How to File a Final Tax Return for Someone Who Has Passed Away Form

Understanding the Final Tax Return for Deceased Individuals

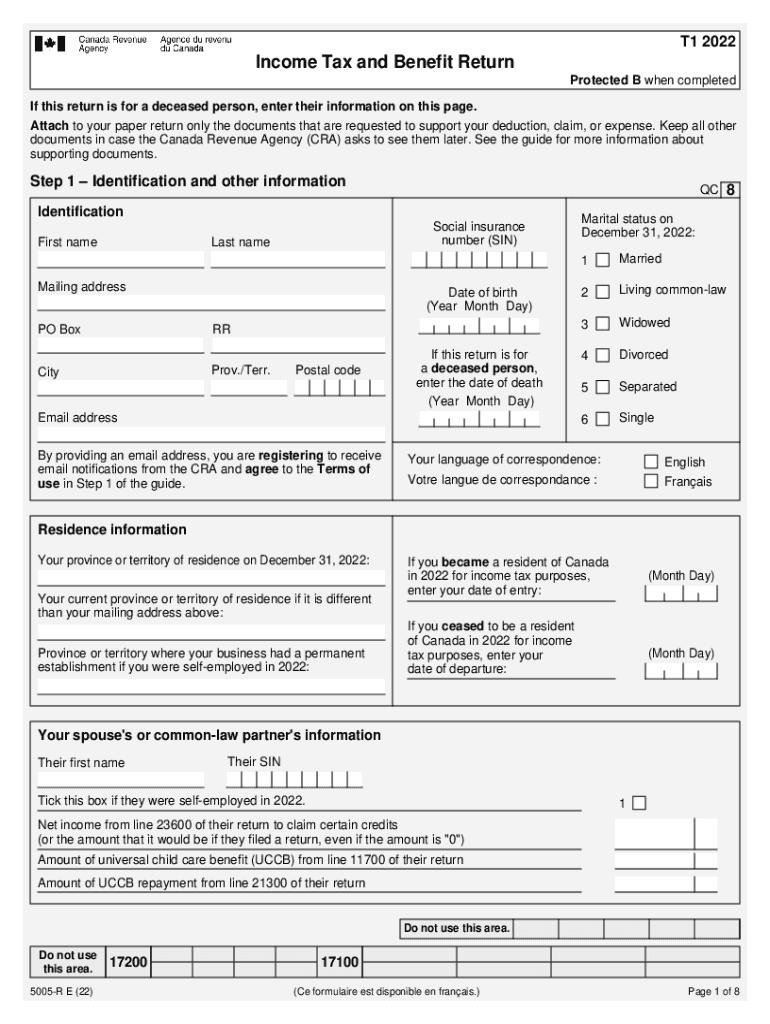

The final tax return for someone who has passed away is a crucial document that must be filed to settle the deceased's financial obligations. This return covers the income earned from January 1 of the year of death until the date of death. It is typically filed using Form 1040, the standard individual income tax return form. The executor or administrator of the estate is responsible for filing this return on behalf of the deceased.

Steps to Complete the Final Tax Return

Filing a final tax return involves several steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Determine the date of death, as this will affect the filing period.

- Complete Form 1040, ensuring all income is reported accurately.

- Claim any deductions or credits the deceased was eligible for.

- Sign the return as the executor or administrator, indicating your role.

- File the return by the tax deadline, which is typically April 15 of the following year.

Required Documents for Filing

To file a final tax return, you will need specific documents:

- Death certificate to verify the date of death.

- Income statements such as W-2s and 1099s for the year of death.

- Records of any deductions or credits that may apply.

- Previous tax returns, if available, to ensure consistency in reporting.

Filing Deadlines and Important Dates

It is essential to adhere to specific deadlines when filing a final tax return. Generally, the return must be filed by April 15 of the year following the individual's death. If the date falls on a weekend or holiday, the deadline may be extended. Failure to file on time can result in penalties and interest on any taxes owed.

IRS Guidelines for Final Tax Returns

The IRS provides specific guidelines for filing final tax returns for deceased individuals. These include instructions on how to report income, claim deductions, and address any tax liabilities. It is important to follow these guidelines closely to avoid issues with the IRS and ensure compliance with tax laws.

Penalties for Non-Compliance

Failure to file a final tax return or inaccuracies in reporting can lead to significant penalties. The IRS may impose fines for late filing, and interest will accrue on any unpaid taxes. Additionally, the executor or administrator may be held personally liable for any taxes owed by the estate if proper procedures are not followed.

Quick guide on how to complete how to file a final tax return for someone who has passed away

Effortlessly Prepare How To File A Final Tax Return For Someone Who Has Passed Away on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the resources necessary to create, edit, and electronically sign your documents quickly and without delays. Handle How To File A Final Tax Return For Someone Who Has Passed Away on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to Edit and eSign How To File A Final Tax Return For Someone Who Has Passed Away with Ease

- Obtain How To File A Final Tax Return For Someone Who Has Passed Away and click Get Form to begin.

- Use the tools we provide to complete your document.

- Mark important sections of your documents or redact sensitive information using tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes just seconds and carries the same legal significance as a traditional handwritten signature.

- Verify the details and click the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign How To File A Final Tax Return For Someone Who Has Passed Away and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the how to file a final tax return for someone who has passed away

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the income tax benefit return download feature in airSlate SignNow?

The income tax benefit return download feature in airSlate SignNow allows users to easily download their completed tax documents. This feature ensures that all necessary forms are readily accessible for filing, making tax season less stressful. With our user-friendly interface, you can manage your documents efficiently.

-

How does airSlate SignNow help with income tax benefit return downloads?

airSlate SignNow streamlines the process of preparing and downloading your income tax benefit return. Our platform allows you to eSign documents securely and download them in various formats. This ensures that you have all your tax documents organized and ready for submission.

-

Is there a cost associated with the income tax benefit return download feature?

The income tax benefit return download feature is included in our affordable pricing plans. We offer various subscription options to fit different business needs, ensuring that you get the best value for your investment. You can choose a plan that suits your requirements without compromising on features.

-

Can I integrate airSlate SignNow with other tax software for income tax benefit return downloads?

Yes, airSlate SignNow offers integrations with popular tax software, enhancing your experience with income tax benefit return downloads. This allows for seamless data transfer and document management, making it easier to handle your tax filings. Our integrations ensure that you can work efficiently across platforms.

-

What are the benefits of using airSlate SignNow for income tax benefit return downloads?

Using airSlate SignNow for your income tax benefit return downloads provides numerous advantages, including time savings and enhanced security. Our platform ensures that your documents are stored safely and can be accessed anytime. Additionally, the eSigning feature speeds up the approval process, allowing for quicker tax submissions.

-

How secure is the income tax benefit return download process?

The income tax benefit return download process in airSlate SignNow is highly secure. We utilize advanced encryption and security protocols to protect your sensitive information. You can trust that your tax documents are safe while using our platform for downloads and eSigning.

-

Can I access my income tax benefit return downloads from any device?

Absolutely! airSlate SignNow allows you to access your income tax benefit return downloads from any device with internet connectivity. Whether you're using a computer, tablet, or smartphone, you can manage and download your tax documents on the go. This flexibility ensures that you can handle your taxes anytime, anywhere.

Get more for How To File A Final Tax Return For Someone Who Has Passed Away

Find out other How To File A Final Tax Return For Someone Who Has Passed Away

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe