P100, State General Property Tax Settlement Report Form

What is the P100, State General Property Tax Settlement Report

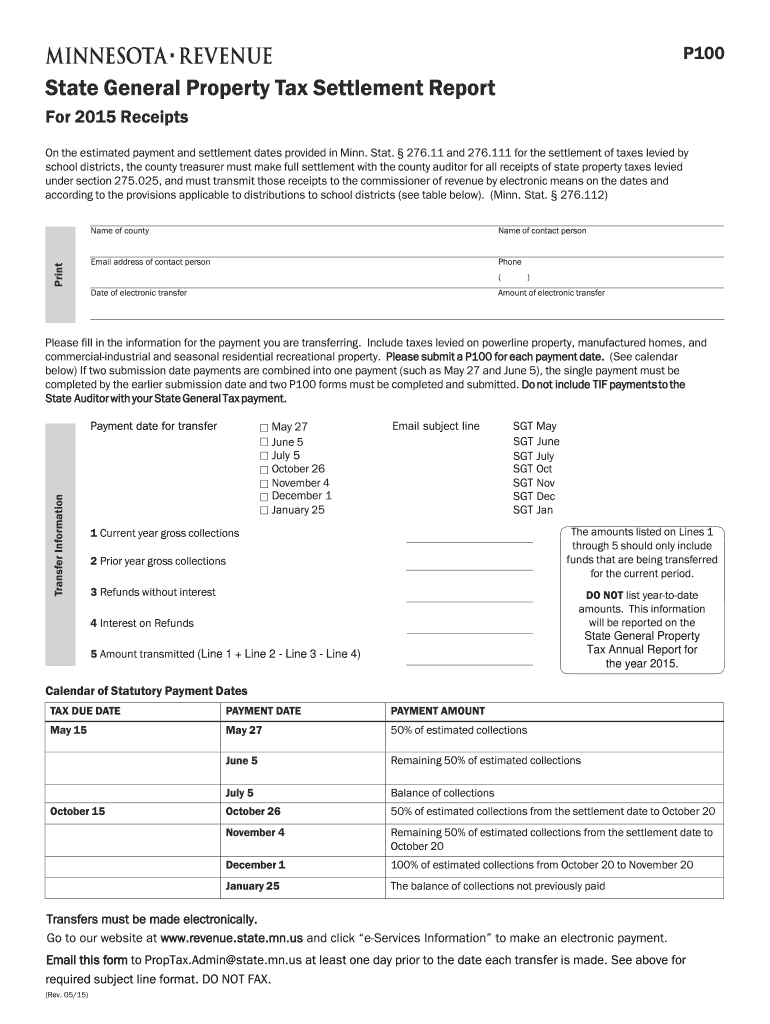

The P100, State General Property Tax Settlement Report, is a crucial document used by property owners and local governments in the United States to report and settle property tax obligations. This form provides a detailed account of property taxes assessed, collected, and distributed among various governmental entities. It serves as a transparent record of property tax transactions, ensuring compliance with state tax regulations.

How to use the P100, State General Property Tax Settlement Report

Using the P100 involves several steps to ensure accurate reporting and compliance. Property owners must fill out the form with precise information regarding their property tax assessments and payments. This includes details about the property location, assessed value, and any exemptions that may apply. Once completed, the report is submitted to the appropriate local tax authority for review and processing.

Steps to complete the P100, State General Property Tax Settlement Report

Completing the P100 requires careful attention to detail. Here are the essential steps:

- Gather all necessary documentation related to property assessments and tax payments.

- Fill in the property details, including address and parcel number.

- Provide information on assessed values and tax rates applicable to the property.

- Include any exemptions or deductions that may affect the total tax liability.

- Review the completed form for accuracy before submission.

Key elements of the P100, State General Property Tax Settlement Report

The P100 includes several key elements that are vital for accurate reporting. These elements typically encompass:

- Property identification details, such as the parcel number and address.

- Assessment values that reflect the market value of the property.

- Tax rates applied to the property based on local regulations.

- Information on payments made and any outstanding balances.

- Details of exemptions or special assessments, if applicable.

Legal use of the P100, State General Property Tax Settlement Report

The P100 is a legally recognized document that fulfills the reporting requirements set forth by state tax authorities. Proper use of this form ensures that property owners remain compliant with tax laws, avoiding potential penalties or legal issues. It is essential to submit the P100 accurately and on time to maintain good standing with local tax agencies.

Filing Deadlines / Important Dates

Filing deadlines for the P100 can vary by state and local jurisdiction. Typically, property owners are required to submit the report annually, often coinciding with the property tax assessment period. It is crucial to check with local tax authorities for specific deadlines to ensure timely submission and avoid any penalties.

Quick guide on how to complete p100 state general property tax settlement report

Effortlessly Complete [SKS] on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to find the correct form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage [SKS] on any device using the airSlate SignNow applications for Android or iOS, and simplify any document-related process today.

The easiest way to edit and electronically sign [SKS] with ease

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all your information and then click the Done button to save your modifications.

- Choose how you prefer to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, monotonous form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to P100, State General Property Tax Settlement Report

Create this form in 5 minutes!

How to create an eSignature for the p100 state general property tax settlement report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the P100, State General Property Tax Settlement Report?

The P100, State General Property Tax Settlement Report is a crucial document that outlines the distribution of property tax revenues among local governments. It ensures transparency and accountability in the allocation of funds. Understanding this report is essential for businesses and municipalities to manage their financial obligations effectively.

-

How can airSlate SignNow help with the P100, State General Property Tax Settlement Report?

airSlate SignNow streamlines the process of preparing and signing the P100, State General Property Tax Settlement Report. Our platform allows users to easily create, send, and eSign documents, ensuring that all necessary parties can review and approve the report quickly. This efficiency helps reduce delays in tax settlement processes.

-

What are the pricing options for using airSlate SignNow for the P100 report?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that facilitate the creation and management of the P100, State General Property Tax Settlement Report. You can choose a plan that best fits your budget and requirements, ensuring cost-effective solutions.

-

What features does airSlate SignNow provide for managing the P100 report?

With airSlate SignNow, you gain access to features such as customizable templates, secure eSigning, and real-time tracking for the P100, State General Property Tax Settlement Report. These tools enhance collaboration and ensure that all stakeholders are kept informed throughout the process. Our platform is designed to simplify document management.

-

Are there any integrations available for the P100, State General Property Tax Settlement Report?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your workflow for the P100, State General Property Tax Settlement Report. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to streamline document storage and management. This integration capability helps you maintain an organized approach to your tax reporting.

-

What are the benefits of using airSlate SignNow for the P100 report?

Using airSlate SignNow for the P100, State General Property Tax Settlement Report offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick document turnaround times, ensuring that your tax settlements are processed without unnecessary delays. Additionally, eSigning provides a legally binding solution that is both convenient and reliable.

-

Is airSlate SignNow secure for handling the P100 report?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your documents, including the P100, State General Property Tax Settlement Report. Our platform ensures that sensitive information remains confidential and secure throughout the signing process. You can trust us to safeguard your data.

Get more for P100, State General Property Tax Settlement Report

Find out other P100, State General Property Tax Settlement Report

- Sign South Dakota Banking Limited Power Of Attorney Mobile

- How Do I Sign Texas Banking Memorandum Of Understanding

- Sign Virginia Banking Profit And Loss Statement Mobile

- Sign Alabama Business Operations LLC Operating Agreement Now

- Sign Colorado Business Operations LLC Operating Agreement Online

- Sign Colorado Business Operations LLC Operating Agreement Myself

- Sign Hawaii Business Operations Warranty Deed Easy

- Sign Idaho Business Operations Resignation Letter Online

- Sign Illinois Business Operations Affidavit Of Heirship Later

- How Do I Sign Kansas Business Operations LLC Operating Agreement

- Sign Kansas Business Operations Emergency Contact Form Easy

- How To Sign Montana Business Operations Warranty Deed

- Sign Nevada Business Operations Emergency Contact Form Simple

- Sign New Hampshire Business Operations Month To Month Lease Later

- Can I Sign New York Business Operations Promissory Note Template

- Sign Oklahoma Business Operations Contract Safe

- Sign Oregon Business Operations LLC Operating Agreement Now

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement