IG255, Statement of Insurance Placed with Unauthorized Insurers Revenue State Mn Form

What is the IG255, Statement Of Insurance Placed With Unauthorized Insurers Revenue State Mn

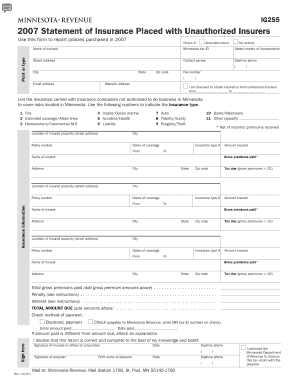

The IG255 form, known as the Statement Of Insurance Placed With Unauthorized Insurers, is a document required by the state of Minnesota. It serves to report insurance policies that have been placed with insurers not authorized to operate within the state. This form is crucial for ensuring compliance with state regulations regarding insurance practices and helps maintain transparency in the insurance market.

How to use the IG255, Statement Of Insurance Placed With Unauthorized Insurers Revenue State Mn

To use the IG255 form effectively, individuals or businesses must accurately fill out the required information regarding unauthorized insurers. This includes details about the insurer, the type of coverage provided, and the policyholder. Once completed, the form must be submitted to the appropriate state authority to ensure that all insurance placements are properly documented and compliant with state laws.

Steps to complete the IG255, Statement Of Insurance Placed With Unauthorized Insurers Revenue State Mn

Completing the IG255 form involves several key steps:

- Gather necessary information about the unauthorized insurer and the insurance policy.

- Fill in the required fields on the form, ensuring accuracy in all details.

- Review the completed form for any errors or omissions.

- Submit the form to the designated state office, either electronically or by mail.

Key elements of the IG255, Statement Of Insurance Placed With Unauthorized Insurers Revenue State Mn

The key elements of the IG255 form include:

- Insurer Information: Name and contact details of the unauthorized insurer.

- Policy Details: Type of insurance coverage and policy number.

- Policyholder Information: Name and address of the individual or business holding the policy.

- Reporting Period: The time frame during which the insurance was in effect.

Legal use of the IG255, Statement Of Insurance Placed With Unauthorized Insurers Revenue State Mn

The IG255 form is legally required for reporting insurance placed with unauthorized insurers in Minnesota. Failure to file this form can result in penalties or legal repercussions for both the insurer and the policyholder. It is essential to understand the legal implications of using unauthorized insurers and to ensure that all reporting is done in accordance with state laws.

Filing Deadlines / Important Dates

Filing deadlines for the IG255 form may vary based on the specific reporting period. It is important to check with the Minnesota Department of Commerce for the most current deadlines. Timely submission is crucial to avoid penalties and ensure compliance with state regulations.

Quick guide on how to complete ig255 statement of insurance placed with unauthorized insurers revenue state mn

Effortlessly prepare [SKS] on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Manage [SKS] across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

Effortlessly modify and eSign [SKS]

- Obtain [SKS] and click Get Form to initiate.

- Utilize the available tools to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive details using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, SMS, or invitation link, or download it directly to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing additional document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your preference. Edit and eSign [SKS] to guarantee exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ig255 statement of insurance placed with unauthorized insurers revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IG255, Statement Of Insurance Placed With Unauthorized Insurers Revenue State Mn?

The IG255, Statement Of Insurance Placed With Unauthorized Insurers Revenue State Mn, is a document required by the state of Minnesota to report insurance placements with unauthorized insurers. This statement ensures compliance with state regulations and helps maintain transparency in the insurance industry.

-

How can airSlate SignNow help with the IG255, Statement Of Insurance Placed With Unauthorized Insurers Revenue State Mn?

airSlate SignNow provides an efficient platform for businesses to create, send, and eSign the IG255, Statement Of Insurance Placed With Unauthorized Insurers Revenue State Mn. Our user-friendly interface simplifies the process, ensuring that you can complete and submit your documents quickly and accurately.

-

What are the pricing options for using airSlate SignNow for the IG255, Statement Of Insurance Placed With Unauthorized Insurers Revenue State Mn?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Whether you need basic features or advanced functionalities for managing the IG255, Statement Of Insurance Placed With Unauthorized Insurers Revenue State Mn, we have a plan that fits your budget.

-

Are there any integrations available for airSlate SignNow when handling the IG255, Statement Of Insurance Placed With Unauthorized Insurers Revenue State Mn?

Yes, airSlate SignNow integrates seamlessly with various applications and platforms, enhancing your workflow when managing the IG255, Statement Of Insurance Placed With Unauthorized Insurers Revenue State Mn. This allows you to connect with your existing tools and streamline your document management process.

-

What features does airSlate SignNow offer for the IG255, Statement Of Insurance Placed With Unauthorized Insurers Revenue State Mn?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for the IG255, Statement Of Insurance Placed With Unauthorized Insurers Revenue State Mn. These features ensure that your documents are handled efficiently and securely, providing peace of mind throughout the process.

-

How does airSlate SignNow ensure the security of the IG255, Statement Of Insurance Placed With Unauthorized Insurers Revenue State Mn?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure cloud storage to protect your documents, including the IG255, Statement Of Insurance Placed With Unauthorized Insurers Revenue State Mn, ensuring that your sensitive information remains confidential and secure.

-

Can I access the IG255, Statement Of Insurance Placed With Unauthorized Insurers Revenue State Mn on mobile devices?

Absolutely! airSlate SignNow is designed to be mobile-friendly, allowing you to access and manage the IG255, Statement Of Insurance Placed With Unauthorized Insurers Revenue State Mn from your smartphone or tablet. This flexibility ensures that you can handle your documents anytime, anywhere.

Get more for IG255, Statement Of Insurance Placed With Unauthorized Insurers Revenue State Mn

Find out other IG255, Statement Of Insurance Placed With Unauthorized Insurers Revenue State Mn

- eSign Hawaii Education Claim Myself

- eSign Hawaii Education Claim Simple

- eSign Hawaii Education Contract Simple

- eSign Hawaii Education NDA Later

- How To eSign Hawaii Education NDA

- How Do I eSign Hawaii Education NDA

- eSign Hawaii Education Arbitration Agreement Fast

- eSign Minnesota Construction Purchase Order Template Safe

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online