Stanford University Transcripts 2013-2026

What is the Stanford University Transcript?

The Stanford University transcript is an official academic record that provides a comprehensive overview of a student's academic history at Stanford. This document includes details such as courses taken, grades received, and degrees conferred. It serves as a vital resource for alumni seeking to verify their educational credentials for employment, further education, or professional licensing. The transcript is typically issued by the Stanford University Registrar's Office and can be requested in both digital and paper formats.

How to Obtain the Stanford University Transcript

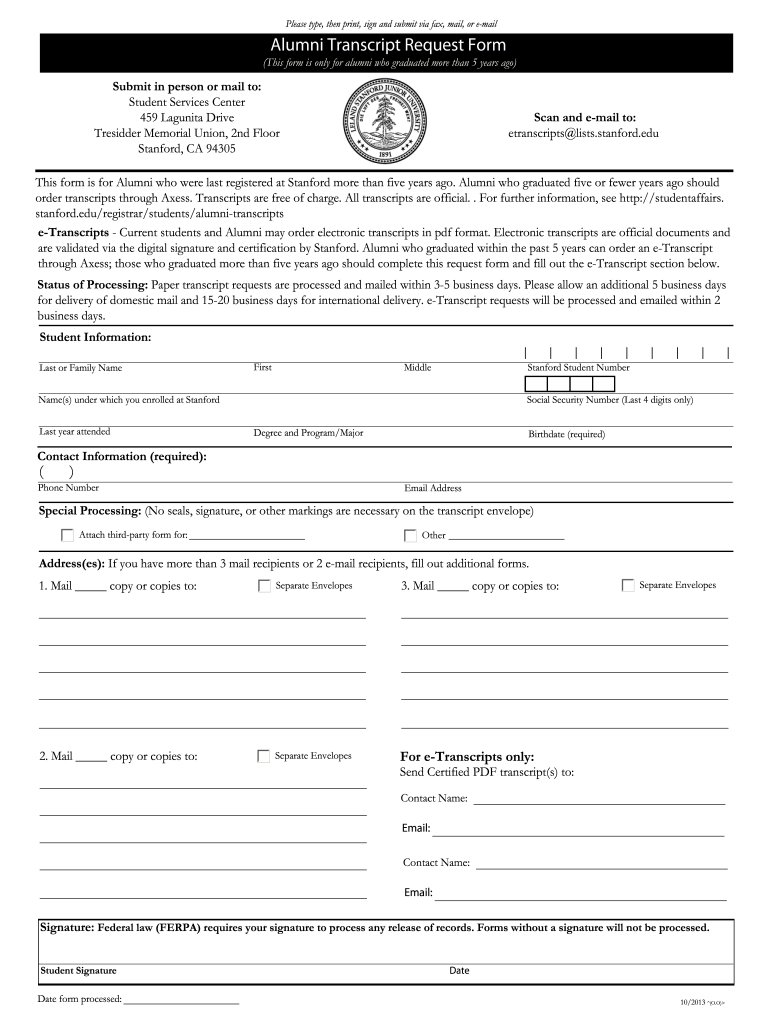

To obtain a Stanford University transcript, alumni must complete a transcript request form. This form can be accessed online through the Stanford University Registrar's website. Alumni need to provide personal information, including their full name, date of birth, and student ID number, if available. Once the form is filled out, it can be submitted electronically or printed and mailed to the Registrar's Office. Processing times may vary, so it is advisable to request the transcript well in advance of any deadlines.

Steps to Complete the Stanford University Transcript Request

Completing the Stanford University transcript request involves several straightforward steps:

- Visit the Stanford University Registrar's website to access the transcript request form.

- Fill in the required personal information accurately.

- Select the preferred delivery method: electronic or paper.

- Review the information for accuracy before submission.

- Submit the form electronically or print and mail it to the Registrar's Office.

Legal Use of the Stanford University Transcript

Stanford University transcripts are legally recognized documents that can be used for various purposes, such as job applications, graduate school admissions, and professional licensing. It is essential to ensure that the transcript is requested and used in compliance with relevant regulations, such as the Family Educational Rights and Privacy Act (FERPA), which protects the privacy of student education records. Alumni should be aware that unauthorized use or alteration of the transcript may lead to legal consequences.

Key Elements of the Stanford University Transcript

The key elements of a Stanford University transcript include:

- Student Information: Full name, student ID, and date of birth.

- Course Listings: Titles of courses taken, along with corresponding grades.

- Degree Information: Details regarding degrees awarded, including majors and minors.

- Academic Honors: Any honors or distinctions received during the academic tenure.

Examples of Using the Stanford University Transcript

Alumni can utilize their Stanford University transcript in various scenarios, such as:

- Applying for jobs that require proof of educational qualifications.

- Submitting applications for graduate programs or professional schools.

- Verifying educational credentials for licensing boards in fields such as nursing or teaching.

Quick guide on how to complete please type then print sign and submit via fax mail or e mail

The optimal method to locate and endorse Stanford University Transcripts

At the scale of an entire organization, ineffective procedures related to paper approvals can use up a signNow amount of work hours. Signing documents like Stanford University Transcripts is an inherent aspect of operations in any organization, which is why the efficiency of each agreement’s lifecycle signNowly impacts the company’s overall performance. With airSlate SignNow, endorsing your Stanford University Transcripts can be as straightforward and rapid as possible. You’ll discover with this platform the most recent version of virtually any document. Even better, you can sign it instantly without needing to install external software on your computer or printing any hard copies.

How to obtain and approve your Stanford University Transcripts

- Browse our library by category or utilize the search bar to locate the document you require.

- Examine the form preview by clicking on Learn more to ensure it is the correct one.

- Click Get form to start editing immediately.

- Fill out your form and incorporate any necessary details using the toolbar.

- When finished, click the Sign tool to endorse your Stanford University Transcripts.

- Select the signature method that is most suitable for you: Draw, Create initials, or upload a photo of your handwritten signature.

- Click Done to finish editing and proceed to document-sharing options if needed.

With airSlate SignNow, you have everything required to manage your documentation effectively. You can find, complete, modify, and even send your Stanford University Transcripts in a single tab without any complications. Enhance your processes with a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct please type then print sign and submit via fax mail or e mail

FAQs

-

I want to create a web app that enables users to sign up/in, fill out a form, and then fax it to a fax machine. How to difficult is this to develop?

Are you sending yourself the fax or are they able to send the fax anywhere? The latter has already been done numerous times. There are email to fax and fax to email applications that have been available for decades. I'm pretty certain that converting email to fax into app or form submission to fax is pretty trivial. They convert faxes to PDF's in many of these apps IIRC so anywhere you could view a PDF you could get a fax.

-

How do I mail a regular letter to Venezuela? Do I need to fill out a customs form for a regular letter or do I just need to add an international mail stamp and send it?

You do not need to fill out a customs form for a regular letter sent from the US to any other country. Postage for an international letter under 1 ounce is currently $1.15. You may apply any stamp - or combination of stamps - which equals that amount.

-

Surveillance: If your txt messages or phone calls are being intercepted Or tapped would there be any signs to look for that would indicate this is happening eg hardware issues like phone turning itself off and then on again, technological issues like your phone not ringing when its called or switching straight to voice mail though it's not in use and in range with signal or provider issues like signNowly delayed or out of sequence voice mail or texts or ones that don't turn up at all? and i

As a US government official working overseas, my phone was sometimes tapped, my housing bugged, and my movements monitored.Awareness of phone tapping depends very much on the technology used. I was 'lucky' enough to be working primarily in low-tech countries, at least so far as surveillance was concerned. When I picked up my phone in certain countries, there was a delay, accompanied by clicking, before obtaining a dial tone. This was not the case with untapped phones which went directly to a dial tone when the receiver was lifted.In one particular country, phone calls were monitored by individuals who had both microphone and headset equipment. I could frequently hear local music playing in the background while conversing with people who would not be listening to that type of music. Sometimes, just to let the monitors know I was aware of their activities, I'd ask them to turn the music down as it was interfering with my call. On other occasions, I could hear monitors coughing or sneezing.Monitoring of cell phones, Internet activity, SMS, WiFi, and the like are not generally detectable at either the sending or receiving end. Newer technology also permits the 'overhearing' of landline phone conversations without interrupting or interfering with the calls. This interception can take place almost anywhere along the channel of communication, not just on one person's phone. Particularly information transmitted through the airwaves -- cell phones, WiFi, SMS -- the signals are being broadcast like a radio. Anyone with the appropriate receiver and analysis equipment can listen in. This is why scramblers, codes, and encryption are used.Cell phones are particularly subject to security concerns. Not only is the signal broadcast to the world at large, but many phones can receive a signal that turns on their microphones, even when the phones are turned off. This is why cell phones (among other electronic devices) are not permitted within secured areas of government buildings where classified information is discussed.If one wishes to avoid possible surveillance, then one has to avoid using most of the standard forms of communication. Before becoming concerned about it, though, one should take a moment to analyze whether one's communications are likely to be a target for interception. In addition to government communications, information of economic value, information transmitted during divorce or child custody cases, or interception solely because one or another of those communicating is famous might lead one to heightened caution. If one is not involved in anything that would attract attention, then it's really not worth worrying about.Different countries have different laws about just what kind of information can be made available to law enforcement bodies without a warrant or subpoena. You'll have to check Australian law (and court cases ruling on those laws) to determine just what is permitted. Certain kinds of information -- such as who has what phone number, who is using a particular IP, and that IP's location -- are generally available to law enforcement with minimal effort.

