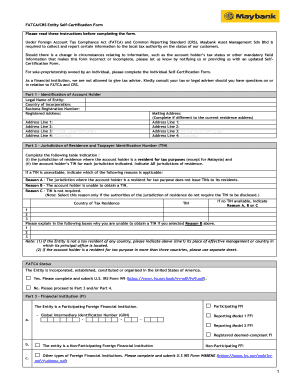

FATCACRS Entity Self Certification Form

What is the FATCA CRS Entity Self Certification Form

The FATCA CRS Entity Self Certification Form is a crucial document used by entities to certify their status for tax purposes under the Foreign Account Tax Compliance Act (FATCA) and the Common Reporting Standard (CRS). This form helps financial institutions determine whether an entity is a U.S. person or a foreign entity. By completing this form, entities confirm their compliance with international tax regulations, ensuring transparency in financial transactions. It is essential for entities to understand their classification, as this affects their reporting obligations and potential withholding tax rates.

Steps to Complete the FATCA CRS Entity Self Certification Form

Completing the FATCA CRS Entity Self Certification Form involves several key steps:

- Identify the entity type: Determine whether the entity is a corporation, partnership, or other type of organization.

- Gather necessary information: Collect details such as the entity's legal name, address, and tax identification number.

- Determine tax residency: Identify the country or countries where the entity is considered a tax resident.

- Complete the form: Fill out the required sections accurately, providing all necessary information to avoid delays.

- Review and sign: Ensure all information is correct before signing the form to validate the certification.

Legal Use of the FATCA CRS Entity Self Certification Form

The legal use of the FATCA CRS Entity Self Certification Form is vital for compliance with U.S. tax laws and international agreements. Entities are required to submit this form to financial institutions to confirm their tax status. Failure to provide accurate information can result in penalties, including withholding taxes on certain payments. The form serves as a legal declaration, and entities must ensure that their submissions are truthful and complete to maintain compliance and avoid legal repercussions.

Required Documents for the FATCA CRS Entity Self Certification Form

To successfully complete the FATCA CRS Entity Self Certification Form, entities need to prepare several key documents:

- Legal entity formation documents, such as articles of incorporation or partnership agreements.

- Proof of tax residency, which may include tax identification numbers or certificates from tax authorities.

- Identification documents for authorized signatories, such as government-issued IDs.

- Any previous self-certification forms, if applicable, to ensure consistency in reporting.

Who Issues the FATCA CRS Entity Self Certification Form

The FATCA CRS Entity Self Certification Form is typically issued by financial institutions that require certification from their clients. These institutions include banks, investment firms, and insurance companies that must comply with FATCA and CRS regulations. Entities seeking to open accounts or establish financial relationships with these institutions will be asked to complete this form to confirm their tax status and ensure compliance with international reporting requirements.

Penalties for Non-Compliance with the FATCA CRS Entity Self Certification Form

Non-compliance with the FATCA CRS Entity Self Certification Form can lead to significant penalties for entities. These may include:

- Withholding taxes on U.S.-source income at a rate of thirty percent.

- Fines imposed by tax authorities for failure to report accurate information.

- Legal repercussions, including potential audits or investigations by tax authorities.

Entities must understand the importance of timely and accurate submissions to mitigate these risks and maintain compliance with tax regulations.

Quick guide on how to complete fatcacrs entity self certification form

Complete FATCACRS Entity Self Certification Form effortlessly on any device

Online document management has become popular with organizations and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage FATCACRS Entity Self Certification Form on any platform using airSlate SignNow's Android or iOS applications and streamline any document-based process today.

How to modify and eSign FATCACRS Entity Self Certification Form without hassle

- Obtain FATCACRS Entity Self Certification Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

No more lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign FATCACRS Entity Self Certification Form and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the fatcacrs entity self certification form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a self certification form?

A self certification form is a document that allows individuals or businesses to confirm their identity or financial status without the need for third-party verification. This form is essential for various applications, including loans and insurance, as it streamlines the process and reduces paperwork.

-

How can airSlate SignNow help with self certification forms?

airSlate SignNow provides a user-friendly platform to create, send, and eSign self certification forms efficiently. With our solution, you can easily customize your forms, ensuring they meet your specific requirements while maintaining compliance with legal standards.

-

Is there a cost associated with using airSlate SignNow for self certification forms?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Our cost-effective solution ensures that you can manage your self certification forms without breaking the bank, providing excellent value for your investment.

-

What features does airSlate SignNow offer for self certification forms?

airSlate SignNow includes features such as customizable templates, secure eSigning, and real-time tracking for self certification forms. These features enhance the efficiency of your document management process, making it easier to handle multiple forms simultaneously.

-

Can I integrate airSlate SignNow with other applications for self certification forms?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to streamline your workflow for self certification forms. Whether you use CRM systems or cloud storage solutions, our platform can connect with them to enhance your document management.

-

What are the benefits of using airSlate SignNow for self certification forms?

Using airSlate SignNow for self certification forms provides numerous benefits, including increased efficiency, reduced turnaround time, and enhanced security. Our platform ensures that your documents are handled securely while allowing you to focus on your core business activities.

-

How secure is the self certification form process with airSlate SignNow?

The self certification form process with airSlate SignNow is highly secure, utilizing advanced encryption and authentication measures. We prioritize the safety of your documents, ensuring that sensitive information remains protected throughout the signing process.

Get more for FATCACRS Entity Self Certification Form

- Place of record form

- Residential lease a pplication form

- Forms virginias judicial system

- Your selection form

- Rights of survivorship the home will pass to the survivor and will not be controlled by form

- Delaware will instructions form

- Spay and neuter program city of nederland form

- Wisconsin dept of revenue notice amountn due form

Find out other FATCACRS Entity Self Certification Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form

- How To Electronic signature Colorado Courts Word

- How To Electronic signature Colorado Courts Form

- How To Electronic signature Colorado Courts Presentation

- Can I Electronic signature Connecticut Courts PPT

- Can I Electronic signature Delaware Courts Document

- How Do I Electronic signature Illinois Courts Document

- How To Electronic signature Missouri Courts Word