Response to Inquiry Mortgage Company Form

What is the Response To Inquiry Mortgage Company

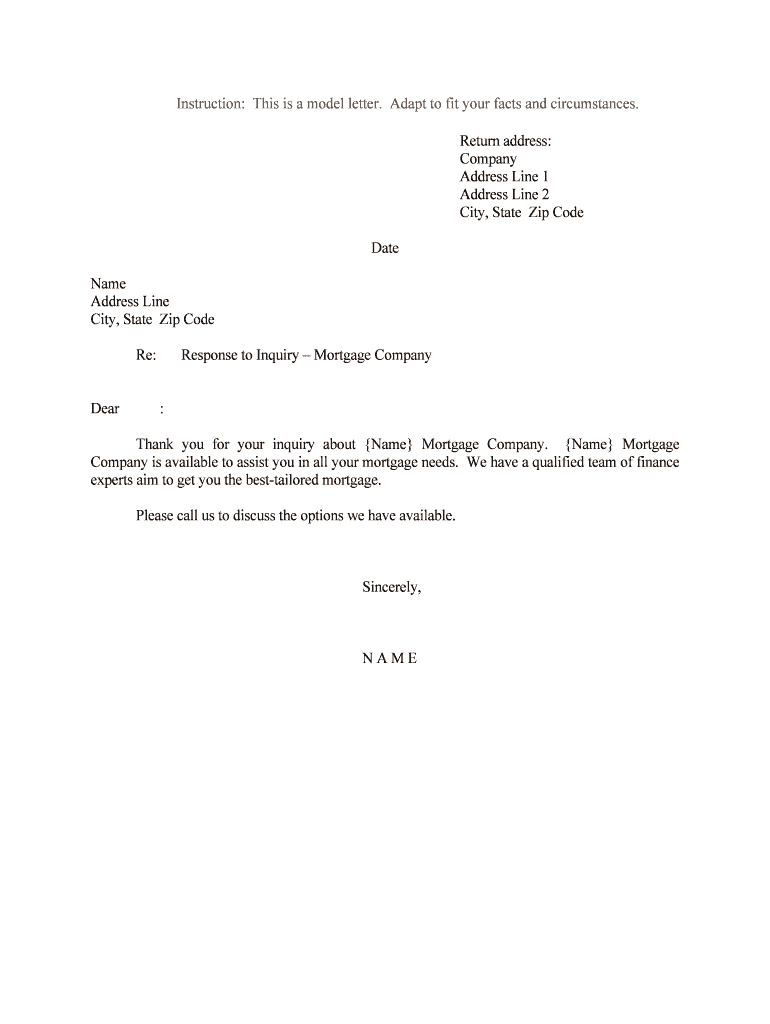

The Response To Inquiry Mortgage Company form is a crucial document used in the mortgage industry. It serves as a formal reply to inquiries made by potential borrowers regarding mortgage options, rates, and terms. This form helps mortgage companies provide detailed information tailored to the specific needs and circumstances of the borrower, ensuring transparency and clarity in the lending process. Understanding this form is essential for both lenders and borrowers to facilitate effective communication and informed decision-making.

How to use the Response To Inquiry Mortgage Company

Using the Response To Inquiry Mortgage Company form involves several straightforward steps. First, gather all necessary information about the mortgage inquiry, including the borrower's financial details and specific questions. Next, fill out the form accurately, ensuring that all relevant sections are completed. This may include sections on loan types, interest rates, and repayment options. Once the form is filled out, it should be sent to the borrower, either electronically or through traditional mail, depending on the lender's process. By using this form correctly, mortgage companies can enhance their customer service and streamline the inquiry response process.

Steps to complete the Response To Inquiry Mortgage Company

Completing the Response To Inquiry Mortgage Company form requires careful attention to detail. Follow these steps for successful completion:

- Review the borrower's inquiry to understand their specific needs.

- Collect necessary data, such as the borrower's credit score, income, and existing debts.

- Fill in the form with accurate and comprehensive information.

- Double-check all entries for accuracy and completeness.

- Submit the form to the borrower through their preferred communication method.

Legal use of the Response To Inquiry Mortgage Company

The legal use of the Response To Inquiry Mortgage Company form is governed by various regulations that ensure its validity and enforceability. It is essential for mortgage companies to comply with federal and state laws regarding lending practices and consumer protection. This includes adhering to the guidelines set forth by the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA). By following these legal requirements, mortgage companies can protect themselves and their clients, ensuring that all communications are clear, accurate, and legally binding.

