Schedule M15 Sequence #11 Underpayment of Estimated Income Tax for Individuals Form M1, Trusts Form M2 and Partnerships Form M3

Understanding the Schedule M15 Sequence #11 Underpayment Of Estimated Income Tax

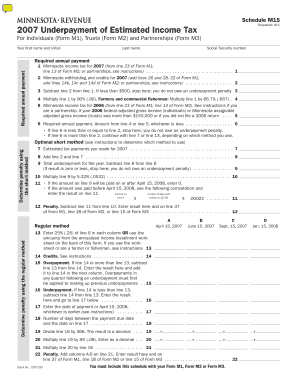

The Schedule M15 Sequence #11 is a crucial form for individuals, trusts, and partnerships in the United States, specifically designed to address underpayment of estimated income tax. This form is essential for reporting any shortfall in estimated tax payments required by the IRS. Individuals must provide their first name, initial last name, and Social Security number to ensure proper identification and processing. Trusts and partnerships also need to include their respective identifying information to comply with federal tax regulations.

Steps to Complete the Schedule M15 Sequence #11

Completing the Schedule M15 Sequence #11 involves several steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, calculate your estimated tax liability for the year, considering any changes in income or deductions. After determining your required annual payment, fill out the form by entering your personal information and the calculated amounts. Finally, review the form for any errors before submission, as inaccuracies can lead to penalties or delays.

Obtaining the Schedule M15 Sequence #11 Form

The Schedule M15 Sequence #11 form can be obtained directly from the IRS website or through tax preparation software that includes IRS forms. It is essential to ensure you are using the most current version of the form to comply with any recent tax law changes. Additionally, local tax offices may provide physical copies of the form for those who prefer traditional methods.

Legal Use of the Schedule M15 Sequence #11

Using the Schedule M15 Sequence #11 is legally required for taxpayers who have underpaid their estimated income tax. Failure to file this form when necessary can result in penalties from the IRS. It is important to understand the legal implications of underpayment and to use this form as a means of rectifying any discrepancies in tax payments. Consulting with a tax professional can provide further clarity on legal obligations related to this form.

Filing Deadlines for the Schedule M15 Sequence #11

Filing deadlines for the Schedule M15 Sequence #11 align with the annual tax filing schedule. Typically, this form must be submitted by the due date for filing your tax return, which is usually April fifteenth for individuals. However, if you are filing for a partnership or trust, the deadlines may differ. It is crucial to stay informed about these dates to avoid late fees and additional interest on underpaid taxes.

Key Elements Required on the Schedule M15 Sequence #11

When filling out the Schedule M15 Sequence #11, certain key elements must be included to ensure the form is complete. This includes your first name, initial last name, Social Security number, and the required annual payment amount. Additionally, you must provide information regarding your estimated tax payments for the year and any adjustments that may apply. Accurate reporting of these elements is vital for the IRS to process your form correctly.

Quick guide on how to complete schedule m15 sequence 11 underpayment of estimated income tax for individuals form m1 trusts form m2 and partnerships form m3 11331695

Effortlessly Prepare [SKS] on Any Device

Online document management has become increasingly favored by businesses and individuals alike. It offers a perfect eco-friendly substitute for traditional printed and signed documents, allowing you to find the appropriate template and securely archive it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric workflow today.

How to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize necessary sections of your documents or obscure confidential information using tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure superior communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule m15 sequence 11 underpayment of estimated income tax for individuals form m1 trusts form m2 and partnerships form m3 11331695

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule M15 Sequence #11 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3?

The Schedule M15 Sequence #11 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3 is a tax form used to report underpayment of estimated income tax. It is essential for individuals, trusts, and partnerships to ensure compliance with tax obligations. Completing this form accurately helps avoid penalties and ensures that your annual payment is calculated correctly.

-

How can airSlate SignNow assist with the Schedule M15 Sequence #11 form?

airSlate SignNow provides an easy-to-use platform for completing and eSigning the Schedule M15 Sequence #11 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3. Our solution streamlines the process, allowing you to fill out the required fields, including your first name, initial, last name, and social security number, efficiently and securely.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Our plans are designed to provide cost-effective solutions for managing documents, including the Schedule M15 Sequence #11 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3. You can choose a plan that fits your budget while ensuring you have access to all necessary features.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure storage, making it ideal for managing tax documents like the Schedule M15 Sequence #11 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3. These features enhance efficiency and ensure that all required information is captured accurately.

-

Is airSlate SignNow compliant with tax regulations?

Yes, airSlate SignNow is designed to comply with relevant tax regulations, ensuring that your use of the Schedule M15 Sequence #11 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3 meets legal standards. Our platform prioritizes security and compliance, giving you peace of mind when handling sensitive tax information.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow when dealing with the Schedule M15 Sequence #11 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3. This allows you to streamline processes and maintain consistency across your business operations.

-

What are the benefits of using airSlate SignNow for tax forms?

Using airSlate SignNow for tax forms like the Schedule M15 Sequence #11 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3 provides numerous benefits, including time savings, reduced errors, and enhanced security. Our platform simplifies the eSigning process, making it easier for you to manage your tax obligations efficiently.

Get more for Schedule M15 Sequence #11 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3

Find out other Schedule M15 Sequence #11 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors