IG262, Fire Safety Surcharge for Mutual Insurance Companies Revenue State Mn Form

What is the IG262, Fire Safety Surcharge For Mutual Insurance Companies Revenue State Mn

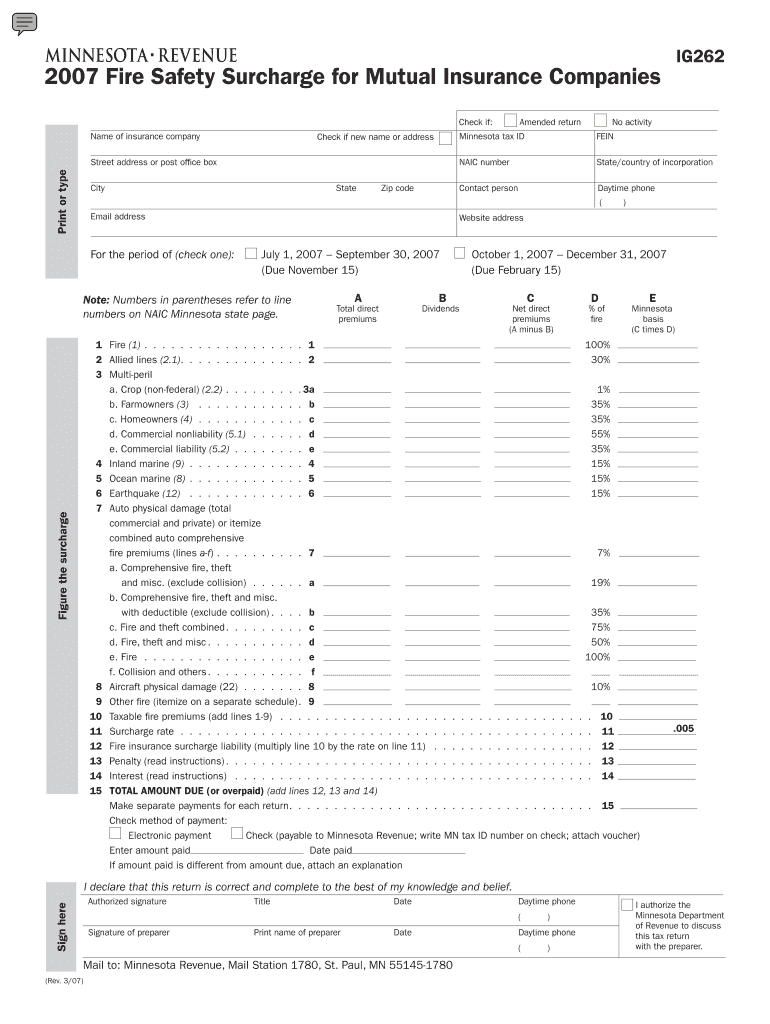

The IG262 form pertains to the Fire Safety Surcharge imposed on mutual insurance companies operating in Minnesota. This surcharge is a regulatory requirement aimed at funding fire safety initiatives within the state. It is essential for mutual insurance companies to accurately report and remit this surcharge to ensure compliance with state regulations. The form captures necessary financial data that reflects the surcharge obligations based on the company’s premium income and other relevant metrics.

How to use the IG262, Fire Safety Surcharge For Mutual Insurance Companies Revenue State Mn

To use the IG262 form, mutual insurance companies must first gather relevant financial information, including total premium income and any applicable deductions. The form requires specific entries that reflect the company’s surcharge liability. After completing the form, companies should review the data for accuracy before submission. It is important to follow the instructions provided with the form to ensure all required fields are filled out correctly.

Steps to complete the IG262, Fire Safety Surcharge For Mutual Insurance Companies Revenue State Mn

Completing the IG262 form involves several key steps:

- Gather financial documents, including premium income statements.

- Calculate the total surcharge based on the state’s prescribed rates.

- Fill out the IG262 form, ensuring all required fields are completed.

- Double-check all calculations and entries for accuracy.

- Submit the completed form by the specified deadline.

Filing Deadlines / Important Dates

Filing deadlines for the IG262 form are critical for compliance. Typically, mutual insurance companies must submit the form by a specific date each year, often aligned with the end of the fiscal year. Companies should be aware of any changes to these deadlines and plan accordingly to avoid penalties. Keeping track of important dates ensures timely submission and adherence to state regulations.

