M2, Income Tax Return for Estates and Trusts Fiduciaries Revenue State Mn Form

What is the M2, Income Tax Return For Estates And Trusts Fiduciaries Revenue State Mn

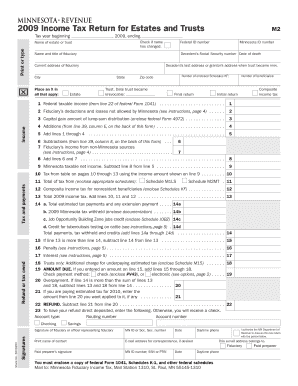

The M2, Income Tax Return for Estates and Trusts Fiduciaries is a specific tax form used in Minnesota for reporting income generated by estates and trusts. This form is essential for fiduciaries, who are responsible for managing the assets of estates or trusts on behalf of beneficiaries. The M2 allows fiduciaries to report income, deductions, and credits associated with the estate or trust, ensuring compliance with state tax laws. It is distinct from individual income tax returns and is tailored to the unique financial situations of estates and trusts.

Steps to complete the M2, Income Tax Return For Estates And Trusts Fiduciaries Revenue State Mn

Completing the M2 form involves several key steps to ensure accurate reporting. First, gather all necessary financial documents, including income statements, deduction records, and any relevant tax documents. Next, complete the form by entering the estate or trust's income, expenses, and deductions in the appropriate sections. It is important to accurately report all figures to avoid penalties. After filling out the form, review it for errors and ensure all required signatures are included. Finally, submit the completed form by the designated deadline, either electronically or by mail.

Legal use of the M2, Income Tax Return For Estates And Trusts Fiduciaries Revenue State Mn

The M2 form is legally required for estates and trusts that generate taxable income in Minnesota. Fiduciaries must file this return to comply with state tax regulations. Failure to submit the M2 can result in penalties, including fines and interest on unpaid taxes. It is crucial for fiduciaries to understand their legal obligations and ensure that the form is completed accurately and submitted on time to avoid legal repercussions.

State-specific rules for the M2, Income Tax Return For Estates And Trusts Fiduciaries Revenue State Mn

In Minnesota, specific rules govern the use of the M2 form. These include regulations regarding the types of income that must be reported, allowable deductions, and the deadlines for filing. For instance, fiduciaries must be aware of state tax rates applicable to estates and trusts, which may differ from individual tax rates. Additionally, certain exemptions and credits may apply, depending on the nature of the estate or trust. Understanding these state-specific rules is essential for accurate tax reporting and compliance.

Required Documents

To complete the M2 form, fiduciaries need several key documents. These typically include:

- Income statements from all sources related to the estate or trust.

- Records of expenses and deductions that can be claimed.

- Previous tax returns for the estate or trust, if applicable.

- Any relevant legal documents, such as the trust agreement or will.

Having these documents on hand will facilitate a smoother filing process and help ensure all information reported is accurate.

Filing Deadlines / Important Dates

Fiduciaries must be aware of the filing deadlines for the M2 form to avoid penalties. The due date for the M2 is typically the same as the federal income tax deadline, which is generally April 15. However, if the estate or trust has a fiscal year that does not align with the calendar year, the deadline may differ. It is important to check for any updates or changes to filing dates each tax year to ensure timely submission.

Quick guide on how to complete m2 income tax return for estates and trusts fiduciaries revenue state mn

Complete M2, Income Tax Return For Estates And Trusts Fiduciaries Revenue State Mn effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-conscious alternative to traditional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents promptly without interruptions. Handle M2, Income Tax Return For Estates And Trusts Fiduciaries Revenue State Mn on any device using airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to modify and electronically sign M2, Income Tax Return For Estates And Trusts Fiduciaries Revenue State Mn effortlessly

- Locate M2, Income Tax Return For Estates And Trusts Fiduciaries Revenue State Mn and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Mark essential sections of your documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to submit your form, via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form hunts, or mistakes that require new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Alter and electronically sign M2, Income Tax Return For Estates And Trusts Fiduciaries Revenue State Mn and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the m2 income tax return for estates and trusts fiduciaries revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M2, Income Tax Return For Estates And Trusts Fiduciaries Revenue State Mn?

The M2, Income Tax Return For Estates And Trusts Fiduciaries Revenue State Mn is a specific tax form required for fiduciaries managing estates and trusts in Minnesota. This form helps ensure compliance with state tax regulations and accurately reports income generated by the estate or trust.

-

How can airSlate SignNow assist with the M2, Income Tax Return For Estates And Trusts Fiduciaries Revenue State Mn?

airSlate SignNow provides an efficient platform for preparing and eSigning the M2, Income Tax Return For Estates And Trusts Fiduciaries Revenue State Mn. Our solution simplifies document management, allowing fiduciaries to focus on compliance and accuracy without the hassle of traditional paperwork.

-

What are the pricing options for using airSlate SignNow for M2 tax returns?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses handling M2, Income Tax Return For Estates And Trusts Fiduciaries Revenue State Mn. Our cost-effective solutions ensure that you only pay for what you need, making it accessible for both small and large fiduciaries.

-

What features does airSlate SignNow offer for managing tax documents?

With airSlate SignNow, you gain access to features such as customizable templates, secure eSigning, and document tracking, all essential for managing the M2, Income Tax Return For Estates And Trusts Fiduciaries Revenue State Mn. These tools streamline the process, ensuring that all documents are handled efficiently and securely.

-

Are there integrations available for airSlate SignNow with accounting software?

Yes, airSlate SignNow integrates seamlessly with various accounting software, enhancing your ability to manage the M2, Income Tax Return For Estates And Trusts Fiduciaries Revenue State Mn. This integration allows for easy data transfer and ensures that your tax documents are always up-to-date and accurate.

-

What benefits does airSlate SignNow provide for fiduciaries handling tax returns?

By using airSlate SignNow, fiduciaries can benefit from increased efficiency, reduced paperwork, and enhanced security when managing the M2, Income Tax Return For Estates And Trusts Fiduciaries Revenue State Mn. Our platform simplifies the eSigning process, allowing for quicker turnaround times and improved compliance.

-

Is airSlate SignNow user-friendly for those unfamiliar with tax documents?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible for individuals who may not be familiar with the M2, Income Tax Return For Estates And Trusts Fiduciaries Revenue State Mn. Our intuitive interface guides users through the process, ensuring that everyone can manage their tax documents with ease.

Get more for M2, Income Tax Return For Estates And Trusts Fiduciaries Revenue State Mn

Find out other M2, Income Tax Return For Estates And Trusts Fiduciaries Revenue State Mn

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement

- Can I Electronic signature New York Residential lease agreement form