Instructions for 2106 Instructions for Form 2106 Irs

What is the Instructions For Form 2106?

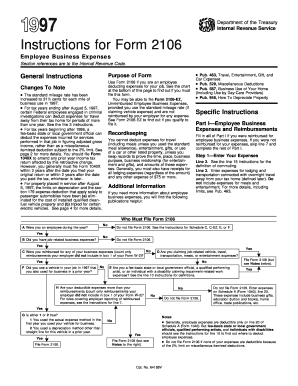

The Instructions For Form 2106 provide essential guidance for taxpayers who are claiming employee business expenses. This form is primarily used by employees to deduct unreimbursed expenses related to their job, such as travel, meals, and other necessary costs incurred while performing their work duties. Understanding these instructions is crucial for accurately completing the form and ensuring compliance with IRS regulations.

Key Elements of the Instructions For Form 2106

Several key elements are included in the Instructions For Form 2106 that help taxpayers navigate the filing process:

- Eligibility Criteria: Specifies who can use the form, including employees who incur expenses that are not reimbursed by their employer.

- Required Documents: Lists the documents needed to support the deductions claimed, such as receipts and mileage logs.

- Filing Deadlines: Outlines important dates for submitting the form to ensure timely processing.

- IRS Guidelines: Provides detailed instructions on how to fill out the form correctly, including line-by-line explanations.

Steps to Complete the Instructions For Form 2106

Completing the Instructions For Form 2106 involves several steps to ensure accurate reporting of expenses:

- Gather all necessary documentation, including receipts and records of expenses.

- Review the eligibility criteria to confirm that you qualify to use the form.

- Follow the IRS guidelines to fill out each section of the form accurately.

- Calculate the total expenses and ensure that they align with the documentation provided.

- Submit the completed form by the specified deadline, either electronically or by mail.

How to Obtain the Instructions For Form 2106

The Instructions For Form 2106 can be obtained directly from the IRS website or through tax preparation software. It is advisable to ensure that you are using the most current version of the instructions, as tax laws and requirements can change annually. Additionally, many tax professionals can provide copies of the instructions as part of their services.

IRS Guidelines for Form 2106

The IRS provides specific guidelines for completing Form 2106, which include:

- Clarification on what qualifies as a deductible expense.

- Instructions on how to report these expenses accurately on your tax return.

- Information on how to handle any reimbursements received from employers.

Following these guidelines is essential to avoid potential issues with the IRS and to maximize eligible deductions.

Penalties for Non-Compliance

Failure to comply with the Instructions For Form 2106 can result in penalties, including:

- Disallowance of claimed deductions, leading to higher tax liabilities.

- Potential fines for incorrect reporting or failure to file.

- Increased scrutiny from the IRS, which may lead to audits.

It is important to adhere strictly to the instructions to mitigate these risks and ensure compliance with tax regulations.

Quick guide on how to complete instructions for 2106 instructions for form 2106 irs

Easily Prepare [SKS] on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources you need to create, edit, and electronically sign your documents swiftly without any hold-ups. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The Easiest Way to Edit and Electronically Sign [SKS]

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form navigation, or mistakes that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] while ensuring excellent communication throughout the entire form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Instructions For 2106 Instructions For Form 2106 Irs

Create this form in 5 minutes!

How to create an eSignature for the instructions for 2106 instructions for form 2106 irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Instructions For 2106 Instructions For Form 2106 Irs?

The Instructions For 2106 Instructions For Form 2106 Irs provide detailed guidance on how to fill out Form 2106, which is used for claiming employee business expenses. Understanding these instructions is crucial for accurately reporting expenses and maximizing deductions on your tax return.

-

How can airSlate SignNow help with the Instructions For 2106 Instructions For Form 2106 Irs?

airSlate SignNow simplifies the process of managing and signing documents related to the Instructions For 2106 Instructions For Form 2106 Irs. With our platform, you can easily create, send, and eSign forms, ensuring compliance and accuracy in your submissions.

-

What features does airSlate SignNow offer for handling IRS forms?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing IRS forms like the Instructions For 2106 Instructions For Form 2106 Irs. These tools streamline the process and enhance efficiency for businesses.

-

Is airSlate SignNow cost-effective for small businesses needing IRS form assistance?

Yes, airSlate SignNow is a cost-effective solution for small businesses looking to manage IRS forms, including the Instructions For 2106 Instructions For Form 2106 Irs. Our pricing plans are designed to fit various budgets while providing essential features for document management.

-

Can I integrate airSlate SignNow with other software for IRS form management?

Absolutely! airSlate SignNow offers integrations with various software applications, making it easier to manage IRS forms like the Instructions For 2106 Instructions For Form 2106 Irs. This flexibility allows you to streamline your workflow and enhance productivity.

-

What are the benefits of using airSlate SignNow for IRS forms?

Using airSlate SignNow for IRS forms, including the Instructions For 2106 Instructions For Form 2106 Irs, provides numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled with care and compliance.

-

How secure is airSlate SignNow when handling sensitive IRS documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect sensitive IRS documents, including those related to the Instructions For 2106 Instructions For Form 2106 Irs. You can trust that your information is safe with us.

Get more for Instructions For 2106 Instructions For Form 2106 Irs

Find out other Instructions For 2106 Instructions For Form 2106 Irs

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure