Assessment Year Property Tax Refund Homestead File M S Revenue State Mn Form

What is the Assessment Year Property Tax Refund Homestead File M S Revenue State Mn

The Assessment Year Property Tax Refund Homestead File is a crucial document for homeowners in Minnesota seeking a property tax refund. This form is specifically designed for individuals who qualify for the homestead classification, which can reduce property taxes based on the property's value and the owner's residency status. The Minnesota Department of Revenue oversees this process, ensuring that eligible homeowners receive their rightful refunds. Understanding this form is essential for maximizing tax benefits and ensuring compliance with state regulations.

How to use the Assessment Year Property Tax Refund Homestead File M S Revenue State Mn

Using the Assessment Year Property Tax Refund Homestead File involves several steps to ensure accurate completion and submission. First, gather all necessary information, including property details, your Social Security number, and income documentation. Next, carefully fill out the form, ensuring that all sections are completed accurately. After completing the form, review it for any errors or omissions. Finally, submit the form to the Minnesota Department of Revenue by the specified deadline, either online or via mail, to initiate the refund process.

Eligibility Criteria

To qualify for the property tax refund under the Assessment Year Property Tax Refund Homestead File, homeowners must meet specific eligibility criteria. These include being a Minnesota resident, occupying the property as their primary residence, and having a household income below a certain threshold. Additionally, the property must be classified as homestead property, which typically includes single-family homes, townhouses, and certain manufactured homes. Meeting these criteria is essential for receiving a refund on property taxes paid.

Required Documents

When preparing to file the Assessment Year Property Tax Refund Homestead File, certain documents are necessary to support your application. Homeowners should provide proof of residency, such as a driver's license or utility bill, and documentation of income, which may include pay stubs, tax returns, or Social Security statements. Additionally, information regarding the property, including its tax statement and any previous homestead applications, may also be required. Having these documents ready can streamline the filing process and ensure a successful application.

Form Submission Methods (Online / Mail / In-Person)

The Assessment Year Property Tax Refund Homestead File can be submitted through various methods, allowing flexibility for homeowners. The Minnesota Department of Revenue offers an online submission option, which is typically the fastest and most efficient way to file. Alternatively, homeowners can mail their completed forms to the appropriate address provided by the department. In some cases, in-person submissions may also be possible at designated local offices, although this may vary based on location and current health guidelines.

Filing Deadlines / Important Dates

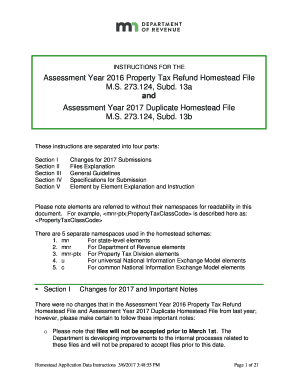

Filing deadlines for the Assessment Year Property Tax Refund Homestead File are critical to ensure timely processing of refunds. Homeowners must submit their forms by the established deadline, which is typically set for August 15 of the year following the assessment year. It is essential to keep track of these dates to avoid missing out on potential refunds. Additionally, homeowners should be aware of any changes in deadlines that may arise due to legislative updates or other factors affecting tax regulations.

Quick guide on how to complete assessment year property tax refund homestead file m s revenue state mn

Complete [SKS] effortlessly on any device

Managing documents online has gained traction among companies and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed papers, as you can easily access the right form and securely save it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

The easiest way to edit and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your selected device. Modify and eSign [SKS] and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Assessment Year Property Tax Refund Homestead File M S Revenue State Mn

Create this form in 5 minutes!

How to create an eSignature for the assessment year property tax refund homestead file m s revenue state mn

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Assessment Year Property Tax Refund Homestead File M S Revenue State Mn?

The Assessment Year Property Tax Refund Homestead File M S Revenue State Mn refers to the process of filing for property tax refunds in Minnesota for homestead properties. This program allows eligible homeowners to receive refunds based on their property taxes paid. Understanding this process is crucial for maximizing your potential refund.

-

How can airSlate SignNow help with the Assessment Year Property Tax Refund Homestead File M S Revenue State Mn?

airSlate SignNow streamlines the document signing process for the Assessment Year Property Tax Refund Homestead File M S Revenue State Mn. With our easy-to-use platform, you can quickly prepare, send, and eSign necessary documents, ensuring a hassle-free experience. This efficiency can save you time and reduce the stress associated with filing.

-

What are the pricing options for using airSlate SignNow for property tax refund filings?

airSlate SignNow offers flexible pricing plans that cater to various business needs, including those involved in the Assessment Year Property Tax Refund Homestead File M S Revenue State Mn. Our plans are designed to be cost-effective, ensuring that you only pay for the features you need. You can choose from monthly or annual subscriptions based on your usage.

-

Are there any specific features in airSlate SignNow that assist with property tax refund filings?

Yes, airSlate SignNow includes features specifically designed to assist with the Assessment Year Property Tax Refund Homestead File M S Revenue State Mn. These features include customizable templates, automated reminders, and secure cloud storage for all your documents. This ensures that you have everything you need at your fingertips when filing.

-

What benefits does airSlate SignNow provide for filing property tax refunds?

Using airSlate SignNow for the Assessment Year Property Tax Refund Homestead File M S Revenue State Mn offers numerous benefits, including increased efficiency and reduced paperwork. Our platform allows for quick document turnaround, which can expedite your refund process. Additionally, the secure eSigning feature ensures that your documents are legally binding and protected.

-

Can airSlate SignNow integrate with other software for property tax management?

Absolutely! airSlate SignNow can seamlessly integrate with various software solutions that assist with the Assessment Year Property Tax Refund Homestead File M S Revenue State Mn. This integration allows for a more streamlined workflow, enabling you to manage your property tax documents alongside other financial tools you may be using.

-

Is airSlate SignNow user-friendly for those unfamiliar with eSigning?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it accessible for everyone, including those unfamiliar with eSigning. The intuitive interface guides users through the process of preparing and signing documents related to the Assessment Year Property Tax Refund Homestead File M S Revenue State Mn. Our customer support is also available to assist with any questions.

Get more for Assessment Year Property Tax Refund Homestead File M S Revenue State Mn

Find out other Assessment Year Property Tax Refund Homestead File M S Revenue State Mn

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free

- eSignature Wyoming Legal Executive Summary Template Myself

- eSignature Alabama Non-Profit Lease Agreement Template Computer

- eSignature Arkansas Life Sciences LLC Operating Agreement Mobile

- eSignature California Life Sciences Contract Safe