Beneficiary TransferDistribution Request Form 2024-2026

What is the Beneficiary Transfer Distribution Request Form

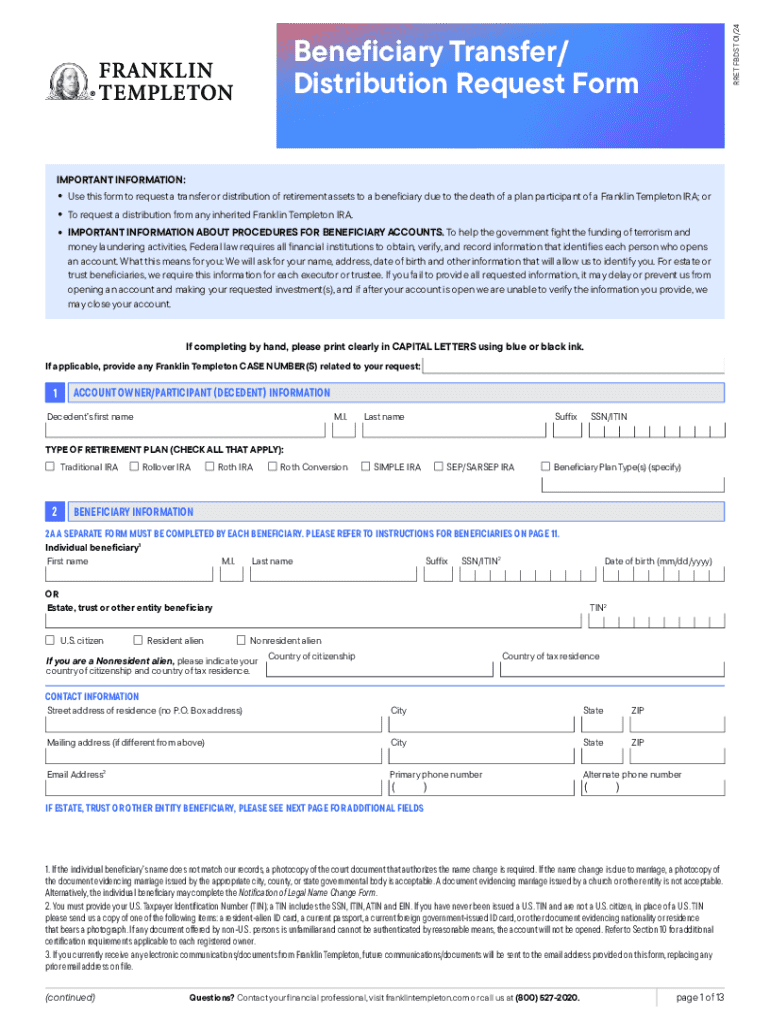

The Franklin Templeton beneficiary transfer distribution request form is a crucial document used by beneficiaries to request the transfer of assets from a deceased individual's investment account. This form facilitates the distribution of funds to the rightful beneficiaries as designated in the deceased's estate plan. It is essential for ensuring that the transfer process adheres to legal requirements and accurately reflects the wishes of the deceased.

How to use the Beneficiary Transfer Distribution Request Form

To effectively use the Franklin Templeton beneficiary transfer distribution request form, beneficiaries must first obtain the form from the official Franklin Templeton website or customer service. After acquiring the form, beneficiaries should fill it out with accurate information, including the account number, the deceased's details, and the beneficiary's information. Once completed, the form must be submitted according to the instructions provided, either online or via mail, to initiate the asset transfer process.

Steps to complete the Beneficiary Transfer Distribution Request Form

Completing the beneficiary transfer distribution request form involves several important steps:

- Gather necessary information, including the deceased's account details and personal identification.

- Carefully fill out the form, ensuring all fields are completed accurately.

- Review the form for any errors or omissions.

- Sign and date the form as required.

- Submit the form through the specified method, whether online or by mail.

Required Documents

When submitting the Franklin Templeton beneficiary transfer distribution request form, beneficiaries must include several key documents to support their request. These typically include:

- A copy of the death certificate of the deceased.

- Proof of identity for the beneficiary, such as a government-issued ID.

- Any relevant legal documents, such as a will or trust, that designate the beneficiary.

Form Submission Methods

The beneficiary transfer distribution request form can be submitted through various methods to accommodate different preferences. Beneficiaries may choose to:

- Submit the form online through the Franklin Templeton website, if available.

- Mail the completed form to the designated address provided on the form.

- Deliver the form in person at a local Franklin Templeton office, if applicable.

Legal use of the Beneficiary Transfer Distribution Request Form

The legal use of the Franklin Templeton beneficiary transfer distribution request form is vital for ensuring compliance with estate laws. This form serves as a formal request for the distribution of assets, and its proper completion and submission help protect the rights of beneficiaries. It is important for beneficiaries to understand that incomplete or incorrect forms may lead to delays or complications in the transfer process.

Quick guide on how to complete beneficiary transferdistribution request form

Prepare Beneficiary TransferDistribution Request Form effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides you with all the resources required to generate, modify, and electronically sign your documents swiftly without delays. Handle Beneficiary TransferDistribution Request Form on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign Beneficiary TransferDistribution Request Form effortlessly

- Locate Beneficiary TransferDistribution Request Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Choose how you want to submit your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and eSign Beneficiary TransferDistribution Request Form and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct beneficiary transferdistribution request form

Create this form in 5 minutes!

How to create an eSignature for the beneficiary transferdistribution request form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the franklin templeton beneficiary transfer distribution request form?

The franklin templeton beneficiary transfer distribution request form is a document used to initiate the transfer of benefits from a Franklin Templeton account to designated beneficiaries. This form ensures that the distribution process is handled efficiently and in accordance with the account holder's wishes.

-

How do I complete the franklin templeton beneficiary transfer distribution request form?

To complete the franklin templeton beneficiary transfer distribution request form, you will need to provide your account information, details of the beneficiaries, and any required signatures. Make sure to review the form for accuracy before submission to avoid delays in processing.

-

What are the benefits of using the franklin templeton beneficiary transfer distribution request form?

Using the franklin templeton beneficiary transfer distribution request form simplifies the process of transferring benefits to your heirs. It ensures that your beneficiaries receive their entitled distributions promptly and helps prevent any potential disputes regarding the distribution of your assets.

-

Is there a fee associated with the franklin templeton beneficiary transfer distribution request form?

Typically, there are no fees associated with submitting the franklin templeton beneficiary transfer distribution request form. However, it is advisable to check with Franklin Templeton for any specific conditions or potential fees that may apply to your account.

-

Can I submit the franklin templeton beneficiary transfer distribution request form online?

Yes, you can submit the franklin templeton beneficiary transfer distribution request form online through the Franklin Templeton website. This online submission process is designed to be user-friendly and secure, allowing for quick and efficient processing of your request.

-

What information do I need to provide on the franklin templeton beneficiary transfer distribution request form?

When filling out the franklin templeton beneficiary transfer distribution request form, you will need to provide your personal information, account details, and the names and contact information of your beneficiaries. Ensure that all information is accurate to facilitate a smooth transfer process.

-

How long does it take to process the franklin templeton beneficiary transfer distribution request form?

The processing time for the franklin templeton beneficiary transfer distribution request form can vary, but it typically takes a few business days. Factors such as the completeness of the form and the volume of requests being processed may affect the timeline.

Get more for Beneficiary TransferDistribution Request Form

- Wellmark subrogation department form

- Electronic fund transfer eft direct deposit authorization form afspa

- Prior authorization request form truescripts

- Patient demographic sheet form

- Life insurance policy form

- Cvs caremark prescription reimbursement claim form

- 6370 14423 ibm 1011 form

- Los robles hospital volunteer form

Find out other Beneficiary TransferDistribution Request Form

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe