Nc5x 2013-2026

What is the Nc5x?

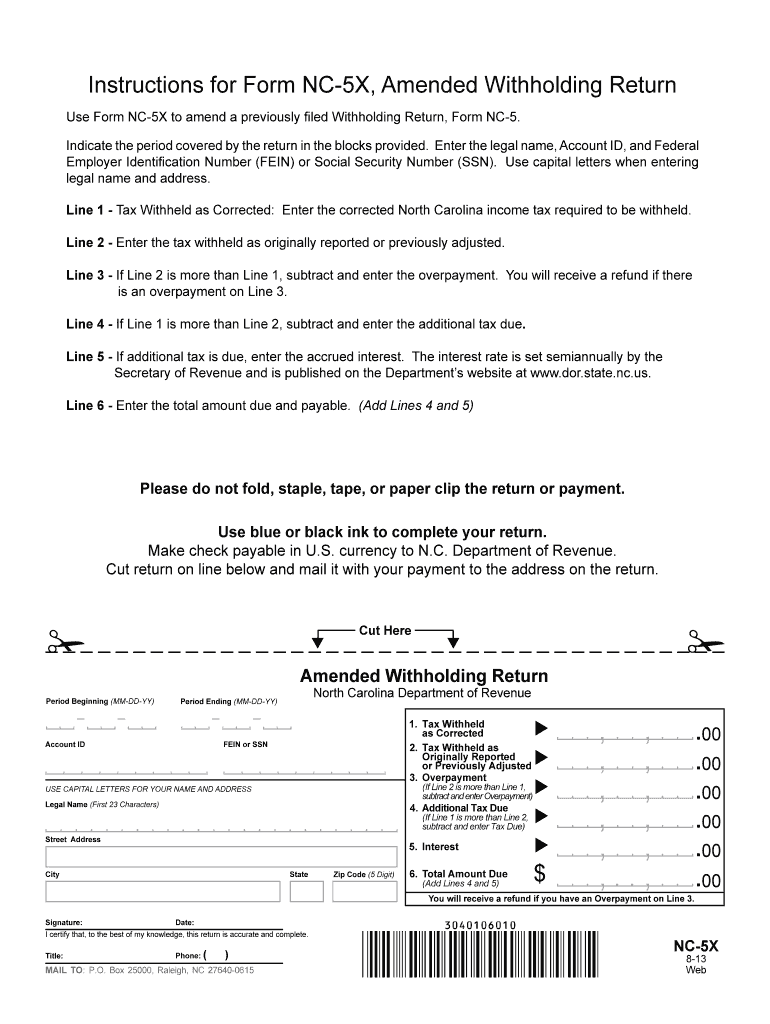

The Nc5x form, also known as the NC 5x form, is an important document used for reporting tax information in the United States. This form is specifically designed for individuals and businesses to report income and calculate tax liabilities. The Nc5x form serves as a means to ensure compliance with state tax regulations and helps facilitate accurate tax reporting. It is essential for taxpayers to understand the purpose and requirements of this form to avoid potential issues with tax authorities.

How to use the Nc5x

Using the Nc5x form involves several key steps. First, gather all necessary financial documents, including income statements and previous tax returns. Next, access the Nc5x form online through a secure platform like signNow, where you can fill in the required information electronically. Ensure that all fields are completed accurately, and review the form for any errors before submission. Once the form is filled out, you can eSign it using a reliable eSignature solution, which enhances the security and legality of your submission.

Steps to complete the Nc5x

Completing the Nc5x form requires careful attention to detail. Follow these steps:

- Obtain the Nc5x form from a trusted source.

- Fill in your personal information, including name, address, and Social Security number.

- Input your income details, ensuring all figures are accurate and reflect your financial situation.

- Review any deductions or credits you may be eligible for, and include them on the form.

- Double-check all entries for accuracy before finalizing.

- eSign the document using a secure eSignature platform.

- Submit the completed form electronically or via mail as per the guidelines.

Legal use of the Nc5x

The Nc5x form is legally recognized for tax reporting purposes in the United States. To ensure its legal validity, it must be completed accurately and submitted in accordance with state regulations. The Internal Revenue Service (IRS) has accepted eSignatures on this form, provided that the electronic signing process adheres to the standards set forth in the ESIGN Act. Taxpayers should maintain copies of their submitted forms for their records, as this can be crucial in the event of an audit or inquiry.

Filing Deadlines / Important Dates

Filing deadlines for the Nc5x form can vary based on individual circumstances and state regulations. Generally, taxpayers are required to submit their Nc5x forms by April 15th of each year to avoid penalties. However, extensions may be available under certain conditions. It is essential to stay informed about any changes to tax deadlines, especially in light of recent adjustments made by tax authorities during exceptional circumstances, such as the COVID-19 pandemic.

Who Issues the Form

The Nc5x form is issued by the North Carolina Department of Revenue (DOR). This state agency is responsible for administering tax laws and ensuring compliance among taxpayers. The DOR provides resources and guidance to help individuals and businesses understand their tax obligations, including the use of the Nc5x form. It is advisable for taxpayers to consult the DOR's website or contact their office for the most current information regarding the form and its requirements.

Required Documents

To complete the Nc5x form accurately, several documents may be required. These typically include:

- Previous year’s tax return for reference.

- W-2 forms from employers.

- 1099 forms for any additional income sources.

- Documentation for deductions and credits, such as receipts or statements.

- Any relevant financial statements that reflect your income.

Quick guide on how to complete nc tax payment voucher 2013 2019 form

Your assistance manual on how to prepare your Nc5x

If you’re interested in understanding how to finalize and submit your Nc5x, here are a few brief guidelines on how to simplify tax declaration.

To start, you just need to set up your airSlate SignNow profile to modify how you manage documents online. airSlate SignNow is a highly user-friendly and efficient document solution that enables you to edit, create, and complete your tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and return to amend information as necessary. Optimize your tax management with advanced PDF editing, eSigning, and straightforward sharing.

Follow the instructions below to finish your Nc5x in a few minutes:

- Create your account and begin working on PDFs in no time.

- Utilize our directory to find any IRS tax form; browse through various versions and schedules.

- Click Get form to open your Nc5x in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-binding eSignature (if needed).

- Review your document and rectify any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to file your taxes digitally with airSlate SignNow. Please note that submitting on paper can increase return errors and delay refunds. It is essential to check the IRS website for filing regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct nc tax payment voucher 2013 2019 form

FAQs

-

How do I fill out 2013 tax forms?

I hate when people ask a question, then rather than answer, someone jumps in and tells them they don't need to know--but today, I will be that guy, because this is serious.Why oh why do you think you can do this yourself?Two things to consider:People who get a masters degree in Accounting then go get a CPA then start doing taxes--only then do some of them start specializing in international accounting. I've taught Accounting at the college-level, have taken tax classes beyond that, and wouldn't touch your return.Tax professionals generally either charge by the form or by the hour. Meaning you can sit and do this for 12 hours, or you can pay a CPA by the hour to do it, or you can go to an H&R Block that has flat rates and will do everything but hit Send for free. So why spend 12 hours doing it incorrectly, destined to worry about the IRS putting you in jail, bankrupting you, or deporting you for the next decade when you can get it done professionally for $200-$300?No, just go get it done right.

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How many forms are filled out in the JEE Main 2019 to date?

You should wait till last date to get these type of statistics .NTA will release how much application is received by them.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

What is the procedure to book a slot for the JEE Mains 2019? I have filled out the application form and completed the payment, but I did not find any option for booking the time and date slot.

Hi,Well, you can not book slots in JEE Main 2019.About the time: The time for appearing in JEE Main 2019 paper 1 will be either 9:30 AM to 12:30 PM or 2:30 PM to 5:30 PM. There will be 2 shifts. NTA will allot any one shift to you.About the date: JEE Main 2019 will be conducted on Saturdays and Sundays between 6 to 20 Jan 2019. NTA will select one day for you.Rounding up, NTA will allot the day and shift of exam to you. The exam center will be also allotted by NTA, however, you can provide 4 preference of exam center in the application form.For more clarification read this[1].Read the official notice below:Footnotes[1] Allotment of Shift In JEE Main 2019 - How To Select Exam Shift, Day And Centre | AglaSem

Create this form in 5 minutes!

How to create an eSignature for the nc tax payment voucher 2013 2019 form

How to create an electronic signature for the Nc Tax Payment Voucher 2013 2019 Form in the online mode

How to generate an eSignature for the Nc Tax Payment Voucher 2013 2019 Form in Chrome

How to generate an eSignature for signing the Nc Tax Payment Voucher 2013 2019 Form in Gmail

How to create an electronic signature for the Nc Tax Payment Voucher 2013 2019 Form straight from your smartphone

How to make an eSignature for the Nc Tax Payment Voucher 2013 2019 Form on iOS

How to generate an eSignature for the Nc Tax Payment Voucher 2013 2019 Form on Android devices

People also ask

-

What is nc5x and how does it relate to airSlate SignNow?

nc5x is an innovative feature within airSlate SignNow that enables businesses to simplify their document management processes. By leveraging nc5x, users can efficiently send and eSign documents, ensuring smoother workflows and enhanced productivity.

-

What are the key features of airSlate SignNow's nc5x?

The nc5x feature in airSlate SignNow offers advanced functionalities such as customizable templates, real-time tracking, and automated reminders. These features enhance user experience by allowing streamlined document signing and management tailored to individual business needs.

-

How much does airSlate SignNow with nc5x cost?

airSlate SignNow offers various pricing plans to accommodate different business sizes and needs, including features from nc5x. By evaluating the specific requirements of your organization, you can select a cost-effective plan that includes the powerful benefits of nc5x.

-

What benefits can businesses expect from using nc5x with airSlate SignNow?

Businesses using nc5x with airSlate SignNow can expect improved efficiency, reduced turnaround times, and enhanced document security. These benefits contribute to a faster, more reliable signing process and greater overall satisfaction for both businesses and their clients.

-

Can nc5x integrate with other applications or tools?

Yes, nc5x supports numerous integrations with popular applications such as CRMs and project management tools. This interoperability enhances collaboration and ensures that document workflows seamlessly fit into your existing business processes.

-

Is there a mobile app available for using nc5x?

Absolutely! airSlate SignNow provides a mobile app that incorporates the nc5x feature, allowing users to send and eSign documents from anywhere. This flexibility ensures that users can manage their signing needs on the go, enhancing their productivity.

-

What support options are available for users of nc5x?

Users of nc5x with airSlate SignNow have access to excellent customer support resources, including a help center, live chat, and email support. Whether you have questions about setup or need assistance with features, our team is ready to help ensure a smooth experience.

Get more for Nc5x

- I 175 fill out on line form

- Form vtr 34 2015

- Pre engagement acknowledgement for contingent workers alleghenyvalleylibrary form

- Puppy contract bill of sale sharonamp39s cocker spaniels form

- City of becker employment application form

- Attestation of activities doc form

- Fresno unified renewal of inter district transfer form

- Red bay sports form

Find out other Nc5x

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now