DIV Deduction for Dividends Received the Deduction for Dividends Received is Not Allowed If the Corporation Includes the Stock I Form

Understanding the DIV Deduction for Dividends Received

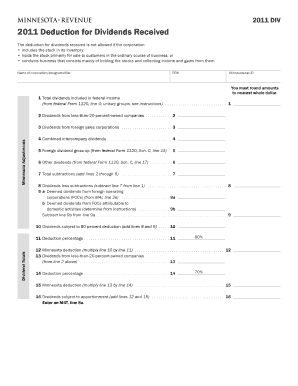

The DIV deduction for dividends received is a tax benefit that allows corporations to deduct a portion of the dividends they receive from other corporations. This deduction is designed to mitigate the effects of double taxation on corporate earnings. However, it is important to note that the deduction is not permitted if the corporation includes the stock from which the dividends are received in its inventory. This restriction aims to prevent corporations from benefiting from the deduction while also treating the stock as inventory for tax purposes.

Eligibility Criteria for the DIV Deduction

To qualify for the DIV deduction, corporations must meet specific criteria. The dividends must be received from a domestic corporation, and the recipient corporation must hold the stock for a minimum period, typically 45 days. Additionally, the corporation must not include the stock in its inventory. If the stock is classified as inventory, the corporation is ineligible for the deduction, as this would create a conflict in how the stock is treated for tax purposes.

Steps to Claim the DIV Deduction

Claiming the DIV deduction involves several steps. First, corporations must ensure they meet the eligibility criteria outlined above. Next, they should gather documentation that verifies the receipt of dividends and the holding period of the stock. Corporations will then report the deduction on their tax returns, typically using Form 1120. It is essential to maintain accurate records to support the deduction in case of an audit.

IRS Guidelines on the DIV Deduction

The IRS provides specific guidelines regarding the DIV deduction for dividends received. These guidelines outline the eligibility criteria, the percentage of dividends that can be deducted, and the necessary documentation required. Corporations should refer to IRS publications and instructions for Form 1120 to ensure compliance with all regulations. Understanding these guidelines helps corporations avoid penalties and ensures they maximize their tax benefits.

Common Scenarios Affecting the DIV Deduction

Various scenarios can impact a corporation's ability to claim the DIV deduction. For instance, if a corporation receives dividends from a subsidiary, the deduction may be limited based on ownership percentage. Additionally, if the corporation sells the stock before the required holding period, it may lose eligibility for the deduction. Corporations must carefully assess their situations to determine how these factors influence their ability to claim the deduction.

Required Documentation for Claiming the DIV Deduction

When claiming the DIV deduction, corporations need to maintain specific documentation to substantiate their claims. This includes records of the dividends received, proof of the holding period for the stock, and any relevant tax filings. Keeping organized records ensures that corporations can provide necessary information to the IRS if requested and helps facilitate the smooth processing of their tax returns.

Quick guide on how to complete div deduction for dividends received the deduction for dividends received is not allowed if the corporation includes the stock

Handle [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused activity today.

The simplest way to edit and eSign [SKS] without any hassle

- Obtain [SKS] and then click Get Form to commence.

- Utilize the tools we provide to fill out your document.

- Emphasize critical sections of the documents or obscure sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click on the Done button to save your updates.

- Choose how you would like to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure seamless communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to DIV Deduction For Dividends Received The Deduction For Dividends Received Is Not Allowed If The Corporation Includes The Stock I

Create this form in 5 minutes!

How to create an eSignature for the div deduction for dividends received the deduction for dividends received is not allowed if the corporation includes the stock

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the DIV Deduction For Dividends Received?

The DIV Deduction For Dividends Received allows corporations to deduct a portion of dividends received from other corporations. However, it's important to note that the Deduction For Dividends Received Is Not Allowed If The Corporation Includes The Stock In Its Inventory. This deduction can signNowly reduce taxable income for eligible corporations.

-

How does airSlate SignNow help with managing dividend documentation?

airSlate SignNow provides a streamlined platform for sending and eSigning documents related to dividend distributions. By using our solution, businesses can ensure that all necessary documentation is properly managed and compliant with tax regulations, including those related to the DIV Deduction For Dividends Received The Deduction For Dividends Received Is Not Allowed If The Corporation Includes The Stock In Its Inventory.

-

What features does airSlate SignNow offer for corporate clients?

airSlate SignNow offers a variety of features tailored for corporate clients, including document templates, automated workflows, and secure eSigning capabilities. These features help businesses efficiently manage their documentation processes, including those related to the DIV Deduction For Dividends Received The Deduction For Dividends Received Is Not Allowed If The Corporation Includes The Stock In Its Inventory.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. Our pricing plans are flexible and cater to different needs, ensuring that you can manage your documentation efficiently without overspending, especially when dealing with complex tax deductions like the DIV Deduction For Dividends Received The Deduction For Dividends Received Is Not Allowed If The Corporation Includes The Stock In Its Inventory.

-

Can airSlate SignNow integrate with other software tools?

Absolutely! airSlate SignNow offers integrations with various software tools, enhancing your workflow efficiency. This is particularly beneficial for managing financial documents and ensuring compliance with tax regulations, including the DIV Deduction For Dividends Received The Deduction For Dividends Received Is Not Allowed If The Corporation Includes The Stock In Its Inventory.

-

What are the benefits of using airSlate SignNow for dividend-related documents?

Using airSlate SignNow for dividend-related documents provides numerous benefits, including improved accuracy, faster processing times, and enhanced security. This is crucial for ensuring compliance with regulations surrounding the DIV Deduction For Dividends Received The Deduction For Dividends Received Is Not Allowed If The Corporation Includes The Stock In Its Inventory.

-

How can I ensure compliance with tax regulations using airSlate SignNow?

To ensure compliance with tax regulations using airSlate SignNow, you can utilize our document templates and automated workflows that are designed to meet legal standards. This is especially important when dealing with the DIV Deduction For Dividends Received The Deduction For Dividends Received Is Not Allowed If The Corporation Includes The Stock In Its Inventory, as proper documentation is essential.

Get more for DIV Deduction For Dividends Received The Deduction For Dividends Received Is Not Allowed If The Corporation Includes The Stock I

Find out other DIV Deduction For Dividends Received The Deduction For Dividends Received Is Not Allowed If The Corporation Includes The Stock I

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF