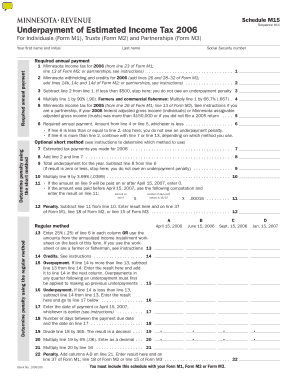

Schedule M15 Sequence #11 Underpayment of Estimated Income Tax for Individuals Form M1, Trusts Form M2 and Partnerships Form M3

Understanding the Schedule M15 Sequence #11 Underpayment Of Estimated Income Tax

The Schedule M15 Sequence #11 Underpayment Of Estimated Income Tax is a crucial form for individuals, trusts, and partnerships in the United States. This form is designed to calculate the underpayment of estimated income tax, ensuring that taxpayers meet their required annual payment obligations. For individuals using Form M1, trusts using Form M2, and partnerships using Form M3, this form helps determine if they have underpaid their estimated taxes and outlines the necessary steps to rectify any discrepancies.

Steps to Complete the Schedule M15 Sequence #11 Form

Completing the Schedule M15 Sequence #11 requires careful attention to detail. Start by gathering all relevant financial information, including your total income, deductions, and credits. Follow these steps:

- Identify your filing status and determine if you are using Form M1, M2, or M3.

- Calculate your total estimated income tax for the year.

- Compare this amount to your actual payments made throughout the year.

- Complete the form by filling in your first name, initial, last name, and Social Security number.

- Submit the completed form by the specified deadline to avoid penalties.

Obtaining the Schedule M15 Sequence #11 Form

The Schedule M15 Sequence #11 form can be obtained through the Internal Revenue Service (IRS) website or directly from your state’s tax authority. It is essential to ensure that you are using the most current version of the form to comply with any updates in tax regulations. You may also find the form available at local tax offices or through tax preparation software.

Legal Use of the Schedule M15 Sequence #11 Form

Using the Schedule M15 Sequence #11 form is legally required for taxpayers who have underpaid their estimated income taxes. Failure to file this form accurately can result in penalties and interest on the amount owed. It is important to understand the legal implications of underpayment and to use this form to maintain compliance with tax laws.

Key Elements of the Schedule M15 Sequence #11 Form

When filling out the Schedule M15 Sequence #11, several key elements must be included:

- Your First Name and Initial: Clearly state your name as it appears on your tax return.

- Last Name: Include your full last name for identification purposes.

- Social Security Number: This is crucial for the IRS to match your form with your tax records.

- Required Annual Payment: Accurately calculate the total amount of estimated taxes owed for the year.

Filing Deadlines for the Schedule M15 Sequence #11 Form

Timely submission of the Schedule M15 Sequence #11 is essential to avoid penalties. The filing deadlines typically align with the tax year, which runs from January first to December thirty-first. Generally, forms must be submitted by April fifteenth of the following year. However, specific deadlines may vary based on individual circumstances, so it is important to verify the exact dates applicable to your situation.

Quick guide on how to complete schedule m15 sequence 11 underpayment of estimated income tax for individuals form m1 trusts form m2 and partnerships form m3

Effortlessly Prepare [SKS] on Any Device

The management of online documents has gained immense popularity among both businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

Easily Modify and eSign [SKS] without Hassle

- Locate [SKS] and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal authority as a standard wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule M15 Sequence #11 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3

Create this form in 5 minutes!

How to create an eSignature for the schedule m15 sequence 11 underpayment of estimated income tax for individuals form m1 trusts form m2 and partnerships form m3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule M15 Sequence #11 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3?

The Schedule M15 Sequence #11 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3 is a tax form used to report underpayment of estimated income tax. It is essential for individuals, trusts, and partnerships to ensure compliance with tax obligations. Completing this form accurately helps avoid penalties and ensures proper payment of taxes owed.

-

How can airSlate SignNow help with the Schedule M15 Sequence #11 form?

airSlate SignNow provides an easy-to-use platform for completing and eSigning the Schedule M15 Sequence #11 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3. Our solution streamlines the document preparation process, allowing users to fill out required fields like your first name, initial, last name, and social security number efficiently.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Our cost-effective solution ensures that you can manage documents, including the Schedule M15 Sequence #11 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3, without breaking the bank. Visit our pricing page for detailed information on available plans.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, which are crucial for managing tax documents like the Schedule M15 Sequence #11 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3. These features enhance efficiency and ensure that all required information is accurately captured.

-

Is airSlate SignNow compliant with tax regulations?

Yes, airSlate SignNow is designed to comply with relevant tax regulations, ensuring that documents like the Schedule M15 Sequence #11 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3 are handled securely and in accordance with legal standards. Our platform prioritizes data security and compliance to protect your sensitive information.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow when managing documents such as the Schedule M15 Sequence #11 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3. This allows for seamless data transfer and improved efficiency across your business processes.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like the Schedule M15 Sequence #11 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3 provides numerous benefits, including time savings, reduced errors, and enhanced security. Our platform simplifies the eSigning process, making it easier for you to meet your tax obligations.

Get more for Schedule M15 Sequence #11 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3

- Char 500 form

- Oklahoma temporary agreement form

- Oklahoma name change legal form

- Name change packet lycoming county form

- Texas general warranty deed pdf form

- Qdro brokerage accounts form

- Sample stipulation to continue trial date in stanislaus couinty superior court form

- Hippa release form state of nevada

Find out other Schedule M15 Sequence #11 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later

- How Do I Sign Tennessee Real Estate Warranty Deed

- Sign Tennessee Real Estate Last Will And Testament Free

- Sign Colorado Police Memorandum Of Understanding Online

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online