Penalties for Non-Compliance

Failure to comply with the requirements of the IG262 form can result in significant penalties for mutual insurance companies. These penalties may include fines, interest on unpaid surcharges, and possible legal action. It is crucial for companies to understand the implications of non-compliance and to prioritize timely and accurate filing of the form to avoid these consequences.

Eligibility Criteria

Eligibility to file the IG262 form is generally limited to mutual insurance companies operating within the state of Minnesota. Companies must meet specific criteria, such as being registered and licensed to provide insurance services in the state. Understanding these eligibility requirements is essential for ensuring that the correct entities are filing the form and complying with the associated regulations.

Quick guide on how to complete ig262 fire safety surcharge for mutual insurance companies revenue state mn

Execute IG262, Fire Safety Surcharge For Mutual Insurance Companies Revenue State Mn seamlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, amend, and eSign your documents swiftly without interruptions. Manage IG262, Fire Safety Surcharge For Mutual Insurance Companies Revenue State Mn on any device using airSlate SignNow's Android or iOS applications and streamline any document-focused process today.

The easiest method to adjust and eSign IG262, Fire Safety Surcharge For Mutual Insurance Companies Revenue State Mn effortlessly

- Find IG262, Fire Safety Surcharge For Mutual Insurance Companies Revenue State Mn and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you want to send your form, either via email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Adjust and eSign IG262, Fire Safety Surcharge For Mutual Insurance Companies Revenue State Mn and guarantee flawless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ig262 fire safety surcharge for mutual insurance companies revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IG262, Fire Safety Surcharge For Mutual Insurance Companies Revenue State Mn?

IG262, Fire Safety Surcharge For Mutual Insurance Companies Revenue State Mn is a regulatory requirement that mandates mutual insurance companies to collect a surcharge for fire safety. This surcharge helps fund fire safety initiatives and ensures compliance with state regulations. Understanding this surcharge is crucial for mutual insurance companies operating in Minnesota.

-

How does airSlate SignNow help with IG262 compliance?

airSlate SignNow provides an efficient platform for mutual insurance companies to manage documents related to IG262, Fire Safety Surcharge For Mutual Insurance Companies Revenue State Mn. With our eSigning capabilities, companies can quickly obtain necessary signatures and maintain compliance with state regulations. This streamlines the process and reduces the risk of errors.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of mutual insurance companies dealing with IG262, Fire Safety Surcharge For Mutual Insurance Companies Revenue State Mn. Our plans are designed to be cost-effective, ensuring that businesses can access essential features without overspending. Contact us for a detailed pricing breakdown.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a variety of features that are beneficial for managing documents related to IG262, Fire Safety Surcharge For Mutual Insurance Companies Revenue State Mn. Key features include customizable templates, secure cloud storage, and real-time tracking of document status. These tools enhance efficiency and ensure that all documents are handled properly.

-

Can airSlate SignNow integrate with other software used by mutual insurance companies?

Yes, airSlate SignNow offers seamless integrations with various software solutions commonly used by mutual insurance companies. This includes CRM systems, accounting software, and other tools that help manage IG262, Fire Safety Surcharge For Mutual Insurance Companies Revenue State Mn documentation. Our integrations facilitate a smooth workflow and enhance productivity.

-

What are the benefits of using airSlate SignNow for mutual insurance companies?

Using airSlate SignNow provides numerous benefits for mutual insurance companies, especially in relation to IG262, Fire Safety Surcharge For Mutual Insurance Companies Revenue State Mn. Our platform simplifies the eSigning process, reduces paperwork, and ensures compliance with state regulations. This leads to increased efficiency and improved customer satisfaction.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely, airSlate SignNow prioritizes security, making it a reliable choice for handling sensitive documents related to IG262, Fire Safety Surcharge For Mutual Insurance Companies Revenue State Mn. Our platform employs advanced encryption and security protocols to protect your data. You can trust that your documents are safe and secure with us.

Get more for IG262, Fire Safety Surcharge For Mutual Insurance Companies Revenue State Mn

- Cancellation by action modere com form

- Math 6 notes 5 3 answer key form

- Gcic consent form

- Fluency and skills practice answer key form

- Form gen 58 power of attorney and declaration

- Form irs 1040 schedule c fill online printable

- Form 1040 cannot be processed with incorrect social

- Form w 7 rev december application for irs individual taxpayer identification number

Find out other IG262, Fire Safety Surcharge For Mutual Insurance Companies Revenue State Mn

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile