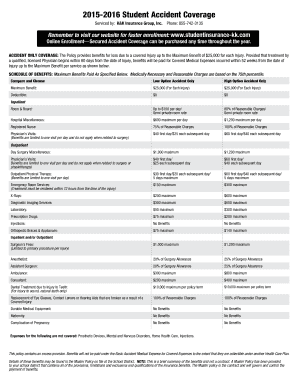

Student Accident Coverage 2015-2026

What is the Student Accident Coverage

The Student Accident Coverage is a type of insurance designed to provide financial protection for students in the event of an accident. This coverage typically includes medical expenses, emergency services, and other related costs that may arise from injuries sustained during school activities or while on school premises. The goal of this coverage is to ensure that students receive necessary medical attention without the burden of overwhelming costs, allowing parents and guardians to focus on recovery rather than finances.

How to use the Student Accident Coverage

Using the Student Accident Coverage involves several key steps. First, ensure that your child is enrolled in a plan that offers this type of coverage. In the event of an accident, promptly notify the school and obtain any necessary incident reports. Next, gather all relevant medical documentation, including bills and treatment records. Finally, submit a claim to the insurance provider, ensuring that all required forms are completed accurately and submitted within the designated timeframe to avoid delays in processing.

Steps to complete the Student Accident Coverage

Completing the Student Accident Coverage form involves a series of straightforward steps. Begin by obtaining the necessary form from the school or the insurance provider. Fill out the form with accurate information, including the student's details, the nature of the accident, and any medical treatment received. Make sure to include any required signatures. Once completed, submit the form either online or via mail, depending on the submission methods accepted by the insurance provider. Keep a copy of the submitted form for your records.

Legal use of the Student Accident Coverage

The legal use of the Student Accident Coverage is governed by specific regulations that ensure compliance with state and federal laws. This coverage must adhere to guidelines set forth by insurance authorities, which may include maintaining proper documentation and following claims procedures. Understanding these legal requirements is essential for both parents and schools to ensure that students are adequately protected and that claims are processed without legal complications.

Eligibility Criteria

Eligibility for the Student Accident Coverage typically depends on several factors, including the student's enrollment status, the type of school attended, and the specific insurance plan chosen. Generally, all students enrolled in participating schools are eligible for coverage, but certain conditions may apply, such as age limits or participation in specific school activities. It is important for parents to review the eligibility criteria outlined by the insurance provider to ensure their child qualifies for the coverage.

Required Documents

To successfully file a claim under the Student Accident Coverage, several documents are usually required. These may include the completed coverage form, incident reports from the school, medical bills, and any treatment records related to the accident. Additionally, proof of enrollment in the school may be necessary to validate the claim. Ensuring that all required documents are gathered and submitted will facilitate a smoother claims process.

Form Submission Methods

Submitting the Student Accident Coverage form can typically be done through various methods, including online submissions, mail, or in-person delivery. Online submissions often provide the quickest processing times, while mailing the form may require additional time for delivery. In-person submissions can offer immediate confirmation of receipt. Parents should choose the method that best suits their needs while ensuring that the form is submitted within any specified deadlines.

Quick guide on how to complete 2015 2016 accident form

The simplest method to discover and sign Student Accident Coverage

On a larger business scale, ineffective procedures surrounding paper approvals can consume a signNow amount of working time. Authorizing documents like Student Accident Coverage is an essential aspect of operations in any enterprise, which is why the efficacy of each agreement’s lifecycle signNowly impacts the overall performance of the company. With airSlate SignNow, signing your Student Accident Coverage is as straightforward and quick as possible. This platform provides you with the latest version of almost any form. Even better, you can sign it immediately without the need to install any external applications on your computer or print anything as physical copies.

Steps to obtain and sign your Student Accident Coverage

- Explore our collection by category or utilize the search bar to find the form you require.

- Review the form preview by clicking Learn more to confirm it is the correct one.

- Hit Get form to begin editing instantly.

- Fill out your form and include any necessary information using the toolbar.

- Once finished, click the Sign tool to authorize your Student Accident Coverage.

- Select the signature method that suits you best: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finalize editing and proceed to document-sharing options if needed.

With airSlate SignNow, you possess everything required to manage your documents effectively. You can search for, complete, edit, and even send your Student Accident Coverage in a single tab without any complications. Enhance your processes by utilizing one, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct 2015 2016 accident form

FAQs

-

How can I fill out the FY 2015-16 and 2016-17 ITR forms after the 31st of March 2018?

As you know the last date of filling income tax retruns has been gone for the financial year 2015–16 and 2016–17. and if you haven’t done it before 31–03–2018. then i don’t think it is possible according to the current guidlines of IT Department. it may possible that they can send you the notice to answer for not filling the retrun and they may charge penalty alsoif your income was less than taxable limit then its ok it is a valid reson but you don’t need file ITR for those years but if your income was more than the limit then, i think you have to write the lette to your assessing officer with a genuine reason that why didn’t you file the ITR.This was only suggestion not adviceyou can also go through the professional chartered accountant

-

How do I fill out 2016 ITR form?

First of all you must know about all of your sources of income. In Indian Income Tax Act there are multiple forms for different types of sources of Income. If you have only salary & other source of income you can fill ITR-1 by registering your PAN on e-Filing Home Page, Income Tax Department, Government of India after registration you have to login & select option fill ITR online in this case you have to select ITR-1 for salary, house property & other source income.if you have income from business & profession and not maintaining books & also not mandatory to prepare books & total turnover in business less than 1 Crores & want to show profit more than 8% & if you are a professional and not required to make books want to show profit more than 50% of receipts than you can use online quick e-filling form ITR-4S i.s. for presumptive business income.for other source of income there are several forms according to source of income download Excel utility or JAVA utility form e-Filing Home Page, Income Tax Department, Government of India fill & upload after login to your account.Prerequisite before E-filling.Last year return copy (if available)Bank Account number with IFSC Code.Form 16/16A (if Available)Saving Details / Deduction Slips LIC,PPF, etc.Interest Statement from Banks or OthersProfit & Loss Account, Balance Sheet, Tax Audit Report only if filling ITR-4, ITR-5, ITR-6, ITR-7.hope this will help you in case any query please let me know.

-

How do I fill the form for my CBSE Improvement form for class 12th, CBSE 2015-2016?

first of all.....improvement exams will be conducted next year for those students who have appeared this year for 12th exam and feel like they can perform better if given one more chance. As exam will be next year you need not to worry now, about forms ....wait till the results.In August or september..just visit regional office of (In your area).Ask them for form for improvement,it is free of cost.Fill the form,you will require to submit fee for appearing in papers through demand draft(dd).submit your form there at cbse office and you are done.Wait till march when you will receive your admit card along with name of your centre ....give exam there with other regular board students ..and thats it...If you have further queries,ask me for my contact number.Happy to help…...please ignore grammatical mistake....good luck

-

How should I fill this contract form "Signed this... day of..., 2016"?

I agree that you need to have the document translated to your native language or read to you by an interpreter.

Create this form in 5 minutes!

How to create an eSignature for the 2015 2016 accident form

How to make an electronic signature for the 2015 2016 Accident Form online

How to make an eSignature for the 2015 2016 Accident Form in Google Chrome

How to generate an electronic signature for putting it on the 2015 2016 Accident Form in Gmail

How to create an eSignature for the 2015 2016 Accident Form right from your smart phone

How to create an eSignature for the 2015 2016 Accident Form on iOS devices

How to make an electronic signature for the 2015 2016 Accident Form on Android

People also ask

-

What is Student Accident Coverage and who needs it?

Student Accident Coverage is a type of insurance designed to protect students from the financial impact of accidental injuries that occur during school activities. This coverage is essential for parents and guardians who want to ensure that their children are protected while participating in sports, field trips, and other school-related events.

-

How much does Student Accident Coverage cost?

The cost of Student Accident Coverage can vary based on several factors, including the level of coverage chosen and the number of students enrolled. Typically, prices range from affordable monthly premiums to annual plans, making it a cost-effective solution for parents looking to safeguard their children.

-

What benefits does Student Accident Coverage offer?

Student Accident Coverage offers numerous benefits, including medical expense reimbursement, coverage for accidental death, and support for rehabilitation services. These benefits ensure that students receive the necessary care and support without placing a financial burden on families.

-

Does Student Accident Coverage cover sports injuries?

Yes, Student Accident Coverage specifically includes injuries that occur during sports activities. This means that if a student is injured while participating in school sports, the coverage will help cover medical expenses, ensuring that they receive the appropriate treatment.

-

Can I customize my Student Accident Coverage plan?

Absolutely! Many providers offer customizable Student Accident Coverage plans that allow you to choose the level of coverage that best fits your needs. You can select options such as higher coverage limits, additional accidental death benefits, or specific exclusions tailored to your child's activities.

-

How can I quickly file a claim for Student Accident Coverage?

Filing a claim for Student Accident Coverage is typically a straightforward process. Most insurance providers offer online claim submission, where you can easily fill out the necessary forms and upload required documentation, ensuring a quick response to your claim.

-

Is Student Accident Coverage necessary if my child has health insurance?

While health insurance provides essential coverage, Student Accident Coverage offers additional protection specifically for school-related injuries. This specialized coverage can help cover gaps that health insurance may not address, such as deductibles and out-of-pocket expenses.

Get more for Student Accident Coverage

- Innihaldslisti og flutningsfyrirmli packing list and eimskip form

- City of hayward rent review office tenant petition hayward ca form

- Fillable letter of authorization by owner form

- Morning jumpstarts math grade 3 by martin leemarcia miller form

- Contractor qualifier agreement template form

- Web maintenance contract template form

- Web service contract template form

- Front end engineer design contract template form

Find out other Student Accident Coverage

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe

- Sign Kentucky Real Estate Warranty Deed Myself

- Sign Louisiana Real Estate LLC Operating Agreement Myself

- Help Me With Sign Louisiana Real Estate Quitclaim Deed

- Sign Indiana Sports Rental Application Free

- Sign Kentucky Sports Stock Certificate Later

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer