M1ED K 12 Education Credit Minnesota Department of Revenue Form

What is the M1ED K 12 Education Credit?

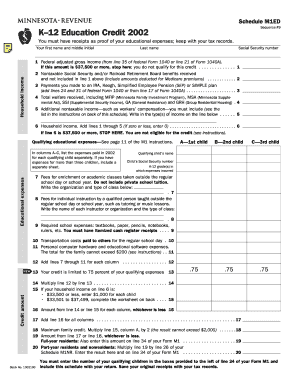

The M1ED K 12 Education Credit is a tax credit offered by the Minnesota Department of Revenue. It is designed to provide financial relief to parents and guardians of K-12 students by allowing them to claim certain educational expenses. This credit can help offset costs associated with tuition, textbooks, and other necessary educational materials, making education more accessible for families.

Eligibility Criteria for the M1ED K 12 Education Credit

To qualify for the M1ED K 12 Education Credit, taxpayers must meet specific criteria. Eligible claimants typically include parents or guardians of students enrolled in K-12 education in Minnesota. The student must be attending an eligible school, and the expenses claimed must be directly related to their education. Additionally, there may be income limits that affect eligibility, so it is essential to review the latest guidelines provided by the Minnesota Department of Revenue.

Steps to Complete the M1ED K 12 Education Credit

Completing the M1ED K 12 Education Credit involves several key steps. First, gather all necessary documentation, including receipts for educational expenses. Next, fill out the M1ED form accurately, ensuring that all information is complete and correct. After completing the form, review it for any errors before submission. Finally, submit the form to the Minnesota Department of Revenue by the designated filing deadline, which is typically aligned with state tax return deadlines.

Required Documents for the M1ED K 12 Education Credit

When applying for the M1ED K 12 Education Credit, specific documentation is required to substantiate your claim. This may include:

- Receipts for tuition payments

- Invoices for educational materials and supplies

- Proof of enrollment for the K-12 student

- Any other relevant documents that validate the educational expenses incurred

Ensuring that all documents are organized and readily available will facilitate a smoother application process.

How to Obtain the M1ED K 12 Education Credit

To obtain the M1ED K 12 Education Credit, taxpayers must complete the M1ED form, which can be accessed through the Minnesota Department of Revenue's website. The form is typically available in both digital and paper formats. After filling out the form with accurate information, submit it according to the instructions provided, either online or via mail. It is crucial to keep a copy of the submitted form and all supporting documents for your records.

Filing Deadlines for the M1ED K 12 Education Credit

Filing deadlines for the M1ED K 12 Education Credit generally coincide with the state income tax return deadlines. Typically, taxpayers must submit their claims by April 15 of the following tax year. However, it is advisable to check the Minnesota Department of Revenue's official announcements for any updates or changes to these deadlines, as they may vary from year to year.

Quick guide on how to complete m1ed k 12 education credit minnesota department of revenue

Complete [SKS] effortlessly on any device

Web-based document management has become favored by businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents quickly without hold-ups. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and streamline any document-oriented process today.

The easiest way to alter and eSign [SKS] without hassle

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your needs in document management in just a few clicks from any device of your choosing. Alter and eSign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to M1ED K 12 Education Credit Minnesota Department Of Revenue

Create this form in 5 minutes!

How to create an eSignature for the m1ed k 12 education credit minnesota department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M1ED K 12 Education Credit Minnesota Department Of Revenue?

The M1ED K 12 Education Credit Minnesota Department Of Revenue is a tax credit designed to help families cover educational expenses for K-12 students. This credit can signNowly reduce the financial burden of educational costs, making it easier for parents to invest in their children's education.

-

Who is eligible for the M1ED K 12 Education Credit Minnesota Department Of Revenue?

Eligibility for the M1ED K 12 Education Credit Minnesota Department Of Revenue typically includes parents or guardians of K-12 students attending school in Minnesota. Income limits and specific criteria apply, so it's essential to review the guidelines provided by the Minnesota Department of Revenue.

-

How do I apply for the M1ED K 12 Education Credit Minnesota Department Of Revenue?

To apply for the M1ED K 12 Education Credit Minnesota Department Of Revenue, you need to complete the appropriate tax forms during your annual tax filing. Ensure you gather all necessary documentation related to educational expenses to support your claim.

-

What types of expenses are covered by the M1ED K 12 Education Credit Minnesota Department Of Revenue?

The M1ED K 12 Education Credit Minnesota Department Of Revenue covers a variety of educational expenses, including tuition, textbooks, and school supplies. It's important to keep receipts and records of these expenses to substantiate your claim.

-

Is there a limit to the M1ED K 12 Education Credit Minnesota Department Of Revenue?

Yes, there is a limit to the M1ED K 12 Education Credit Minnesota Department Of Revenue, which varies based on the taxpayer's income and the number of qualifying students. Be sure to check the latest guidelines from the Minnesota Department of Revenue for specific limits applicable to your situation.

-

Can I claim the M1ED K 12 Education Credit Minnesota Department Of Revenue for online learning expenses?

Yes, you can claim the M1ED K 12 Education Credit Minnesota Department Of Revenue for eligible online learning expenses, provided they meet the criteria set by the Minnesota Department of Revenue. This includes costs associated with online courses and materials necessary for remote education.

-

How does the M1ED K 12 Education Credit Minnesota Department Of Revenue benefit families?

The M1ED K 12 Education Credit Minnesota Department Of Revenue provides signNow financial relief to families by offsetting educational costs. This credit encourages investment in quality education, allowing parents to allocate more resources towards their children's learning and development.

Get more for M1ED K 12 Education Credit Minnesota Department Of Revenue

Find out other M1ED K 12 Education Credit Minnesota Department Of Revenue

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy

- eSign Kentucky Construction Claim Online

- How Can I eSign Maine Construction Quitclaim Deed

- eSign Colorado Education Promissory Note Template Easy

- eSign North Dakota Doctors Affidavit Of Heirship Now

- eSign Oklahoma Doctors Arbitration Agreement Online

- eSign Oklahoma Doctors Forbearance Agreement Online