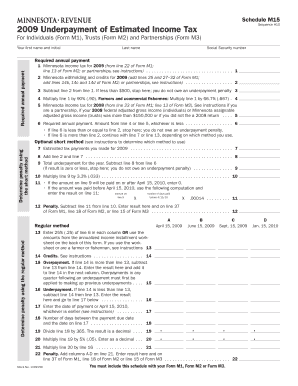

Schedule M15 Sequence #10 Underpayment of Estimated Income Tax for Individuals Form M1, Trusts Form M2 and Partnerships Form M3

Understanding the Schedule M15 Sequence #10 Underpayment Of Estimated Income Tax

The Schedule M15 Sequence #10 is a crucial form for individuals, trusts, and partnerships in the United States. It addresses the underpayment of estimated income tax, which is essential for ensuring compliance with federal tax obligations. This form helps taxpayers calculate any potential penalties for underpayment, based on their estimated tax liabilities. Completing this form accurately is vital for maintaining good standing with the IRS and avoiding unnecessary fines.

Steps to Complete the Schedule M15 Sequence #10

Completing the Schedule M15 Sequence #10 involves several key steps:

- Gather necessary information, including your first name, initial last name, and Social Security number.

- Determine your required annual payment based on your estimated income tax for the year.

- Calculate any underpayment penalties by comparing your actual payments to the required annual payment.

- Fill out the form accurately, ensuring all information is correct to avoid delays.

- Review the completed form for any errors before submission.

Obtaining the Schedule M15 Sequence #10 Form

The Schedule M15 Sequence #10 form can be obtained directly from the IRS website or through authorized tax preparation services. It is advisable to ensure you have the most current version of the form, as tax regulations can change. Additionally, many tax software programs include this form, streamlining the process of completion and submission.

Key Elements of the Schedule M15 Sequence #10

Understanding the key elements of the Schedule M15 Sequence #10 is essential for proper completion. Important components include:

- Taxpayer Information: This includes your name, Social Security number, and any other identifying information required.

- Annual Payment Calculation: A section to calculate your required annual payment based on your estimated tax liability.

- Penalty Calculation: This section helps determine if you owe any penalties for underpayment.

Filing Deadlines for the Schedule M15 Sequence #10

Filing deadlines for the Schedule M15 Sequence #10 are crucial for compliance. Typically, this form must be submitted by the due date of your tax return, which is generally April fifteenth for individuals. However, if you are filing for a partnership or trust, be sure to check the specific deadlines applicable to those entities, as they may differ. Timely submission helps avoid penalties and interest on unpaid taxes.

IRS Guidelines for the Schedule M15 Sequence #10

The IRS provides specific guidelines for completing and submitting the Schedule M15 Sequence #10. These guidelines include detailed instructions on how to fill out each section of the form, what information is required, and how to calculate any penalties. It is important to refer to these guidelines to ensure compliance and accuracy in your tax reporting.

Quick guide on how to complete schedule m15 sequence 10 underpayment of estimated income tax for individuals form m1 trusts form m2 and partnerships form m3

Easily Prepare [SKS] on Any Device

Digital document management has gained popularity among organizations and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, as you can obtain the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, edit, and electronically sign your documents promptly without any delays. Handle [SKS] on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign [SKS] Effortlessly

- Access [SKS] and click on Get Form to initiate the process.

- Use the tools we provide to complete your form.

- Mark important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which only takes seconds and carries the same legal validity as a traditional ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] to ensure exceptional communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Schedule M15 Sequence #10 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3

Create this form in 5 minutes!

How to create an eSignature for the schedule m15 sequence 10 underpayment of estimated income tax for individuals form m1 trusts form m2 and partnerships form m3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Schedule M15 Sequence #10 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3?

The Schedule M15 Sequence #10 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3 is a tax form used to report underpayment of estimated income tax. It is essential for individuals, trusts, and partnerships to ensure compliance with tax obligations. Completing this form accurately helps avoid penalties and ensures proper payment of taxes owed.

-

How can airSlate SignNow help with the Schedule M15 Sequence #10 form?

airSlate SignNow provides an easy-to-use platform for completing and eSigning the Schedule M15 Sequence #10 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3. Our solution streamlines the document preparation process, allowing users to fill out necessary fields like First Name, Initial Last Name, and Social Security Number efficiently. This ensures that your annual payment requirements are met without hassle.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Our plans are designed to provide cost-effective solutions for managing documents, including the Schedule M15 Sequence #10 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3. You can choose a plan that fits your budget while ensuring compliance with annual payment requirements.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, airSlate SignNow prioritizes the security of your sensitive information, including details required for the Schedule M15 Sequence #10 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3. Our platform employs advanced encryption and security protocols to protect your data, ensuring that your Social Security Number and other personal information remain confidential.

-

Can I integrate airSlate SignNow with other software for tax management?

Absolutely! airSlate SignNow offers integrations with various software solutions to enhance your tax management process. This allows you to seamlessly incorporate the Schedule M15 Sequence #10 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3 into your existing workflows, making it easier to manage annual payment requirements and document submissions.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a range of features designed to simplify document management, including templates, eSigning, and collaboration tools. These features are particularly useful for completing the Schedule M15 Sequence #10 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3. Users can easily track changes and ensure all necessary information is included for annual payment compliance.

-

How does airSlate SignNow improve the efficiency of tax document processing?

By using airSlate SignNow, you can signNowly improve the efficiency of processing tax documents like the Schedule M15 Sequence #10 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3. Our platform automates many steps in the document preparation and signing process, reducing the time spent on manual tasks and minimizing errors related to First Name, Initial Last Name, and Social Security Number entries.

Get more for Schedule M15 Sequence #10 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3

Find out other Schedule M15 Sequence #10 Underpayment Of Estimated Income Tax For Individuals Form M1, Trusts Form M2 And Partnerships Form M3

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors