M1CD, Child and Dependent Care Credit Rev 311 Form

What is the M1CD, Child And Dependent Care Credit Rev 311

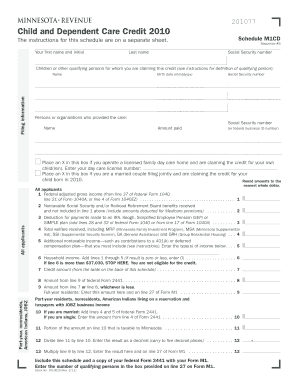

The M1CD, Child And Dependent Care Credit Rev 311 is a tax form used in the United States to claim a credit for expenses incurred for the care of qualifying children and dependents. This credit is designed to assist working families by offsetting the costs associated with childcare, allowing parents to work or seek employment. The form is part of the Minnesota state tax return process and is specifically aimed at providing financial relief to taxpayers who meet certain eligibility criteria.

Eligibility Criteria

To qualify for the Child And Dependent Care Credit, taxpayers must meet specific criteria, including:

- The taxpayer must have incurred expenses for the care of a child under the age of thirteen or a qualifying dependent.

- The care must enable the taxpayer to work or look for work.

- Eligible expenses can include payments made to daycare centers, babysitters, or other care providers.

- Taxpayers must have earned income to claim the credit, and the amount of the credit may vary based on income level.

Steps to complete the M1CD, Child And Dependent Care Credit Rev 311

Completing the M1CD form involves several steps:

- Gather necessary documentation, including proof of care expenses, provider information, and taxpayer identification numbers.

- Fill out the form by providing personal information, including your name, address, and Social Security number.

- Detail the care expenses incurred, including the names and addresses of care providers.

- Calculate the credit amount based on the expenses and your income level, following the guidelines provided in the form instructions.

- Review the completed form for accuracy before submission.

Required Documents

When filing the M1CD, it is essential to have the following documents ready:

- Receipts or invoices from care providers showing the amount paid for services.

- Taxpayer identification numbers for all care providers.

- Proof of employment or job search activities, if applicable.

- Any prior year tax returns that may provide context for income levels.

How to use the M1CD, Child And Dependent Care Credit Rev 311

Using the M1CD form effectively involves understanding how to report your care expenses accurately. Start by identifying all eligible expenses related to childcare. Ensure that the care provider meets the necessary qualifications. Fill out the form with precise details, ensuring that all calculations align with the IRS guidelines. Once completed, the form can be submitted electronically or via mail as part of your state tax return.

Filing Deadlines / Important Dates

Filing deadlines for the M1CD are typically aligned with the standard tax filing deadlines in the United States. Taxpayers should be aware of the following important dates:

- April 15: The general deadline for filing state and federal tax returns.

- Extensions: Taxpayers may apply for an extension, but any owed taxes must still be paid by the original deadline to avoid penalties.

IRS Guidelines

The IRS provides specific guidelines regarding the Child And Dependent Care Credit, including eligibility requirements, qualifying expenses, and the calculation of the credit amount. Taxpayers should refer to the IRS publication related to child and dependent care to ensure compliance with current tax laws. Understanding these guidelines is crucial for accurately completing the M1CD and maximizing the potential credit available.

Quick guide on how to complete m1cd child and dependent care credit rev 311

Prepare [SKS] effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents rapidly without any delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign [SKS] without effort

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information using the tools provided by airSlate SignNow specifically for this purpose.

- Create your signature with the Sign tool, which only takes seconds and has the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Select how you wish to share your form—via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require you to print new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and electronically sign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to M1CD, Child And Dependent Care Credit Rev 311

Create this form in 5 minutes!

How to create an eSignature for the m1cd child and dependent care credit rev 311

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the M1CD, Child And Dependent Care Credit Rev 311?

The M1CD, Child And Dependent Care Credit Rev 311 is a tax credit designed to assist families with the costs of child and dependent care. This credit can signNowly reduce your tax liability, making it easier for parents to manage work and family responsibilities. Understanding this credit is essential for maximizing your tax benefits.

-

How can airSlate SignNow help with the M1CD, Child And Dependent Care Credit Rev 311?

airSlate SignNow streamlines the process of preparing and submitting documents related to the M1CD, Child And Dependent Care Credit Rev 311. Our platform allows you to easily eSign and send necessary forms, ensuring that you meet all deadlines and requirements. This efficiency can save you time and reduce stress during tax season.

-

What features does airSlate SignNow offer for managing the M1CD, Child And Dependent Care Credit Rev 311?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking specifically for the M1CD, Child And Dependent Care Credit Rev 311. These tools help you manage your documents effectively and ensure that all necessary information is included. Our user-friendly interface makes it easy for anyone to navigate.

-

Is there a cost associated with using airSlate SignNow for the M1CD, Child And Dependent Care Credit Rev 311?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The cost is competitive and reflects the value of the features provided, especially for managing documents related to the M1CD, Child And Dependent Care Credit Rev 311. We also offer a free trial, allowing you to explore our services before committing.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the M1CD, Child And Dependent Care Credit Rev 311, provides numerous benefits. You can ensure compliance, reduce paperwork errors, and speed up the submission process. Additionally, our platform enhances collaboration among team members, making it easier to gather necessary information.

-

Can airSlate SignNow integrate with other software for tax preparation?

Yes, airSlate SignNow integrates seamlessly with various tax preparation software, enhancing your workflow for the M1CD, Child And Dependent Care Credit Rev 311. This integration allows for easy transfer of data and documents, reducing the need for manual entry. Our goal is to simplify your tax preparation process.

-

How secure is airSlate SignNow when handling sensitive tax documents?

Security is a top priority at airSlate SignNow, especially when handling sensitive tax documents like the M1CD, Child And Dependent Care Credit Rev 311. We employ advanced encryption and security protocols to protect your data. You can trust that your information is safe and secure while using our platform.

Get more for M1CD, Child And Dependent Care Credit Rev 311

Find out other M1CD, Child And Dependent Care Credit Rev 311

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online