Key elements of the Response To Inquiry Mortgage Company

Key elements of the Response To Inquiry Mortgage Company form include:

- Borrower Information: Details about the borrower, including name, contact information, and financial background.

- Inquiry Details: Specific questions or concerns raised by the borrower regarding mortgage options.

- Loan Options: A summary of available mortgage products, including interest rates and terms.

- Contact Information: Details for follow-up communication, ensuring the borrower can reach the mortgage company easily.

Examples of using the Response To Inquiry Mortgage Company

Examples of using the Response To Inquiry Mortgage Company form can vary widely based on borrower needs. For instance, a first-time homebuyer may use the form to inquire about different loan types and down payment requirements. An investor might request information on refinancing options for rental properties. Each scenario demonstrates how the form can be tailored to provide specific responses that address the unique circumstances of different borrowers, enhancing the overall customer experience.

Quick guide on how to complete response to inquiry mortgage company

Effortlessly Prepare Response To Inquiry Mortgage Company on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to easily access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents swiftly without delays. Manage Response To Inquiry Mortgage Company on any device using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

How to Edit and Electronically Sign Response To Inquiry Mortgage Company with Ease

- Find Response To Inquiry Mortgage Company and click Get Form to initiate the process.

- Use the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you’d like to send your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Response To Inquiry Mortgage Company to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the typical response time for an inquiry to a mortgage company using airSlate SignNow?

The response time can vary, but with airSlate SignNow, mortgage companies can efficiently respond to inquiries within hours. This quick turnaround greatly enhances customer satisfaction and demonstrates the company's commitment to service. By streamlining processes, airSlate SignNow helps ensure that inquiries are handled promptly.

-

How does airSlate SignNow improve the response quality to inquiries for mortgage companies?

airSlate SignNow enhances response quality by providing mortgage companies with templates and tools that ensure consistent communication. These resources make it easier to address common inquiries accurately and thoroughly. As a result, customers receive well-informed responses, improving overall interaction quality.

-

What pricing options does airSlate SignNow offer for mortgage companies?

airSlate SignNow provides flexible pricing plans tailored for mortgage companies of different sizes. These plans are designed to be budget-friendly while offering essential features for handling inquiries effectively. By choosing airSlate SignNow, mortgage companies can ensure a great return on investment in managing responses to inquiries.

-

Can airSlate SignNow integrate with other tools used by mortgage companies?

Yes, airSlate SignNow easily integrates with various third-party applications used by mortgage companies, such as CRM and loan management systems. This seamless integration allows for better management of inquiries and improves workflow efficiency. With these capabilities, mortgage companies can respond to inquiries more effectively.

-

What features does airSlate SignNow offer to enhance document management for mortgage inquiries?

airSlate SignNow offers features like electronic signatures, document templates, and audit trails, ensuring all mortgage inquiries are managed efficiently. These tools help keep track of mailed documents and responses seamlessly. By utilizing these features, mortgage companies can simplify the inquiry response process.

-

How can airSlate SignNow help mortgage companies increase customer satisfaction?

By using airSlate SignNow, mortgage companies can provide faster and more consistent responses to inquiries, leading to enhanced customer satisfaction. The platform's intuitive design allows for smoother communication and quicker document processing. Satisfied customers are likely to return for future services and recommend the company to others.

-

Is airSlate SignNow secure for handling sensitive mortgage information in inquiries?

Absolutely! airSlate SignNow prioritizes security and compliance, making it a safe choice for managing sensitive mortgage information. The platform includes features like encryption and secure access to protect customer data, ensuring that responses to inquiries maintain confidentiality and integrity.

Get more for Response To Inquiry Mortgage Company

- Minicipal business tax return classification 1c tennessee form

- Tngovrevenueformsgeneralr 2012

- 2014 municipal business tax return bus 416 2014 municipal business tax return bus 416 form

- Tennessee estate inheritance tax waiver 2008 form

- Tn fae 170 2008 form

- Tennessee department of revenue blanket certificate of resale form 2008

- Form 302 tn inheritance tax 2013

- Form fae 173 2007

Find out other Response To Inquiry Mortgage Company

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer