Report on Value Lost because of Value Limitations under Tax Form

What is the Report On Value Lost Because Of Value Limitations Under Tax

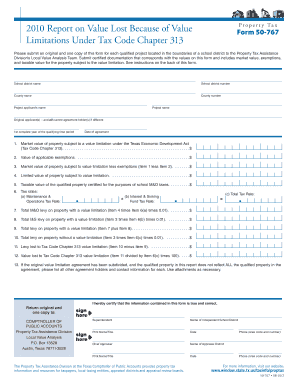

The Report On Value Lost Because Of Value Limitations Under Tax is a formal document that taxpayers use to detail the financial impact of value limitations imposed by tax regulations. This report is essential for individuals and businesses seeking to understand how these limitations affect their overall tax liability. It provides a structured way to present lost value, ensuring that all relevant information is captured for tax purposes. By documenting these losses, taxpayers can potentially leverage them in future tax filings or appeals.

How to use the Report On Value Lost Because Of Value Limitations Under Tax

This report can be utilized by both individuals and businesses to clarify the financial implications of tax limitations. Users should carefully fill out the report by providing accurate financial data, including any relevant calculations that demonstrate the value lost. It is advisable to maintain supporting documentation, such as financial statements or tax returns, to substantiate the claims made in the report. This ensures that the information is credible and can be referenced if needed during audits or disputes.

Steps to complete the Report On Value Lost Because Of Value Limitations Under Tax

Completing the Report On Value Lost Because Of Value Limitations Under Tax involves several key steps:

- Gather all relevant financial documents, including previous tax returns and financial statements.

- Identify the specific value limitations that apply to your situation.

- Calculate the total value lost due to these limitations.

- Fill out the report with detailed information about the calculations and supporting evidence.

- Review the completed report for accuracy before submission.

Legal use of the Report On Value Lost Because Of Value Limitations Under Tax

The legal use of this report is significant, as it serves as a formal record of the financial impacts of tax limitations. Taxpayers can use it to support their claims during audits or disputes with tax authorities. It is important to ensure that the report is completed accurately and truthfully, as any discrepancies could lead to penalties or legal issues. Consulting with a tax professional may be beneficial to ensure compliance with all applicable laws and regulations.

Key elements of the Report On Value Lost Because Of Value Limitations Under Tax

Key elements of the report include:

- A clear statement of the value limitations being reported.

- Detailed calculations of the lost value.

- Supporting documentation that verifies the claims made.

- Taxpayer identification information, including Social Security numbers or Employer Identification Numbers.

- Signature and date of completion to validate the report.

Filing Deadlines / Important Dates

Filing deadlines for the Report On Value Lost Because Of Value Limitations Under Tax vary based on individual circumstances and the nature of the tax return. Generally, it should be filed alongside the annual tax return. It is crucial to stay informed about specific deadlines to avoid late penalties. Taxpayers should also be aware of any changes in tax law that may affect these dates.

Quick guide on how to complete report on value lost because of value limitations under tax

Effortlessly prepare [SKS] on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing users to access the necessary form and store it safely online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents quickly and without delays. Manage [SKS] across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize important sections of the documents or obscure sensitive information using the features that airSlate SignNow offers specifically for this purpose.

- Generate your electronic signature using the Sign tool, a process that takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred delivery method, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] to ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the report on value lost because of value limitations under tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Report On Value Lost Because Of Value Limitations Under Tax?

A Report On Value Lost Because Of Value Limitations Under Tax is a detailed document that outlines the financial impact of tax limitations on your business. It helps you understand how these limitations affect your overall value and can guide your financial decisions. Utilizing airSlate SignNow, you can easily create and manage this report with our user-friendly eSigning features.

-

How can airSlate SignNow help in generating a Report On Value Lost Because Of Value Limitations Under Tax?

airSlate SignNow provides tools that simplify the process of creating a Report On Value Lost Because Of Value Limitations Under Tax. With our templates and eSignature capabilities, you can quickly compile necessary data and ensure that your report is legally binding. This streamlines your workflow and saves you valuable time.

-

What are the pricing options for using airSlate SignNow for tax-related reports?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Whether you need basic features or advanced functionalities for generating a Report On Value Lost Because Of Value Limitations Under Tax, we have a plan that fits your budget. Explore our pricing page for detailed information on each plan.

-

Are there any integrations available for airSlate SignNow to enhance report generation?

Yes, airSlate SignNow integrates seamlessly with various applications to enhance your report generation process. You can connect with accounting software and document management systems to streamline the creation of a Report On Value Lost Because Of Value Limitations Under Tax. This integration ensures that all your data is synchronized and easily accessible.

-

What features does airSlate SignNow offer for creating tax reports?

airSlate SignNow offers a range of features designed to facilitate the creation of tax reports, including customizable templates, eSignature capabilities, and secure document storage. These features make it easy to compile a Report On Value Lost Because Of Value Limitations Under Tax efficiently. Our platform is designed to enhance productivity and ensure compliance.

-

Can I track the status of my Report On Value Lost Because Of Value Limitations Under Tax with airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of your Report On Value Lost Because Of Value Limitations Under Tax. You will receive notifications when documents are viewed, signed, or completed, ensuring you stay informed throughout the process.

-

Is airSlate SignNow secure for handling sensitive tax information?

Yes, security is a top priority at airSlate SignNow. We implement advanced encryption and security protocols to protect your sensitive information, including any Report On Value Lost Because Of Value Limitations Under Tax. You can trust that your data is safe and compliant with industry standards.

Get more for Report On Value Lost Because Of Value Limitations Under Tax

Find out other Report On Value Lost Because Of Value Limitations Under Tax

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure