credit For Nonresident Partners On Taxes Paid To Home State

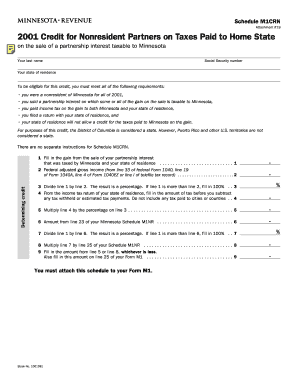

The Schedule M1CRN is a tax form used by nonresident partners in partnerships to claim a credit for taxes paid to their home state. This credit is particularly relevant for individuals who earn income from a partnership operating in a different state than their residence. By utilizing this form, nonresident partners can reduce their tax liability in the state where the partnership is located, thereby avoiding double taxation on the same income.

Steps to complete the Schedule M1CRN Credit For Nonresident Partners On Taxes Paid To Home State

Completing the Schedule M1CRN involves several key steps:

- Gather necessary documents: Collect all relevant tax documents, including your partnership income statement and any tax payments made to your home state.

- Fill out the form: Enter your personal information, including your name, address, and Social Security number, as well as details about the partnership.

- Calculate the credit: Determine the amount of tax paid to your home state and enter this figure on the form.

- Review and sign: Ensure all information is accurate, then sign and date the form.

Key elements of the Schedule M1CRN Credit For Nonresident Partners On Taxes Paid To Home State

Several key elements are essential for understanding the Schedule M1CRN:

- Eligibility: Only nonresident partners who have paid taxes to their home state can claim this credit.

- Tax credit amount: The credit is generally equal to the amount of tax paid to the home state, subject to certain limitations.

- Filing requirements: Nonresident partners must file the Schedule M1CRN along with their state tax return to claim the credit.

Eligibility Criteria

To qualify for the Schedule M1CRN credit, nonresident partners must meet specific eligibility criteria:

- Must be a nonresident of the state where the partnership operates.

- Must have paid income taxes to their home state on income earned from the partnership.

- Must file a state tax return in the state where the partnership operates.

Examples of using the Schedule M1CRN Credit For Nonresident Partners On Taxes Paid To Home State

Here are a few examples illustrating how the Schedule M1CRN can be utilized:

- A partner residing in New York earns income from a partnership based in California and pays taxes to California. By filing Schedule M1CRN, the partner can claim a credit for taxes paid to California on their New York tax return.

- A nonresident partner from Texas earns income from a partnership in Florida. If they pay taxes to Florida, they can use Schedule M1CRN to offset their tax liability in Texas.

Filing Deadlines / Important Dates

It is crucial for nonresident partners to be aware of the filing deadlines associated with the Schedule M1CRN. Typically, the form must be submitted by the same deadline as the state tax return. For most states, this is usually April 15th, but it may vary based on state-specific regulations. Partners should confirm the exact dates to ensure compliance and avoid penalties.

Quick guide on how to complete schedule m1crn credit for nonresident partners on taxes paid to home state

Prepare [SKS] easily on any gadget

Online document organization has become increasingly favored by businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, edit, and eSign your documents swiftly and without delays. Manage [SKS] on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or mislaid files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule M1CRN Credit For Nonresident Partners On Taxes Paid To Home State

Create this form in 5 minutes!

How to create an eSignature for the schedule m1crn credit for nonresident partners on taxes paid to home state

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule M1CRN Credit For Nonresident Partners On Taxes Paid To Home State?

The Schedule M1CRN Credit For Nonresident Partners On Taxes Paid To Home State allows nonresident partners to claim a credit for taxes paid to their home state. This credit helps reduce the tax burden for partners who earn income in a different state. Understanding this credit is essential for accurate tax filing and maximizing potential refunds.

-

How can airSlate SignNow assist with filing the Schedule M1CRN Credit?

airSlate SignNow provides an efficient platform for managing and eSigning documents related to the Schedule M1CRN Credit For Nonresident Partners On Taxes Paid To Home State. Our solution simplifies the document workflow, ensuring that all necessary forms are completed and submitted accurately. This streamlines the process, making tax filing less stressful.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the Schedule M1CRN Credit For Nonresident Partners On Taxes Paid To Home State. These features enhance efficiency and ensure compliance with tax regulations. Users can easily collaborate and share documents with their tax professionals.

-

Is there a cost associated with using airSlate SignNow for tax documents?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, including options for individuals and teams. The cost is competitive and reflects the value of features designed to simplify processes like filing the Schedule M1CRN Credit For Nonresident Partners On Taxes Paid To Home State. A free trial is also available to explore the platform's capabilities.

-

Can I integrate airSlate SignNow with other accounting software?

Absolutely! airSlate SignNow integrates seamlessly with popular accounting software, allowing for a smooth workflow when managing tax documents, including the Schedule M1CRN Credit For Nonresident Partners On Taxes Paid To Home State. This integration helps ensure that all financial data is synchronized, reducing the risk of errors during tax preparation.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, such as the Schedule M1CRN Credit For Nonresident Partners On Taxes Paid To Home State, offers numerous benefits. These include enhanced security, ease of use, and the ability to track document status in real-time. This ensures that your tax filings are handled efficiently and securely.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your tax documents by employing advanced encryption and secure storage solutions. When dealing with sensitive information related to the Schedule M1CRN Credit For Nonresident Partners On Taxes Paid To Home State, you can trust that your data is protected. Our platform complies with industry standards to safeguard your information.

Get more for Schedule M1CRN Credit For Nonresident Partners On Taxes Paid To Home State

Find out other Schedule M1CRN Credit For Nonresident Partners On Taxes Paid To Home State

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure