Revenue Administration Filing of Business Activity 2022-2026

What is the Revenue Administration Filing Of Business Activity

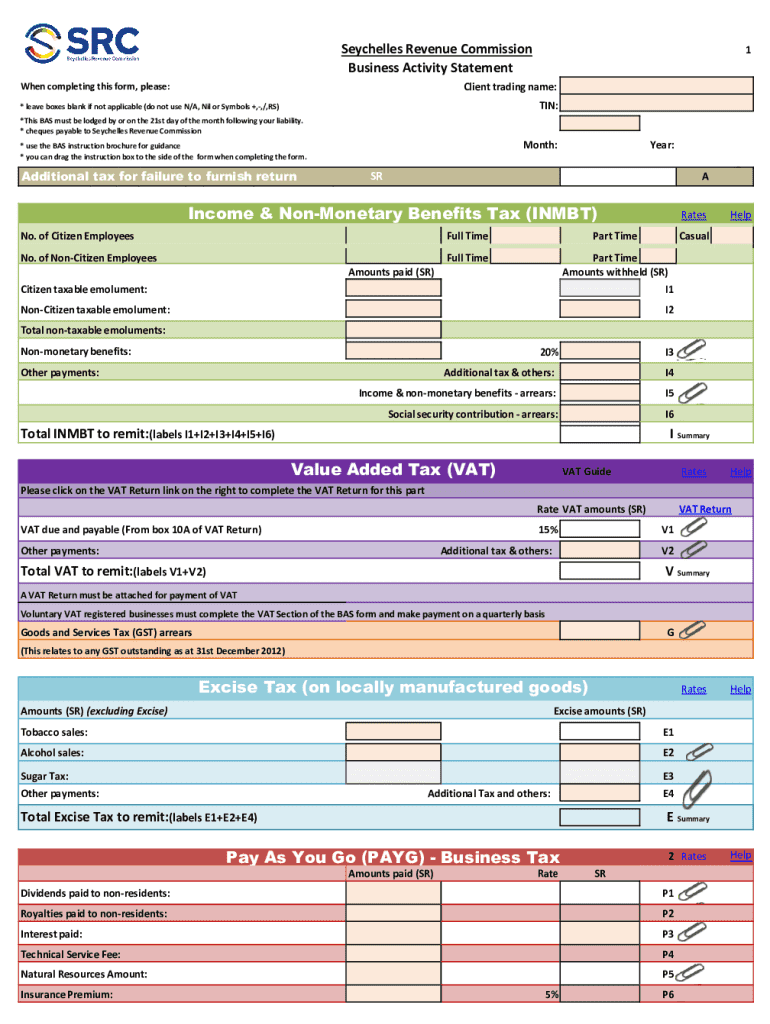

The Revenue Administration Filing of Business Activity is a crucial document required by the Seychelles Revenue Commission for businesses operating within the jurisdiction. This form serves to report the financial activities of a business, ensuring compliance with local tax regulations. It includes details about income, expenses, and other financial transactions that may affect the tax obligations of the business. Understanding this form is essential for maintaining good standing with tax authorities and avoiding potential penalties.

Steps to complete the Revenue Administration Filing Of Business Activity

Completing the Revenue Administration Filing of Business Activity involves several key steps:

- Gather necessary financial documents, including income statements, expense reports, and any relevant receipts.

- Fill out the form accurately, ensuring all sections are completed, including business identification details and financial figures.

- Review the completed form for accuracy, checking for any errors or omissions that could lead to complications.

- Submit the form by the designated deadline, either electronically or via mail, as specified by the Seychelles Revenue Commission.

Required Documents

To successfully complete the Revenue Administration Filing of Business Activity, certain documents are necessary:

- Business registration certificate.

- Financial statements, including profit and loss statements.

- Detailed expense records and receipts.

- Any prior tax returns that may be relevant.

Form Submission Methods

The Revenue Administration Filing of Business Activity can be submitted through various methods, providing flexibility for businesses:

- Online: Many businesses prefer to submit their forms electronically through the Seychelles Revenue Commission's online portal.

- Mail: Physical copies of the form can be sent via postal service to the designated tax office.

- In-Person: Businesses may also choose to deliver their forms directly to the local tax office.

Penalties for Non-Compliance

Failure to comply with the filing requirements for the Revenue Administration Filing of Business Activity can result in significant penalties. These may include:

- Fines for late submissions or inaccurate reporting.

- Interest on any unpaid taxes.

- Potential legal action or audits by the Seychelles Revenue Commission.

Eligibility Criteria

To file the Revenue Administration Filing of Business Activity, businesses must meet specific eligibility criteria, which typically include:

- Having a valid business registration with the Seychelles Revenue Commission.

- Engaging in taxable activities within the jurisdiction.

- Maintaining accurate financial records that reflect business operations.

Quick guide on how to complete revenue administration filing of business activity

Complete Revenue Administration Filing Of Business Activity effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your documents promptly without delays. Handle Revenue Administration Filing Of Business Activity on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric activity today.

How to modify and eSign Revenue Administration Filing Of Business Activity with ease

- Locate Revenue Administration Filing Of Business Activity and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you would prefer to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign Revenue Administration Filing Of Business Activity to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct revenue administration filing of business activity

Create this form in 5 minutes!

How to create an eSignature for the revenue administration filing of business activity

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Seychelles Revenue Commission forms?

Seychelles Revenue Commission forms are official documents required for tax compliance and reporting in Seychelles. These forms help businesses and individuals report their income, expenses, and other financial information to the Seychelles Revenue Commission. Using airSlate SignNow, you can easily fill out and eSign these forms, ensuring compliance and efficiency.

-

How can airSlate SignNow help with Seychelles Revenue Commission forms?

airSlate SignNow streamlines the process of completing Seychelles Revenue Commission forms by providing an intuitive platform for document management. Users can easily fill out, sign, and send these forms electronically, reducing the time spent on paperwork. This solution enhances accuracy and ensures that all necessary information is included.

-

Are there any costs associated with using airSlate SignNow for Seychelles Revenue Commission forms?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan includes features that facilitate the completion of Seychelles Revenue Commission forms, such as unlimited eSigning and document storage. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for managing Seychelles Revenue Commission forms?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure cloud storage for Seychelles Revenue Commission forms. These tools help users efficiently manage their documents and ensure that they are always up-to-date. Additionally, the platform supports real-time collaboration, making it easier for teams to work together.

-

Can I integrate airSlate SignNow with other applications for Seychelles Revenue Commission forms?

Yes, airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow for Seychelles Revenue Commission forms. You can connect with popular tools like Google Drive, Dropbox, and CRM systems to enhance your document management process. This integration capability ensures that all your data is synchronized and easily accessible.

-

Is airSlate SignNow secure for handling Seychelles Revenue Commission forms?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your Seychelles Revenue Commission forms are protected. The platform uses advanced encryption and secure data storage to safeguard sensitive information. You can trust that your documents are handled with the utmost care and confidentiality.

-

How does airSlate SignNow improve the efficiency of completing Seychelles Revenue Commission forms?

By using airSlate SignNow, businesses can signNowly reduce the time spent on completing Seychelles Revenue Commission forms. The platform automates many steps in the document signing process, allowing users to fill out and eSign forms quickly. This efficiency not only saves time but also minimizes the risk of errors in your submissions.

Get more for Revenue Administration Filing Of Business Activity

- Michigan note form

- Notice of option for recording michigan form

- Life documents planning package including will power of attorney and living will michigan form

- General durable power of attorney for property and finances or financial effective upon disability michigan form

- Essential legal life documents for baby boomers michigan form

- Michigan general form

- Revocation of general durable power of attorney michigan form

- Essential legal life documents for newlyweds michigan form

Find out other Revenue Administration Filing Of Business Activity

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple