Expiration of Work Opportunity Tax Credit Quarterly Report 2023-2026

Understanding the Expiration of Work Opportunity Tax Credit Quarterly Report

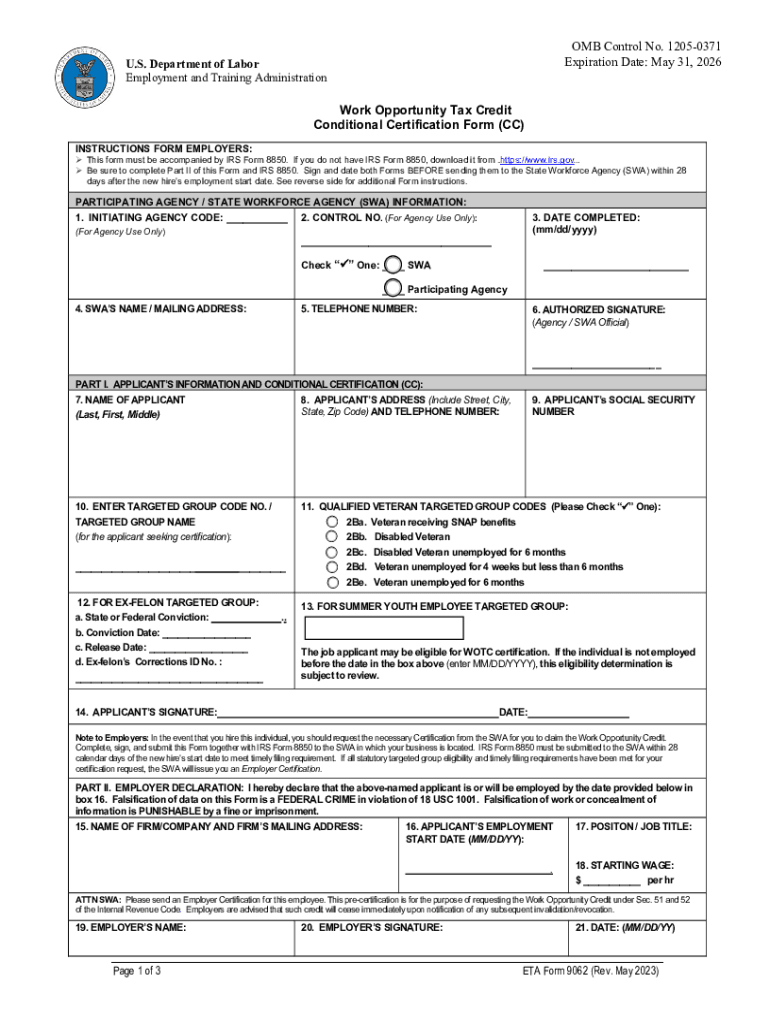

The Expiration of Work Opportunity Tax Credit Quarterly Report is a crucial document for businesses that wish to claim the Work Opportunity Tax Credit (WOTC). This report outlines the eligibility of employees hired during specific periods and ensures compliance with IRS regulations. The WOTC is designed to encourage the hiring of individuals from certain target groups who face barriers to employment. Understanding this report helps businesses maximize their tax benefits while adhering to legal requirements.

Steps to Complete the Expiration of Work Opportunity Tax Credit Quarterly Report

Completing the Expiration of Work Opportunity Tax Credit Quarterly Report involves several key steps:

- Gather necessary employee information, including names, Social Security numbers, and hire dates.

- Verify eligibility by checking if the employees belong to one of the designated target groups.

- Fill out the report accurately, ensuring all required fields are completed.

- Review the report for any errors or omissions before submission.

- Submit the report by the specified deadline to avoid penalties.

Eligibility Criteria for the Work Opportunity Tax Credit

To qualify for the Work Opportunity Tax Credit, employers must hire individuals from specific groups, including:

- Veterans

- Long-term unemployed individuals

- Individuals receiving public assistance

- Ex-felons

- Youth aged 16 to 24 who are residents of designated empowerment zones

Employers should ensure that their new hires meet these criteria to benefit from the tax credit.

Filing Deadlines and Important Dates

Timely filing of the Expiration of Work Opportunity Tax Credit Quarterly Report is essential. Key deadlines include:

- Quarterly reports must be submitted within 28 days after the end of each quarter.

- Employers should keep track of any changes in deadlines announced by the IRS.

Missing these deadlines can result in lost tax credits and potential penalties.

Required Documents for Submission

When preparing the Expiration of Work Opportunity Tax Credit Quarterly Report, employers should have the following documents ready:

- Employee records, including hire dates and eligibility documentation.

- Previous tax filings that may impact the current report.

- Any correspondence from the IRS regarding prior claims.

Having these documents on hand will streamline the reporting process and ensure compliance.

Legal Use of the Expiration of Work Opportunity Tax Credit Quarterly Report

The Expiration of Work Opportunity Tax Credit Quarterly Report must be used in accordance with IRS guidelines. Employers are legally required to:

- Ensure accuracy in reporting employee eligibility.

- Retain records for a minimum of four years in case of an audit.

- Submit reports in a timely manner to maintain compliance.

Failure to adhere to these legal requirements can result in penalties and loss of tax credits.

Quick guide on how to complete expiration of work opportunity tax credit quarterly report

Prepare Expiration Of Work Opportunity Tax Credit Quarterly Report effortlessly on any device

Managing documents online has gained signNow traction among companies and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your files promptly without delays. Manage Expiration Of Work Opportunity Tax Credit Quarterly Report on any platform using airSlate SignNow’s Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign Expiration Of Work Opportunity Tax Credit Quarterly Report with ease

- Locate Expiration Of Work Opportunity Tax Credit Quarterly Report and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or mask sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would like to send your form—via email, text message (SMS), or a shareable link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you prefer. Modify and eSign Expiration Of Work Opportunity Tax Credit Quarterly Report and assure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct expiration of work opportunity tax credit quarterly report

Create this form in 5 minutes!

How to create an eSignature for the expiration of work opportunity tax credit quarterly report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the eta 9062 form?

The eta 9062 form is a document used for various purposes, including verifying eligibility for certain programs. It is essential for businesses and individuals to understand its requirements to ensure compliance. Using airSlate SignNow, you can easily fill out and eSign the eta 9062 form, streamlining the process.

-

How can airSlate SignNow help with the eta 9062 form?

airSlate SignNow provides a user-friendly platform to create, send, and eSign the eta 9062 form efficiently. With its intuitive interface, you can quickly fill out the form and ensure all necessary fields are completed. This saves time and reduces the risk of errors in your submissions.

-

Is there a cost associated with using airSlate SignNow for the eta 9062 form?

Yes, airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan includes features that facilitate the eSigning and management of documents like the eta 9062 form. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for the eta 9062 form?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking for the eta 9062 form. These tools enhance your workflow and ensure that your documents are handled efficiently. Additionally, you can collaborate with team members in real-time.

-

Can I integrate airSlate SignNow with other applications for the eta 9062 form?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when handling the eta 9062 form. Whether you use CRM systems or cloud storage solutions, you can connect them seamlessly to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the eta 9062 form?

Using airSlate SignNow for the eta 9062 form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that your documents are signed and stored securely, giving you peace of mind. Additionally, it simplifies the entire process, making it accessible for everyone.

-

How secure is airSlate SignNow when handling the eta 9062 form?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your data when handling the eta 9062 form. Your documents are stored securely, and access is controlled to ensure confidentiality. This makes it a reliable choice for sensitive information.

Get more for Expiration Of Work Opportunity Tax Credit Quarterly Report

Find out other Expiration Of Work Opportunity Tax Credit Quarterly Report

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document