Schedule M2MT Alternative Minimum Tax for Estates and Trusts Name of Estate or Trust Federal ID Number Determine Minnesota Alter Form

Understanding the Schedule M2MT Alternative Minimum Tax for Estates and Trusts

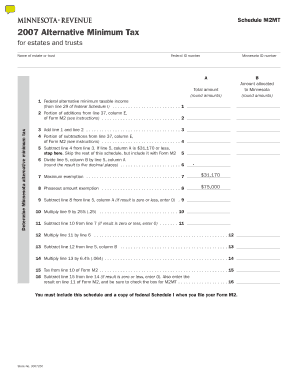

The Schedule M2MT is a tax form specifically designed for estates and trusts to calculate the Alternative Minimum Tax (AMT) in Minnesota. This form requires detailed information about the estate or trust, including its name and federal identification number. The AMT is a separate tax calculation that ensures certain taxpayers pay a minimum amount of tax, regardless of deductions and credits. It is essential for estates and trusts to accurately report their federal Alternative Minimum Taxable Income, as this will impact their overall tax obligations.

Steps to Complete the Schedule M2MT

Completing the Schedule M2MT involves several key steps:

- Gather necessary documents, including the estate or trust's federal tax return.

- Fill out the form by providing the name of the estate or trust and its federal ID number.

- Calculate the federal Alternative Minimum Taxable Income based on the provided guidelines.

- Determine the Minnesota Alternative Minimum Tax by applying the appropriate state rules.

- Round amounts as required by the form’s instructions to ensure accuracy.

Key Elements of the Schedule M2MT

Several critical components must be included when filling out the Schedule M2MT:

- Name of the estate or trust, which identifies the entity for tax purposes.

- Federal ID number, which is necessary for the IRS to track the tax obligations.

- Total amount of federal Alternative Minimum Taxable Income, which is used to calculate the AMT.

- Specific instructions for rounding amounts, ensuring compliance with state regulations.

State-Specific Rules for Minnesota

When completing the Schedule M2MT, it is vital to adhere to Minnesota's specific tax regulations. These rules may differ from federal guidelines, impacting how the Alternative Minimum Tax is calculated for estates and trusts. Familiarity with these state-specific regulations can help ensure accurate reporting and compliance, potentially avoiding penalties for misreporting.

Legal Use of the Schedule M2MT

The Schedule M2MT serves a legal purpose by ensuring that estates and trusts fulfill their tax obligations under Minnesota law. Proper completion and submission of this form are essential for compliance with both state and federal tax laws. Failure to accurately report can lead to legal repercussions, including fines or additional taxes owed.

Filing Deadlines for the Schedule M2MT

Timely filing of the Schedule M2MT is crucial to avoid penalties. Estates and trusts must be aware of the specific deadlines set by the Minnesota Department of Revenue. Typically, the form is due on the same date as the federal tax return for the estate or trust. Keeping track of these dates helps ensure compliance and mitigates the risk of incurring late fees.

Quick guide on how to complete schedule m2mt alternative minimum tax for estates and trusts name of estate or trust federal id number determine minnesota

Prepare [SKS] effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, as you can easily locate the appropriate form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign [SKS] with ease

- Obtain [SKS] and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then select the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searches, or mistakes that require printing new copies. airSlate SignNow caters to your needs in document management in just a few clicks from any device you choose. Modify and electronically sign [SKS] and ensure outstanding communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule m2mt alternative minimum tax for estates and trusts name of estate or trust federal id number determine minnesota

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule M2MT Alternative Minimum Tax for Estates and Trusts?

The Schedule M2MT Alternative Minimum Tax for Estates and Trusts is a tax form used to calculate the alternative minimum tax for estates and trusts. It helps determine the federal alternative minimum taxable income from line items, ensuring compliance with tax regulations. Understanding this form is crucial for accurately reporting the tax obligations of your estate or trust.

-

How do I fill out the Schedule M2MT for my estate or trust?

To fill out the Schedule M2MT for your estate or trust, you need to gather relevant financial information, including the name of the estate or trust and the federal ID number. Follow the instructions carefully to determine the Minnesota alternative minimum tax and round amounts as necessary. Utilizing airSlate SignNow can streamline this process by providing templates and eSigning capabilities.

-

What are the benefits of using airSlate SignNow for tax documentation?

Using airSlate SignNow for tax documentation, including the Schedule M2MT Alternative Minimum Tax for Estates and Trusts, offers numerous benefits. It provides an easy-to-use platform for sending and eSigning documents, ensuring that your tax forms are completed accurately and efficiently. Additionally, it is a cost-effective solution that can save you time and reduce errors.

-

Is there a cost associated with using airSlate SignNow for tax forms?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses and individuals. Pricing varies based on the features you choose, but the investment can lead to signNow time savings and improved accuracy when handling documents like the Schedule M2MT Alternative Minimum Tax for Estates and Trusts.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easier to manage your tax preparation process. By integrating with your existing tools, you can streamline the workflow for completing the Schedule M2MT Alternative Minimum Tax for Estates and Trusts, ensuring a seamless experience.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow provides a range of features for managing tax documents, including customizable templates, eSigning capabilities, and secure document storage. These features are particularly useful when dealing with complex forms like the Schedule M2MT Alternative Minimum Tax for Estates and Trusts, allowing you to maintain organization and compliance.

-

How can I ensure my Schedule M2MT is filed correctly?

To ensure your Schedule M2MT is filed correctly, it's essential to double-check all entries, including the name of the estate or trust and the federal ID number. Utilizing airSlate SignNow can help by providing templates that guide you through the process, reducing the likelihood of errors. Additionally, consider consulting a tax professional for further assistance.

Get more for Schedule M2MT Alternative Minimum Tax For Estates And Trusts Name Of Estate Or Trust Federal ID Number Determine Minnesota Alter

Find out other Schedule M2MT Alternative Minimum Tax For Estates And Trusts Name Of Estate Or Trust Federal ID Number Determine Minnesota Alter

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed