M15NP Attachment #3 Additional Charge for Underpayment of Estimated Tax for Tax Exempt Organizations, Cooperatives, Homeowners a Form

Understanding the M15NP Attachment #3

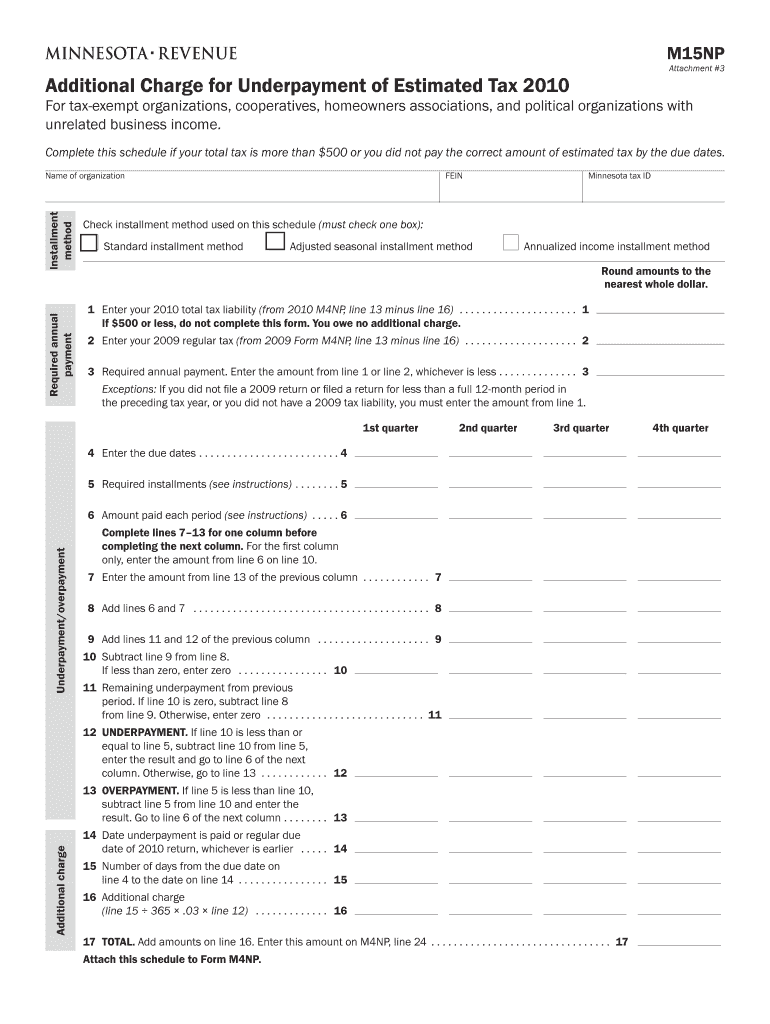

The M15NP Attachment #3 is a specific form used by tax-exempt organizations, cooperatives, homeowners associations, and political organizations that have unrelated business income. This form addresses the additional charge for underpayment of estimated tax. It is essential for these entities to comply with tax obligations, as failure to do so may result in penalties. The form helps ensure that organizations meet their estimated tax payments accurately, thereby avoiding unnecessary charges.

How to Complete the M15NP Attachment #3

Completing the M15NP Attachment #3 involves several steps. First, gather all necessary financial information, including income and expenses related to unrelated business activities. Next, calculate the estimated tax liability based on the income generated. After determining the estimated tax, fill out the form accurately, providing details about the organization and the calculated amounts. Ensure that all figures are correct to prevent any issues with underpayment. Finally, review the completed form for accuracy before submission.

Obtaining the M15NP Attachment #3

The M15NP Attachment #3 can typically be obtained from the official tax authority's website or through tax preparation offices. Organizations may also find the form available in tax software that supports nonprofit and tax-exempt filings. It is crucial to use the most current version of the form to ensure compliance with the latest tax regulations.

Key Elements of the M15NP Attachment #3

Several key elements are essential when filling out the M15NP Attachment #3. These include the organization's name, address, and taxpayer identification number. Additionally, the form requires a breakdown of unrelated business income and the estimated tax calculations. Accurate reporting of these elements is vital for proper processing and to avoid penalties associated with underpayment.

Filing Deadlines for the M15NP Attachment #3

Filing deadlines for the M15NP Attachment #3 align with the tax year of the organization. Typically, tax-exempt organizations must submit their estimated tax payments quarterly. It is important to be aware of these deadlines to avoid late fees or penalties. Keeping a calendar of important tax dates can help ensure timely submissions.

Penalties for Non-Compliance

Organizations that fail to submit the M15NP Attachment #3 or underpay their estimated taxes may face penalties. The IRS imposes charges based on the amount of underpayment and the duration of the delay. Understanding these penalties is crucial for organizations to maintain compliance and avoid financial repercussions.

Quick guide on how to complete m15np attachment 3 additional charge for underpayment of estimated tax for tax exempt organizations cooperatives homeowners

Complete [SKS] seamlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed papers, as you can easily find the appropriate form and securely keep it online. airSlate SignNow provides all the tools necessary for you to create, modify, and electronically sign your documents promptly and without interruptions. Manage [SKS] on any platform using airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign [SKS] effortlessly

- Find [SKS] and click Get Form to commence.

- Utilize the tools available to complete your document.

- Mark important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, frustrating form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign [SKS] and ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to M15NP Attachment #3 Additional Charge For Underpayment Of Estimated Tax For Tax exempt Organizations, Cooperatives, Homeowners A

Create this form in 5 minutes!

How to create an eSignature for the m15np attachment 3 additional charge for underpayment of estimated tax for tax exempt organizations cooperatives homeowners

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M15NP Attachment #3 Additional Charge For Underpayment Of Estimated Tax?

The M15NP Attachment #3 Additional Charge For Underpayment Of Estimated Tax For Tax exempt Organizations, Cooperatives, Homeowners Associations, And Political Organizations With Unrelated Business Income is a form used to report additional taxes owed due to underpayment of estimated tax. This attachment is crucial for organizations that may not meet their estimated tax obligations, ensuring compliance with IRS regulations.

-

Who needs to file the M15NP Attachment #3?

Tax exempt organizations, cooperatives, homeowners associations, and political organizations with unrelated business income are required to file the M15NP Attachment #3 Additional Charge For Underpayment Of Estimated Tax. This ensures that they accurately report any additional charges incurred due to underpayment of estimated taxes.

-

How does airSlate SignNow help with the M15NP Attachment #3 process?

airSlate SignNow streamlines the process of preparing and submitting the M15NP Attachment #3 Additional Charge For Underpayment Of Estimated Tax. Our platform allows users to easily eSign and send documents, making compliance with tax obligations more efficient and less time-consuming.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the M15NP Attachment #3 Additional Charge For Underpayment Of Estimated Tax, offers several benefits. It provides a secure, user-friendly interface for document management, ensures timely submissions, and reduces the risk of errors in tax filings.

-

Is there a cost associated with filing the M15NP Attachment #3 through airSlate SignNow?

While there may be fees associated with filing the M15NP Attachment #3 Additional Charge For Underpayment Of Estimated Tax, airSlate SignNow offers a cost-effective solution for document management and eSigning. Our pricing plans are designed to accommodate various organizational needs, ensuring affordability.

-

Can airSlate SignNow integrate with other tax software for filing the M15NP Attachment #3?

Yes, airSlate SignNow can integrate with various tax software solutions to facilitate the filing of the M15NP Attachment #3 Additional Charge For Underpayment Of Estimated Tax. This integration allows for seamless data transfer and enhances the overall efficiency of the tax filing process.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers a range of features for managing tax documents, including secure eSigning, document templates, and automated workflows. These features are particularly beneficial for organizations needing to file the M15NP Attachment #3 Additional Charge For Underpayment Of Estimated Tax, ensuring a smooth and compliant process.

Get more for M15NP Attachment #3 Additional Charge For Underpayment Of Estimated Tax For Tax exempt Organizations, Cooperatives, Homeowners A

Find out other M15NP Attachment #3 Additional Charge For Underpayment Of Estimated Tax For Tax exempt Organizations, Cooperatives, Homeowners A

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form