-

What is a registered exporter system (REX)?

In Simple Words REX is Compliance system initiated by European union for Certification of Origin.If one wants to export goods value exceeds 6000 EUR to Europe then has to attach this certificate with consignment.In Official Frame of words:Subject: – Certification of Origin of Goods for European Union Generalised System of Preferences (EU-GSP) – Modification of the system as of 1 January 2017.In exercise of powers conferred under paragraph 2.04 of the Foreign Trade Policy, 2015-2020, the Director General of Foreign Trade hereby inserts a new sub para (c) under Para 2.104 Generalised System of Preferences (GSP) as under:(c) The European Union (EU) has introduced a self-certification scheme for signNowing the rules of origin under GSP from 1.1.2017 onwards. Under the Registered Exporter System (REX) being introduced from 1.1.2017, exporters with a REX number will be able to self-signNow the Statement on Origin of their goods being exported to EU under the GSP Scheme. The registration on REX is without any fee or charges and this system would eventually phase out the current system of issuance of Certificates of Origin (Form-A) by the Competent Authorities listed in Appendix-2C of FTP (2015-20) by 1.1.2018 (one year transition period). The details of the scheme are at Annex 1 to Appendix 2C of the Foreign Trade Policy (2015- 20).3. Effect of this Public Notice: Registered Exporters System (REX) as of 1 January 2017 for the EU Generalised System of Preferences (GSP) is notified.(A.K.Bhalla)Director General of Foreign TradeEmail: dgft@nic.in[Issued from F. No.01/93/180/56/AM-13/PC-2B]ANNEXURE 1 to APPENDIX 2CCertification of Origin of Goods for the EU Generalised System of Preferences (GSP)-Modification of the system as of 1st January 2017.Introduction:1.1 The EU has been continuously undertaking reforms of its GSP rules of origin. One such reform finalised in 2011 relates to the self-certification of the rules of origin criteria by exporters themselves. The purpose of this reform is to facilitate trade and reduce administrative burden and costs for exporters.1.2 Under the new scheme of self-certification, being introduced from 1.1.2017, the current system of issuance of certificates of origin (Form-A) by competent authorities as listed in Appendix 2C of Foreign Trade Policy (2015-20) will be replaced with “statements on origin” to be issued by exporters themselves. This “statement on origin” is to be made out on, on any commercial document (such as commercial invoice etc.) of the exported consignment. However, during the transition period of twelve months from 1.1.2017 until 31.12.2017, the competent authorities [as listed in Appendix 2C of the FTP (2015-20)] would continue to issue certificates of origin (Form A) at the request of exporters who are not registered in the REX system. At the end of this period, i.e. from 1.1.2018 onwards, the consignments above the value of € 6000 will be entitled to GSP preferential tariff treatment, only if accompanied by a statement on origin made out by a registered exporter. Exporters consigning low value goods (i.e. less than €6000 per consignment) are however entitled to make out statements on origin without being registered in REX, instead of submitting “Form- A” from 1.1.2017 itself.1.3 As exporters are in the best position to assess the origin of their products, the European Union considers it appropriate that the exporters directly provide their customers in the EU with ‘statements on origin’ that no longer need to be endorsed by their national authorities. For this purpose, exporters will need to be registered by the competent authorities in an electronic system, named the REX system, or the. ‘Registered Exporter System’.1.4 The competent authorities would have access to the REX system for registration of exporters as well as access to relevant information. The registration of exporters in the system will not require any fees. An exporter will be registered in the system only once and the REX system will be common to the GSP schemes of the European Union, Norway, Switzerland and Turkey (based on Turkey fulfilling certain conditions).1.5 The REX is a composite system relating to both registration of exporters and all other aspects related to the self-certification of the rules of origin under the EU GSP. The rules of the REX system are laid down in European Commission’s Implementing Regulation (EU) No 2015/2447 [the Union Customs Code (UCC) “Implementing Act”(IA)]. The details on the REX system are available at the following URL:https://ec.europa.eu/taxation_cu...1.6 Questions and Answers on the reform of GSP rules of origin can also be assed atReform of GSP rules of origin1.7 While the REX system will come into operation on 1.1.2017 and exporters will be able to submit their applications for registration under REX w.e.f 1.1.2017, the registration on the REX System will only be done when EU operationalizes the system and gives access to the system to competent authorities in India. Exporters may submit their applications to the competent authorities as listed in Annexure 1(b) who will receive such applications, verify the details therein and if accepted, these applications will be registered on the REX once their access to REX is permitted. Upon registration with REX, they will intimate the REX registration number and it’s validity date to the exporters through email and a communication at the address indicated in the application form.2. Tasks and responsibilities of the competent authorities under the REX system:2.1 Under the EU GSP self-certification system, all the beneficiary countries would have two types of competent authorities namely.i. Competent authority for administrative cooperation (ADC) which interfaces with the EU on issues related to the EU GSP and takes overall policy decisions on the EU GSPii. Competent authority for registration (REG) which is responsible for registration of exporters through local users as also assistance related to verification.2.2 Each of these competent authorities must have at least one local administrator namelyi. Local administrator(s) for administrative cooperation (ADC)ii. Local administrator(s) for registration (REG)The role of the local administrators is to create local users in their competent authority. Hence, the Local Users for registration (REG) would be created by the Local Administrators for registration (REG). The exporters would need to approach these local users for registration (REG) to undertake a one time registration for exports under the EU GSP self- certification.2.3 The Department of Commerce is the Local Administrator of India for Administrative Cooperation (ADC) under the EU GSP self-certification scheme. Besides, the Department of Commerce, India would have sixteen Local Administrators for Registration (REG). The Local Administrators for Registration along with the name of their nodal officers, designation, email id and telephone numbers is listed at Annexure.-“1A”. All these Local Administrators would access the REX system through their ECAS IDs. The Local Administrators for Registration on the request of the Local Administrator for Administrative Cooperation (i.e the Department of Commerce) will also provide all support requested by the Commission for the monitoring of the proper management of the scheme in the country, including verification visits on the spot by the Commission or the customs authorities of EU Member States.2.4 The Local Administrators for Registration would nominate and create the Local Users for Registration (REG) in the REX system through their ECAS IDs. This would have to be done by logging into the T-REX (sub-component of the REX system).and registering the local users. Local Administrators for REG would also train the Local Users in registering exporters under the REX system. Local Administrators for REG will maintain updated record of its Local Users for Registration (name, address, email id and phone no.) and intimate any change in details of Local Users for Registration to EU / Switzerland / Norway administrators and to Department of Commerce at the following email IDsd1rmtr-doc@nic.inusrmtr-doc@nic.inmoc_rmtr@nic.inThe Local users for Registration (REG) nominated by the Local Administrators for Registration are at Annexure.-“1B”.Updates on the REX system can be viewed at Directorate General of Foreign Trade.2.5 The Local Users for Registration shall undertake the following tasks:i. Disseminate information on the REX system to exporters and other stakeholders;ii. Receive signed applications for registration in REX from exporters in the requisite format (Annexure-“1C”). The REX system provides for a Pre-Application component (AREX Form) which allows exporters to fill their details in a REX Pre-Application form and print it. The same can be signed and submitted manually to the Local User. When being processed, the Local User will retrieve the related information using the exporter’s IEC number/Importer Exporter profile.iii. Register Exporters on REX, using either details from Pre-Application (AREX Form) or using details from the paper based application signed and submitted by the exporter;iv. Check whether the applications submitted contains all the information required;v. Check that the applicants are established and functional manufacturers or traders, and their Importer Exporter Code (IEC) is not under DEL(Denied Entity List);vi. Enter information about the exporters into the REX system and assign registered exporter (REX) number, in the 20 digit format namely INREX [10 digit IEC number]- [2 digit alphabetical code for Local Administrator]-[3 digit numeric code for Local User for Registration beginning from 001 until 999]. The two digit alphabetical code for Local Administrator for Registration is given in Appendix IA while the term “INREX” stands for India REX,);vii. Inform exporters of their REX number; date of registration in REX any other relevant details through both email and a hard copy. The date from which the registration is valid should be the date on which the complete application was received by the Local User;viii. Store the application form in safe custody;ix. Keep the electronic record of registered exporters up-to-date;x. Recommend to the Local Administrator for Registration, the revocation of the exporter’s registration if the exporter:a. no longer exists, no longer intends to export goods under the GSP or no longer meets the conditions for exporting goods under the GSP;b. intentionally or negligently draws up, or causes to be drawn up, a statement on origin which contains incorrect information and leads his customer to wrongfully obtaining preferential tariff treatment in the EU;c. fails to keep information relating to his registration up-do-date, where this shortcoming is considered to be serious;xi. inform registered exporters whose registration has been revoked on the action taken for revocation of the date from which the revocation will take effectxii. carry out regular checks, verification and audits on registered exporters, based on the requests of EU Member States Or after obtaining the consent of both the Local Administrator for Registration (REG) and the Local Administrator for Administrative Cooperation (ADC). The fees charged for checks, verification and audits will commensurate with the cost of services rendered. The Local User for Registration (REG) will provide details of the fees to be charged by it (including a rough estimate of the total cost to the exporter) to both the Local Administrator for Registration (REG) and the Local Administrator for Administrative Cooperation (ADC).xiii. Re-registration of the exporter based on the due process of checks and based on recommendation of the Local Administrator for Registration (REG).xiv. Send on a monthly basis, the summary of the “statements on origin” to the Local Administrator for Registration and the Local Administrator for Administrative Cooperation (ADC).2.6 In accordance with Article 93 of the reformed EU GSP rules of origin under Regulation 2015/2447 the competent authorities must revoke a registration if the registered exporter no longer exists, no longer intends to export goods under the GSP or no longer meets the conditions for exporting goods under the GSP.2.7 Without prejudice to the system of penalties and sanctions applicable in the beneficiary country, if a registered exporter intentionally or negligently draws up, or causes to be drawn up, a “statement on origin” which contains incorrect information and leads his customer to wrongfully obtaining preferential tariff treatment in the EU, the Local User must recommend revocation of the exporter’s registration to the Local Administrator for Registration. The Local User for Registration may also recommend revocation to the Local Administrator for Registration if the registered exporter fails to keep information relating to his registration up-to-date and this shortcoming is considered to be serious.2.8 Without prejudice to the possible impact of irregularities found on pending verifications, revocation of the registration can only take effect for statements made out after the date of revocation. Exporters whose registration has been revoked may only be registered again if they prove that they have remedied the situation.2.9 An appeal against the revocation and annulment of the Registration of an exporter shall lie with the Local Administrator for Administrative Cooperation (ADC).3. Tasks and Responsibilities of the Registered Exporters under the REX System3.1 To be registered, an exporter must file an application with one of the Local Users for Registration (REG). The selection of the Local User for Registration (REG) is to be made taking into account the products being exported, nature of the unit (SEZ or DTA) etc. . The application must be made using the form set out in Annexure -“1C” and must contain all the information. Exporters will also have the possibility to pre-encode their application in the Pre-Application component (AREX Form) of the REX system and print it. Paper copy of the application with hand-written signature has to be submitted to the Local User. The application will only be accepted by the competent authorities if it is complete. Registration is valid from the moment a complete application is submitted by the exporter. There is no impact on the exporter if there is a technical problem for the registration or if the competent authorities have organizational difficulties to register the exporter immediately.3.2 An exporter will be registered in the system only once, as the REX system is common to the GSP schemes in the EU, Norway and Switzerland. It will also apply to Turkey’s GSP scheme, once that country meets certain conditions. However, these GSP schemes may differ in terms of country and product coverage. As a result, a particular registration will only be effective for exports under a GSP scheme that considers India as a beneficiary country.3.3 By completing the form, exporters consent to this information being stored in the Commission’s database and being published on a publicly accessible website. In column 6 of the application form the Exporter must indicate as to whether the information furnished by him can be published on the public website. If the exporter gives his consent, the IEC number, name, address, contact details and the registered exporter and the indicative description of his goods which qualify for preferential treatment are made public on the Internet. If the exporter doesn’t give his consent, only the REX number, its validity date, address where the registered exporter is established and date of the revocation of the registration where applicable, is shared on the internet; besides also indicating as to whether the registration applies also to exports to Norway or Switzerland.3.4 Exporters, whether registered or not, (i.e even those whose consignment values are less than €6000 ) must comply with the following obligations:i. they must maintain appropriate commercial accounting records for the production and supply of goods qualifying for preferential treatment;ii. they must keep available all evidence relating to the material used in manufacturing these goods;iii. they must keep all customs documentation relating to the material used in manufacturing these goods;iv. for at least three years from end of the calendar year in which the statement on origin was made out, or more if required by national law, they must keep records of:v. the statements on origin they made out, andvi. details of their originating and non-originating materials, its production and stock accounts.3.5 These records and statements on origin may be kept in an electronic format but must allow the materials used in manufacturing the exported products to be traced and their originating status to be confirmed. These obligations also apply to suppliers who provide exporters with supplier’s declarations signNowing the originating status of the goods they supply.3.6 Registered exporters must immediately inform the competent authorities (i.e. Local User for Registration where exporter applied for REX No.) of changes to the information they provided during registration. Registered exporters who no longer meet conditions for exporting goods under the scheme or no longer intend to export goods under the scheme must inform the competent authorities of this.3.7 The Registered exporters would provide a summary of the “statement on origin” to the Local Users for Registration. This summary would contain the following details:i. HS Code,ii. Description,iii. Document No/ date on which Statement on Origin is made out,iv. FOB value of exports (in $),v. destination port,vi. destination of exportvii. Origin Criteria, W/P HS four digit4. Documents to be used by the exporters registered in REX4.1 The “statement on origin” is made out by the registered exporter in the country of export to the EU as soon as the exportation has taken place or is ensured, if the goods can be considered as originating in the beneficiary country concerned. However, the registered exporter must indicate another beneficiary country on the “statement on origin” if:Regional or inter-regional cumulation takes place between the beneficiary countries in question, andIn the country of export to the EU, the goods were subject to working or processing operations insufficient to confer origin as listed in Article 78(1) (b) to (q) of the reformed EU GSP rules of origin.4.2 The exporters must provide the statement on origin to their customer(s) in the EU. It must contain the details specified in Annexure “1D” of this document. A “statement on origin” may be made out in English or any other language approved in the EU regulations on any commercial document allowing the exporter, consignee and the goods involved to be identified.4.3 When bilateral or regional cumulation applies, the exporter of a product manufactured using materials originating in a party with which cumulation is permitted, can rely on the “statement on origin” provided by its supplier. In these cases, the “statement on origin” made out by the exporter must contain the indication: ‘EU cumulation’ or ‘regional cumulation’;4.4 When cumulation under Article 85 of the reformed EU GSP rules of origin applies, the exporter of a product manufactured using materials originating in a party with which cumulation is permitted, can rely on the proof of origin provided by its supplier and issued in accordance with the provisions of GSP rules of origin in Norway or Switzerland (and, in future, Turkey). In these cases, the statement on origin made out by the exporter must contain one of the indications:‘Norway cumulation’, or ‘Switzerland cumulation’ or ‘Turkey cumulation’.4.5 When extended cumulation under Article 86(7) and (8) of the reformed EU GSP rules of origin applies, the exporter of a product manufactured using materials originating in a party with which extended cumulation is permitted, can rely on the proof of origin provided by its supplier and issued in accordance with the provisions of the relevant free-trade agreement between the EU and the relevant party. In these cases, the statement on origin made out by the exporter must contain the indication-‘extended cumulation with country ‘X’.4.6 A “statement on origin” must be made out for each consignment. In exceptional circumstances, a statement on origin may be made out after the goods have been exported (‘retrospective statement’) as it is presented in the Member State of declaration, for release for free circulation, no more than two years after the goods were imported. A statement on origin is valid for 12 months from the date on which it is made out.4.7 A single “statement on origin” may cover several consignments if the goods meet the following conditions:i. They are dismantled or non-assembled products within the meaning of general rule 2(a) of the Harmonised System.ii. are falling within Section XVI or XVII or heading 7308 or 9406 of the Harmonised System, andiii. are intended to be imported in installments.4.8 The reformed EU GSP Rules of Origin may be accessed at the following links:i. http://unctad.org/en/Publication...ii. https://ec.europa.eu/taxation_cu...iii. Trade Helpdesk & language Id=ENAnnexes:iv Rules of Origin - Taxation and customs union - European CommissionAnnexure 1AAnnex.-“1C”:Application to become a registered exporter[For the purpose of schemes of generalized tariff preferences of the European Union, Norway, Switzerland and Turkey(1)]1.Exporter’s Name full address country and EORI* or TIN* (*for India it is IEC)2.Contact details including telephone and fax number where available as well as e-mail address:3.Specify whether the main activity is producing or trading4.Indicative description of goods which qualify for preferential treatment, including indicative list of Harmonised System headings (or chapters where goods traded fall within more than 20 Harmonised System headings5.Undertakings to be given by an exporterThe undersigned hereby– Declares that the above details are correct.– Certifies that no previous registration has been revoked, conversely, certifies that the situation which led to any such revocation has been remedied.– Undertakes to make out statements on origin only for goods which qualify for preferential treatment and comply with the origin rules specified for those goods in the Generalised System of Preferences.– Undertakes to maintain appropriate commercial accounting records for production/supply of goods qualifying for preferential treatment and to keep them for at least three years from the end of the calendar year in which the statement on origin was made out.– Undertakes to immediately notify the competent authority of changes as they arise to his registration data since acquiring the number of registered exporter– Undertakes to cooperate with the competent authority– Undertakes to accept any checks on the accuracy of his statements on origin, including verification of accounting records and visits to his premises by the European Commission orMember States authorities, as well as the authorities of Norway, Switzerland and Turkey (applicable only to exporters in beneficiary countries)– Undertakes to request his removal from the system, should he no longer meet the conditions for exporting any goods under the scheme– Undertakes to request his removal from the system, should he no longer intend to export such goods under the schemePlace date, signature of authorized signatory, name and job title6. Prior specific and informed consent of exporter to the publication of his data on the public websiteThe undersigned is hereby informed that the information supplied in this application may be disclosed to the public via the public website.The undersigned accepts the publication and disclosure of this information via the public website.The undersigned may withdraw his consent to the publication of this information via the public website by sending a request to the competent authorities responsible for the registration.7. Box for official use by competent authorityThe applicant is registered under the following number:Registration Number:Date of Registration:Date from which the registration is valid:Signature and stampInformation noticeConcerning the protection and processing of personal data incorporated in the system1. Where the European Commission processes personal data contained in this application to become a registered exporter, Regulation (EC) No. 45/2001 of the European Parliament and of the Council on the protection of individuals with regard to the processing of personal data by the Union institutions and bodies and on the free movement of such data will apply. Where the competent authorities of beneficiary country or a third country implementing Directive 95/46/EC process personal data contained in this application to become a registered exporter the relevant national provisions of the aforementioned Directive will apply.2. Personal data in respect of the application to become a registered exporter are processed for the purpose of EU GSP rules of origin as defined in the relevant EU legislation. The said legislation providing for EU GSP rules of origin constitutes the legal basis for processing personal data in respect of the application to become a registered exporter.3. The competent authority in a country where the application has been submitted is the controller with respect to processing of the data in the REX system. The list of competent authority/customs departments is published on the website of the Commission.4. Access to all data of this application is granted through a user ID/password to users in the Commission, the competent authorities of beneficiary countries and the customsauthorities in the Member States, Norway, Switzerland and Turkey.5. The data of a revoked registration shall be kept by the competent authorities of the beneficiary country and the customs authorities of Member States in the REX system for 10 calendar years. This period shall run from the end of the year in which the revocation of a registration has taken place.6. The data subject has a right of access to the data relating to him that will be processed through the REX system and where appropriate, the right to rectify erase or block data in accordance with Regulation (EC) No. 45/2001 or the national laws implementing Directive 95/46/EC. Any requests for right of access, rectification erasure or blocking shall be submitted to and processed by the competent authorities of beneficiary countries and the customs authorities of Member States responsible for the registration, as appropriate. Where the registered exporter has submitted a request for the exercise of that right to the Commission, the Commission shall forward such requests to the competent authorities of the beneficiary country or the customs authorities of Member States concerned, respectively, if the registered exporter failed to obtain his rights from the controller of data the registered exporter shall submit such request to the Commission acting as controller. The Commission shall have the right to rectify, erase or block the data.7. Complaints can be addressed to the relevant national data protection authority. The contact details of the national data protection authorities are available on the website of the European Commission, Directorate General for Justice:(http.//ec.europaeu/justice/data-protection/bodies/authorities/eu//index_en htm#h2-1.8. Where the complaint concerns processing of data by the European Commission, it should be addressed to the European Data Protection supervisor (EDPS): (http.//www.edps.europa.eu/EDPSWEB/)(1)The present application form is common to the GSP schemes of four entities, the Union (EU), Norway, Switzerland and Turkey (the entities). Please note, however, that the respective GSP schemes of these entities may differ in terms of country and product coverage. Consequently a given registration will only be effective for the purpose of exports under the GSP scheme(s) that consider(s) your country as a beneficiary country.(2)The indication of EORI number is mandatory for EU exporters and re-consignors. For exporters in beneficiary countries, Norway, Switzerland and Turkey, the indication of TIN is mandatory.Annexure-“1D”STATEMENT ON ORIGINTo be made out on any commercial documents showing the name and full address of the exporter and consignee as well as a description of the products and the date of issue(1)The exporter … (Number of Registered Exporter (_2)(_3)(4) of the products covered by this document declares that, except where otherwise clearly indicated, these products are of…. Preferential origin (5) according to rules of origin of the Generalised System of Preferences of the European Union and that the origin of the Generalised System of Preferences of the European Union and that the origin criterion met is … …(6).——————————-(1)Where the statement on origin replaces another statement in accordance with Article 97d(2) and (3), the replacement statement on origin shall bear the mention “Replacement statement”. The replacement shall also indicate the date of issue of the initial statement and all other necessary data according to Article 97d(6).(2)Where the statement on origin replaces another statement in accordance with subparagraph 1 of Article 97d(2) and paragraph (3) of Article 97d, the re-consignor of the goods making out such a statement shall indicate his name and full address followed by his number of registered exporter.(3)Where the statement on origin replaces another statement in accordance with subparagraph 2 of Article 97d(2), the re-consignor of the goods making out such a statement shall indicate his name and full address followed by the mention (English version)” acting on the basis of the statement on origin made out by [name and complete address of the exporter in the beneficiary country] registered under the following number [Number of Registered Exporter of the exporter in the beneficiary country]”(4)Where the statement on origin replaces another statement in accordance with Article 97d(2), the re-consignor of the goods shall indicate the number of registered exporter only if the value of originating products in the initial consignment exceeds EUR 6 000.(5)Country of origin of products to be indicated. When the statement on origin relates, in whole or in part, to products originating in Ceuta and Melilla within the meaning of Article 97j, the exporter must clearly indicate them in the document on which the statement is made out by means of the symbol “XC/XL”.(6)Products wholly obtained: enter the letter “P”, Products sufficiently worked or processed: enter the letter ‘W’ followed by a heading of the Harmonised System (example “W”9618).Where appropriate the above mention shall be replaced with one of the following indications:(a) In the case of bilateral cumulation: “EU cumulation”.(b) In the case of cumulation with Norway, Switzerland or Turkey: “Norway cumulation”,“Switzerland cumulation” or “Turkey cumulation”.(c) In the case of regional cumulation: “regional cumulation”.(d) In the case of extended cumulation: “extend cumulation with country x”.

Create this form in 5 minutes!

How to create an eSignature for the please type then print sign and submit via fax mail or e mail

How to create an electronic signature for your Please Type Then Print Sign And Submit Via Fax Mail Or E Mail in the online mode

How to make an electronic signature for the Please Type Then Print Sign And Submit Via Fax Mail Or E Mail in Google Chrome

How to make an electronic signature for signing the Please Type Then Print Sign And Submit Via Fax Mail Or E Mail in Gmail

How to create an electronic signature for the Please Type Then Print Sign And Submit Via Fax Mail Or E Mail from your mobile device

How to make an eSignature for the Please Type Then Print Sign And Submit Via Fax Mail Or E Mail on iOS devices

How to make an electronic signature for the Please Type Then Print Sign And Submit Via Fax Mail Or E Mail on Android devices

People also ask

-

What is the Stanford application form PDF and how do I obtain it?

The Stanford application form PDF is a vital document required for prospective students to apply to Stanford University. You can obtain the form directly from the Stanford University admissions website or through our platform where it's easily accessible and can be filled out electronically.

-

Is the Stanford application form PDF available for electronic signing?

Yes, the Stanford application form PDF can be signed electronically using airSlate SignNow. This feature allows applicants to complete necessary paperwork conveniently and securely, streamlining the submission process.

-

What features does airSlate SignNow offer for handling the Stanford application form PDF?

airSlate SignNow offers a range of features for handling the Stanford application form PDF, including document templates, seamless eSigning, and the ability to collaborate in real-time. These tools make it easy for users to complete and manage their applications efficiently.

-

How much does it cost to use airSlate SignNow for the Stanford application form PDF?

airSlate SignNow offers flexible pricing plans to suit different needs, including plans suitable for students and educational institutions. Pricing is competitive and aims to provide a cost-effective solution for managing documents like the Stanford application form PDF.

-

Can I integrate airSlate SignNow with other applications while working on the Stanford application form PDF?

Absolutely! airSlate SignNow supports integration with various applications like Google Drive, Dropbox, and Microsoft Office. This compatibility allows users to easily access and manage the Stanford application form PDF alongside other important documents.

-

What benefits does airSlate SignNow provide for handling the Stanford application form PDF?

Using airSlate SignNow to manage the Stanford application form PDF provides numerous benefits, including improved efficiency, enhanced document security, and easier submission tracking. These features help ensure that students have a smooth application experience.

-

Is it possible to track the status of my Stanford application form PDF after submission?

Yes, airSlate SignNow offers tracking features that allow you to monitor the status of your Stanford application form PDF after submission. You will receive notifications about any updates or actions taken regarding your application.

Get more for Stanford University Transcripts

- Ankle grading system pdf form

- Ll sr03 application under section 243 by an individual member of companieshouse gov form

- Pigtrace canada movement reporting form bc pork bcpork

- Samenvatting aeo self assessment do 442 1t7fol form

- Claim supplement usli com form

- Printing s corp jhgp r 1 gp5248us frp john hancock form

- Sample stuttering report minot state university minotstateu form

- Deaconess weight loss solutions medical history form for initial

Find out other Stanford University Transcripts

- Sign New Mexico Resignation Letter Now

- How Do I Sign Oklahoma Junior Employment Offer Letter

- Sign Oklahoma Resignation Letter Simple

- How Do I Sign Oklahoma Acknowledgement of Resignation

- Can I Sign Pennsylvania Resignation Letter

- How To Sign Rhode Island Resignation Letter

- Sign Texas Resignation Letter Easy

- Sign Maine Alternative Work Offer Letter Later

- Sign Wisconsin Resignation Letter Free

- Help Me With Sign Wyoming Resignation Letter

- How To Sign Hawaii Military Leave Policy

- How Do I Sign Alaska Paid-Time-Off Policy

- Sign Virginia Drug and Alcohol Policy Easy

- How To Sign New Jersey Funeral Leave Policy

- How Can I Sign Michigan Personal Leave Policy

- Sign South Carolina Pregnancy Leave Policy Safe

- How To Sign South Carolina Time Off Policy

- How To Sign Iowa Christmas Bonus Letter

- How To Sign Nevada Christmas Bonus Letter

- Sign New Jersey Promotion Announcement Simple