Croydon Sutton Credit Union 2022-2026

Understanding the Croydon Sutton Credit Union

The Croydon Sutton Credit Union is a member-owned financial cooperative that provides a range of financial services to its members. This credit union focuses on promoting savings and providing affordable loans to individuals and families in the Croydon area. Members can benefit from lower interest rates on loans compared to traditional banks, making it an attractive option for those seeking to manage their finances more effectively.

How to Access Services at the Croydon Sutton Credit Union

Accessing services at the Croydon Sutton Credit Union is straightforward. Members can visit physical branches or use online platforms to manage their accounts. The credit union offers various services, including savings accounts, personal loans, and financial advice. Members can sign up for online banking to check balances, transfer funds, and apply for loans digitally, enhancing convenience and accessibility.

Eligibility Criteria for Membership

To become a member of the Croydon Sutton Credit Union, individuals must meet specific eligibility criteria. Typically, this includes residing or working in the Croydon area or being part of a related group or organization. Members may need to provide identification and proof of address during the application process. Understanding these criteria is essential for those looking to join and take advantage of the credit union's offerings.

Application Process for Loans

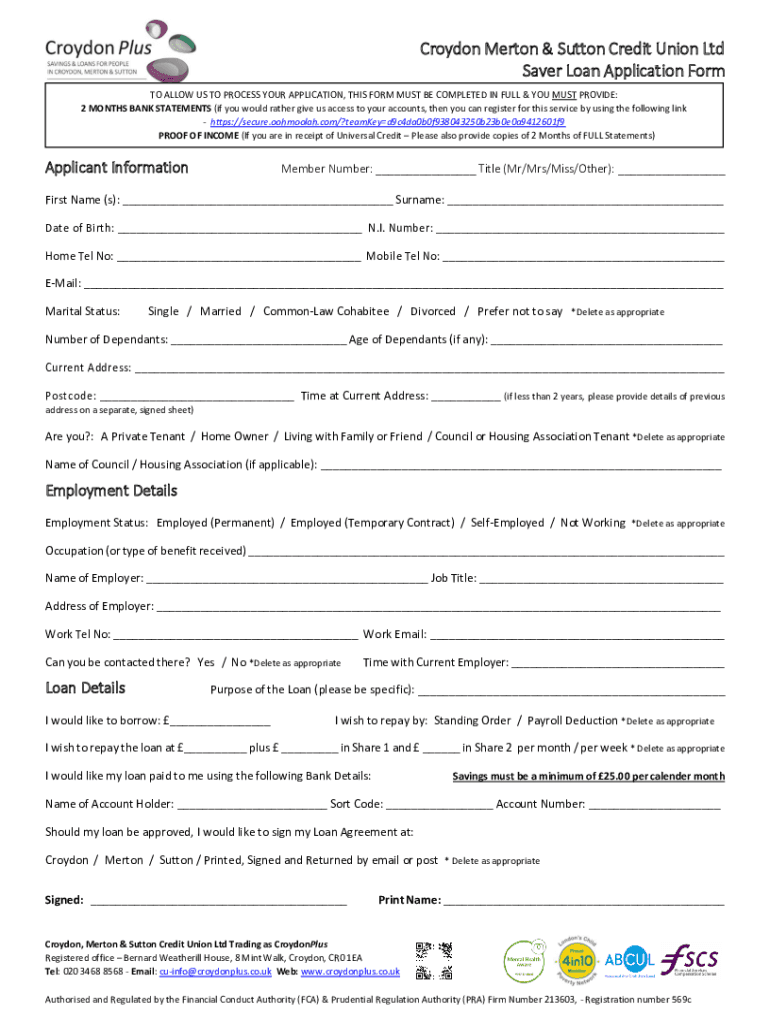

Applying for a loan through the Croydon Sutton Credit Union involves a clear and structured process. Members should first assess their financial needs and determine the type of loan that suits them best. The application can usually be completed online, requiring personal information, income details, and the purpose of the loan. After submission, the credit union reviews the application, and members can expect a response within a few days regarding approval and terms.

Required Documentation for Membership and Loans

When applying for membership or a loan at the Croydon Sutton Credit Union, specific documentation is necessary. This typically includes identification, proof of income, and proof of residence. For loans, additional information such as credit history may be requested. Having these documents ready can streamline the application process and improve the chances of approval.

Legal Considerations for Credit Union Operations

The Croydon Sutton Credit Union operates under specific legal frameworks that govern credit unions in the United States. These regulations ensure that member funds are protected and that the credit union adheres to fair lending practices. Understanding these legal aspects is vital for members, as it provides insight into their rights and responsibilities as part of the credit union community.

Examples of Financial Services Offered

The Croydon Sutton Credit Union provides a variety of financial services designed to meet the needs of its members. These include savings accounts, personal loans, and emergency loans. Additionally, members can access financial education resources to help them make informed decisions about their finances. By offering these services, the credit union aims to support its members' financial well-being and promote responsible borrowing and saving habits.

Quick guide on how to complete croydon sutton credit union

Prepare Croydon Sutton Credit Union seamlessly on any gadget

Digital document management has become popular among businesses and individuals alike. It offers an excellent eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides all the tools you require to create, edit, and electronically sign your documents swiftly without holdups. Handle Croydon Sutton Credit Union on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to edit and electronically sign Croydon Sutton Credit Union with ease

- Find Croydon Sutton Credit Union and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your alterations.

- Choose how you would like to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Croydon Sutton Credit Union to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct croydon sutton credit union

Create this form in 5 minutes!

How to create an eSignature for the croydon sutton credit union

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Croydon Credit Union?

The Croydon Credit Union is a community-based financial cooperative that offers savings and loan services to its members. It aims to provide affordable financial solutions while promoting responsible borrowing and saving habits. By joining the Croydon Credit Union, members can access various financial products tailored to their needs.

-

How can I become a member of the Croydon Credit Union?

To become a member of the Croydon Credit Union, you need to meet certain eligibility criteria, which typically include living or working in the Croydon area. You can apply online or visit their local branch to complete the membership application. Once approved, you can start enjoying the benefits of being a member.

-

What types of loans does the Croydon Credit Union offer?

The Croydon Credit Union offers a variety of loans, including personal loans, home improvement loans, and car loans. These loans are designed to be affordable and accessible, with competitive interest rates and flexible repayment terms. Members can apply for loans that suit their financial needs and goals.

-

What are the benefits of using the Croydon Credit Union?

Using the Croydon Credit Union provides numerous benefits, such as lower interest rates on loans, higher savings rates, and a focus on community support. Members also enjoy personalized service and financial education resources. Additionally, profits are reinvested into the community, making it a socially responsible choice.

-

Are there any fees associated with the Croydon Credit Union?

The Croydon Credit Union aims to keep fees minimal to benefit its members. While there may be some nominal fees for specific services, such as late payments or account maintenance, these are generally lower than those charged by traditional banks. It's best to review their fee schedule for detailed information.

-

How does the Croydon Credit Union ensure the security of my information?

The Croydon Credit Union prioritizes the security of its members' information by implementing robust security measures. This includes encryption technology, secure online banking practices, and regular security audits. Members can feel confident that their personal and financial data is protected.

-

Can I access my Croydon Credit Union account online?

Yes, the Croydon Credit Union offers online banking services that allow members to manage their accounts conveniently. You can check your balance, transfer funds, and apply for loans through their secure online platform. This feature enhances accessibility and makes banking easier for members.

Get more for Croydon Sutton Credit Union

- Urology pre surgery 1283 order form physician signature

- Additional details form 6 478788877

- Ps form 2181 d disclosure and authorization for consumer reports and investigative consumer reports

- Massanutten regional library form

- Animal license form animal license form

- Va form 28 1902w 779285100

- Rental registration application form

- Sa2 appeal form university of ulster ulster ac

Find out other Croydon Sutton Credit Union

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free