Representative Authority Purpose of This Form Retu

Understanding the Purpose of Form CS3042

The Representative Authority Purpose of Form CS3042 is designed to establish the authority of a designated representative to act on behalf of an individual or entity in specific matters. This form is essential for ensuring that the representative has the legal capacity to handle tasks such as filing documents, making decisions, and communicating with relevant authorities. By clearly outlining the powers granted, this form helps protect the interests of both the principal and the representative.

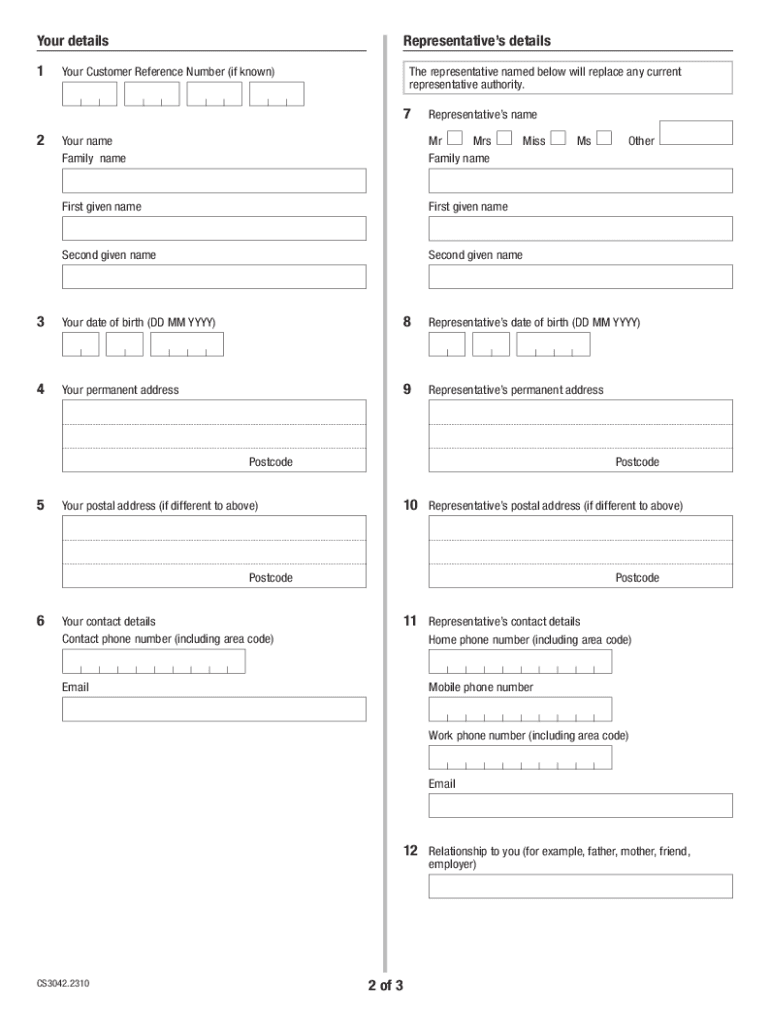

Steps to Complete Form CS3042

Completing Form CS3042 requires careful attention to detail. Begin by entering the full name and contact information of both the principal and the representative. Next, specify the scope of authority being granted, including any limitations or specific tasks the representative is authorized to perform. It is crucial to review the form for accuracy and completeness before signing. Finally, ensure that all parties involved sign and date the document to validate the agreement.

Legal Considerations for Form CS3042

Form CS3042 must comply with relevant legal standards to be enforceable. It is important to understand the jurisdiction in which the form will be used, as laws regarding representative authority can vary by state. The form should be executed in accordance with local regulations, which may include notarization or witness requirements. Failure to meet these legal standards can result in the form being deemed invalid, potentially leading to complications in representation.

Examples of Using Form CS3042

Form CS3042 can be utilized in various scenarios. For instance, a business owner may use this form to authorize an accountant to file tax returns on their behalf. Similarly, an individual may grant a family member the authority to handle medical decisions during a health crisis. These examples illustrate the versatility of the form in both personal and professional contexts, highlighting its importance in facilitating effective representation.

Required Documents for Form CS3042

When submitting Form CS3042, certain supporting documents may be required. These can include identification for both the principal and the representative, proof of the representative's qualifications if applicable, and any additional documentation that outlines the specific authority being granted. Ensuring that all required documents are included with the form submission can help avoid delays or complications in processing.

Submission Methods for Form CS3042

Form CS3042 can typically be submitted through various methods, including online, by mail, or in person. The preferred submission method may depend on the specific requirements of the authority receiving the form. It is advisable to check the guidelines provided by the relevant agency to determine the most appropriate submission method, ensuring timely processing of the form.

Eligibility Criteria for Using Form CS3042

To utilize Form CS3042, both the principal and the representative must meet certain eligibility criteria. The principal must have the legal capacity to grant authority, while the representative must be a competent individual or entity capable of fulfilling the responsibilities outlined in the form. Understanding these criteria is vital to ensure that the form is valid and that the representation is effective.

Quick guide on how to complete representative authority purpose of this form retu

Complete Representative Authority Purpose Of This Form Retu seamlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, adjust, and electronically sign your documents quickly and efficiently. Handle Representative Authority Purpose Of This Form Retu on any device with airSlate SignNow's Android or iOS applications and simplify any document-centered workflow today.

How to modify and eSign Representative Authority Purpose Of This Form Retu effortlessly

- Locate Representative Authority Purpose Of This Form Retu and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes moments and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to confirm your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the hassles of lost or misplaced files, tedious document searches, or errors that necessitate printing additional copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Edit and eSign Representative Authority Purpose Of This Form Retu and guarantee excellent communication at every phase of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the representative authority purpose of this form retu

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is cs3042 and how does it relate to airSlate SignNow?

cs3042 is a key feature of airSlate SignNow that enhances document management and eSigning capabilities. It allows users to streamline their workflows, making it easier to send and sign documents securely. By utilizing cs3042, businesses can improve efficiency and reduce turnaround times.

-

How much does airSlate SignNow cost with the cs3042 feature?

The pricing for airSlate SignNow with the cs3042 feature is competitive and designed to fit various business needs. Plans start at an affordable monthly rate, providing access to essential eSigning and document management tools. For detailed pricing, it's best to visit our website or contact our sales team.

-

What are the main features of airSlate SignNow's cs3042?

The cs3042 feature in airSlate SignNow includes advanced eSigning capabilities, customizable templates, and secure document storage. Additionally, it offers real-time tracking and notifications, ensuring that users stay informed throughout the signing process. These features collectively enhance productivity and user experience.

-

How can cs3042 benefit my business?

Implementing cs3042 through airSlate SignNow can signNowly benefit your business by reducing paperwork and speeding up the signing process. It allows for seamless collaboration among team members and clients, ultimately leading to faster decision-making. This efficiency can translate into cost savings and improved customer satisfaction.

-

Does airSlate SignNow with cs3042 integrate with other software?

Yes, airSlate SignNow with cs3042 offers integrations with various popular software applications, including CRM and project management tools. This allows businesses to create a cohesive workflow that enhances productivity. Integrating cs3042 with your existing systems can streamline processes and improve data accuracy.

-

Is cs3042 secure for handling sensitive documents?

Absolutely, cs3042 in airSlate SignNow is designed with security in mind. It employs advanced encryption and compliance with industry standards to protect sensitive documents during the signing process. Users can trust that their data is secure while utilizing the cs3042 feature.

-

Can I customize my documents using cs3042 in airSlate SignNow?

Yes, cs3042 allows users to customize documents easily within airSlate SignNow. You can create templates, add fields, and tailor the signing experience to meet your specific needs. This flexibility ensures that your documents align with your brand and operational requirements.

Get more for Representative Authority Purpose Of This Form Retu

- Real estate office policy manual template 100073588 form

- Clickit realty reviews 48848923 form

- Ct600 2018 company tax return ct600 2018 company tax return form

- Title 24 california energy code compliance at each construction form

- Under federal fmla employees are entitled to take ctgov form

- New voter form

- Application for permit driver license or non driver id card permit driver license or non driver id application form

- Hsbc account opening form 12005958

Find out other Representative Authority Purpose Of This Form Retu

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF