Schedule M1wfc Minnesota Working Family Credit Form

What is the Schedule M1wfc Minnesota Working Family Credit

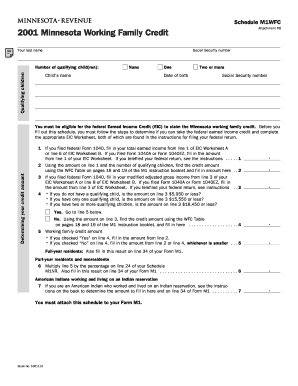

The Schedule M1WFC is a tax form used in Minnesota to claim the Working Family Credit. This credit is designed to provide financial assistance to low- to moderate-income working families. It aims to reduce poverty and encourage employment by offering a refundable tax credit, which means that eligible taxpayers can receive a refund even if they do not owe any taxes. The amount of the credit varies based on income, family size, and other factors, making it an essential resource for qualifying families in Minnesota.

Eligibility Criteria

To qualify for the Schedule M1WFC, applicants must meet specific eligibility requirements. Primarily, the applicant must be a resident of Minnesota and have earned income from employment or self-employment. Additionally, the family must have a qualifying child under the age of 19 or a student under the age of 24. Income limits apply, and the credit amount decreases as income increases. It is crucial to review the current income thresholds and family size requirements to determine eligibility accurately.

Steps to complete the Schedule M1wfc Minnesota Working Family Credit

Completing the Schedule M1WFC involves several key steps:

- Gather necessary documentation, including proof of income and information about qualifying children.

- Fill out the form accurately, ensuring all required sections are completed.

- Calculate the credit amount based on the provided income and family size.

- Review the form for accuracy before submission to avoid delays.

Once completed, the form should be submitted with the Minnesota tax return.

Required Documents

When preparing to file the Schedule M1WFC, certain documents are essential. Taxpayers should collect:

- W-2 forms from employers, showing total earnings.

- 1099 forms for self-employment income, if applicable.

- Social Security numbers for all qualifying children.

- Any other documentation that supports claimed income and family size.

Having these documents ready will streamline the filing process and help ensure the accuracy of the information provided.

How to use the Schedule M1wfc Minnesota Working Family Credit

Using the Schedule M1WFC effectively involves understanding how to apply the credit to your tax situation. After determining eligibility, taxpayers should complete the form and include it with their Minnesota income tax return. The credit can be claimed for the tax year in which the eligible income was earned. It is important to keep records of all income and documentation for future reference, especially if the Minnesota Department of Revenue requests verification.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule M1WFC align with Minnesota's standard tax return deadlines. Typically, the deadline for filing individual income tax returns is April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of any changes to deadlines and plan accordingly to ensure timely submission of their forms.

Quick guide on how to complete schedule m1wfc minnesota working family credit

Prepare [SKS] seamlessly on any device

Digital document management has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed papers, as you can locate the right form and securely save it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without holdups. Manage [SKS] on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the resources we offer to fill out your form.

- Highlight pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal standing as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses your requirements in document management in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule M1wfc Minnesota Working Family Credit

Create this form in 5 minutes!

How to create an eSignature for the schedule m1wfc minnesota working family credit

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule M1wfc Minnesota Working Family Credit?

The Schedule M1wfc Minnesota Working Family Credit is a tax credit designed to assist low- to moderate-income working families in Minnesota. This credit can signNowly reduce your tax liability, providing financial relief to eligible families. Understanding how to apply for this credit is essential for maximizing your tax benefits.

-

How can airSlate SignNow help with the Schedule M1wfc Minnesota Working Family Credit?

airSlate SignNow streamlines the process of preparing and submitting documents related to the Schedule M1wfc Minnesota Working Family Credit. With our easy-to-use platform, you can quickly eSign and send necessary forms, ensuring you meet all deadlines. This efficiency can help you focus more on your finances and less on paperwork.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the Schedule M1wfc Minnesota Working Family Credit. These tools help ensure that your documents are completed accurately and submitted on time. Additionally, our platform is user-friendly, making it accessible for everyone.

-

Is there a cost associated with using airSlate SignNow for the Schedule M1wfc Minnesota Working Family Credit?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for individuals and businesses. The cost is competitive and reflects the value of the features provided, such as secure eSigning and document management. Investing in airSlate SignNow can save you time and reduce stress during tax season.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various tax preparation software, enhancing your ability to manage documents related to the Schedule M1wfc Minnesota Working Family Credit. This integration allows for a smoother workflow, enabling you to access all necessary tools in one place. You can easily import and export documents as needed.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the Schedule M1wfc Minnesota Working Family Credit, offers numerous benefits. You gain access to a secure platform for eSigning, document storage, and tracking, which simplifies the entire process. Additionally, our solution is designed to save you time and reduce the likelihood of errors.

-

How secure is airSlate SignNow when handling sensitive tax documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your sensitive tax documents, including those related to the Schedule M1wfc Minnesota Working Family Credit. You can trust that your information is safe and secure while using our platform.

Get more for Schedule M1wfc Minnesota Working Family Credit

Find out other Schedule M1wfc Minnesota Working Family Credit

- eSignature Oklahoma Payroll Deduction Authorization Easy

- How To eSignature Texas Payroll Deduction Authorization

- Can I Electronic signature Connecticut Retainer for Attorney

- How Do I Electronic signature Idaho Assignment of License

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer