EST Attachment #4 Additional Charge for Underpayment of Estimated Tax Name of Corporationdesignated Filer Minnesota Tax ID FEIN Form

Understanding the EST Attachment #4 Additional Charge for Underpayment of Estimated Tax

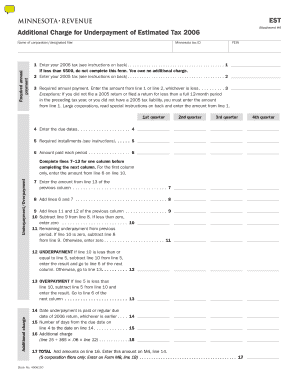

The EST Attachment #4 is a form used by corporations in Minnesota to report additional charges incurred due to underpayment of estimated taxes. This form is essential for ensuring compliance with state tax regulations. It requires the name of the corporation, the designated filer, and the Minnesota Tax ID or FEIN. Understanding this form is crucial for corporations to avoid penalties and ensure accurate tax reporting.

How to Complete the EST Attachment #4

To complete the EST Attachment #4, corporations must gather necessary information, including the total estimated tax liability and any payments made throughout the year. The form will require specific entries such as the corporation's name, Tax ID, and the amount of underpayment. Each section of the form must be filled out accurately to prevent delays or issues with the Minnesota Department of Revenue.

Key Elements of the EST Attachment #4

Important components of the EST Attachment #4 include:

- Name of Corporation: The legal name of the business entity.

- Designated Filer: The individual responsible for filing the form.

- Tax ID or FEIN: The unique identification number assigned to the corporation.

- Required Annual Payment: The total estimated tax payment required for the year.

- Calculation of Underpayment: The amount that was underpaid based on the estimated tax liability.

Filing Deadlines for the EST Attachment #4

Corporations must be aware of the filing deadlines associated with the EST Attachment #4 to avoid penalties. Typically, the form must be submitted by the due date of the corporation's tax return. It is advisable to check the Minnesota Department of Revenue's official calendar for specific dates, as they may vary each year.

Penalties for Non-Compliance

Failure to file the EST Attachment #4 or to pay the required estimated tax can result in significant penalties. The Minnesota Department of Revenue may impose fines based on the amount of underpayment and the duration of the delay. Understanding these penalties is vital for corporations to maintain compliance and avoid unnecessary financial burdens.

Digital Submission Methods for the EST Attachment #4

Corporations have the option to submit the EST Attachment #4 digitally. This method is often more efficient and allows for quicker processing times. Corporations can use approved electronic filing systems or platforms that facilitate the submission of tax forms to the Minnesota Department of Revenue.

Quick guide on how to complete est attachment 4 additional charge for underpayment of estimated tax name of corporationdesignated filer minnesota tax id fein

Finish [SKS] effortlessly on any gadget

Online document management has gained traction among companies and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely preserve it online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents swiftly and without holdups. Handle [SKS] on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Leave behind concerns about lost or mislaid documents, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device of your preference. Modify and eSign [SKS] and ensure excellent communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to EST Attachment #4 Additional Charge For Underpayment Of Estimated Tax Name Of Corporationdesignated Filer Minnesota Tax ID FEIN

Create this form in 5 minutes!

How to create an eSignature for the est attachment 4 additional charge for underpayment of estimated tax name of corporationdesignated filer minnesota tax id fein

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the EST Attachment #4 Additional Charge For Underpayment Of Estimated Tax Name Of Corporationdesignated Filer Minnesota Tax ID FEIN Required Annual Payment?

The EST Attachment #4 Additional Charge For Underpayment Of Estimated Tax Name Of Corporationdesignated Filer Minnesota Tax ID FEIN Required Annual Payment is a form that corporations in Minnesota must complete to report any additional charges due to underpayment of estimated taxes. This form ensures compliance with state tax regulations and helps avoid penalties.

-

How can airSlate SignNow help with the EST Attachment #4 process?

airSlate SignNow streamlines the process of completing and submitting the EST Attachment #4 Additional Charge For Underpayment Of Estimated Tax Name Of Corporationdesignated Filer Minnesota Tax ID FEIN Required Annual Payment. Our platform allows users to easily fill out, eSign, and send documents securely, ensuring timely submission and compliance.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax documents like the EST Attachment #4 Additional Charge For Underpayment Of Estimated Tax Name Of Corporationdesignated Filer Minnesota Tax ID FEIN Required Annual Payment. These tools enhance efficiency and accuracy in tax filing.

-

Is there a cost associated with using airSlate SignNow for tax document management?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. The cost is competitive and provides access to features that simplify the completion of forms like the EST Attachment #4 Additional Charge For Underpayment Of Estimated Tax Name Of Corporationdesignated Filer Minnesota Tax ID FEIN Required Annual Payment, making it a cost-effective solution.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax management software. This integration allows for a smoother workflow when handling documents such as the EST Attachment #4 Additional Charge For Underpayment Of Estimated Tax Name Of Corporationdesignated Filer Minnesota Tax ID FEIN Required Annual Payment, enhancing overall productivity.

-

What are the benefits of using airSlate SignNow for corporate tax filings?

Using airSlate SignNow for corporate tax filings, including the EST Attachment #4 Additional Charge For Underpayment Of Estimated Tax Name Of Corporationdesignated Filer Minnesota Tax ID FEIN Required Annual Payment, provides numerous benefits. These include increased efficiency, reduced errors, and the ability to track document status in real-time, ensuring compliance and timely submissions.

-

How secure is airSlate SignNow for handling sensitive tax information?

airSlate SignNow prioritizes security and employs advanced encryption protocols to protect sensitive tax information. When managing documents like the EST Attachment #4 Additional Charge For Underpayment Of Estimated Tax Name Of Corporationdesignated Filer Minnesota Tax ID FEIN Required Annual Payment, users can trust that their data is safe and secure.

Get more for EST Attachment #4 Additional Charge For Underpayment Of Estimated Tax Name Of Corporationdesignated Filer Minnesota Tax ID FEIN

- Deviation addendum form new york child support

- Civildomestic bench trial calendar gwinnett county courts form

- Disclosure statement wisconsinillinois child support border form

- In the circuit court of cook county illinois county 50195170 form

- Illinois statutory summary suspension form

- Application for miscellaneous services indian consulate san francisco application for miscellaneous services indian consulate form

- Affidavit to dissolve louisiana corporation affidavit to dissolve louisiana corporation brac form

- Md rule 9 202 form

Find out other EST Attachment #4 Additional Charge For Underpayment Of Estimated Tax Name Of Corporationdesignated Filer Minnesota Tax ID FEIN

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself