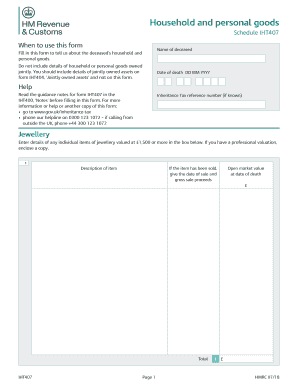

Iht407 Form

What is the Iht407

The Iht407 form is a crucial document used in the context of estate tax in the United States. It is specifically designed for reporting the value of an estate when someone passes away. This form is part of the process of calculating the inheritance tax owed by the estate. Understanding the Iht407 is essential for executors and administrators who are responsible for settling an estate, as it provides a comprehensive overview of the estate's assets and liabilities.

How to use the Iht407

Using the Iht407 form involves several steps to ensure accurate reporting of the estate's value. Executors must first gather all relevant financial information, including details about real estate, bank accounts, investments, and any outstanding debts. Once all information is compiled, the executor can fill out the form, detailing the assets and liabilities of the estate. It is important to be thorough and precise, as inaccuracies can lead to penalties or delays in processing.

Steps to complete the Iht407

Completing the Iht407 requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents related to the deceased's estate.

- List all assets, including real estate, personal property, and financial accounts.

- Document any liabilities, such as debts or outstanding taxes.

- Fill out the Iht407 form, ensuring all information is accurate and complete.

- Review the form for any errors before submission.

Legal use of the Iht407

The legal use of the Iht407 form is to comply with federal and state regulations regarding estate taxation. Executors must submit this form to the appropriate tax authorities to report the estate's value accurately. Failure to use the form correctly can result in legal complications, including fines or penalties. It is advisable to consult with a legal professional or tax advisor to ensure compliance with all relevant laws.

Required Documents

To complete the Iht407 form, several documents are typically required. These may include:

- The deceased's will or trust documents.

- Death certificate.

- Financial statements for all accounts and assets.

- Property deeds and titles.

- Documentation of any debts or liabilities.

Filing Deadlines / Important Dates

Filing the Iht407 form must be done within specific deadlines to avoid penalties. Generally, the form should be submitted within nine months of the date of death. However, extensions may be available under certain circumstances. It is essential to keep track of these dates to ensure compliance and avoid any unnecessary complications.

Quick guide on how to complete iht407 461109236

Effortlessly Prepare Iht407 on Any Device

The management of online documents has gained traction among companies and individuals alike. It serves as a perfect environmentally friendly substitute for conventional printed and signed papers, enabling you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, alter, and electronically sign your documents promptly and without interruption. Handle Iht407 on any device using the airSlate SignNow applications for Android or iOS, and enhance any document-driven task today.

The optimal method to modify and eSign Iht407 with ease

- Find Iht407 and click Get Form to begin.

- Utilize the tools available to submit your form.

- Emphasize pertinent sections of the documents or obscure confidential details with tools specifically designed by airSlate SignNow for that function.

- Generate your electronic signature using the Sign feature, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Revise and eSign Iht407 to ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the iht407 461109236

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is iht407 and how does it relate to airSlate SignNow?

The iht407 is a specific document type that can be efficiently managed using airSlate SignNow. This platform allows users to send, sign, and store iht407 documents securely, streamlining the entire process for businesses.

-

How much does airSlate SignNow cost for managing iht407 documents?

airSlate SignNow offers competitive pricing plans that cater to various business needs, including those requiring the management of iht407 documents. You can choose from monthly or annual subscriptions, ensuring you find a plan that fits your budget.

-

What features does airSlate SignNow provide for iht407 document management?

airSlate SignNow includes features such as customizable templates, real-time tracking, and secure eSigning for iht407 documents. These tools enhance efficiency and ensure compliance, making it easier for businesses to handle their documentation.

-

Can I integrate airSlate SignNow with other applications for iht407 processing?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to manage iht407 documents alongside your existing tools. This flexibility helps streamline workflows and enhances productivity.

-

What are the benefits of using airSlate SignNow for iht407 documents?

Using airSlate SignNow for iht407 documents provides numerous benefits, including reduced turnaround times and improved accuracy. The platform's user-friendly interface ensures that even those unfamiliar with digital signing can navigate it easily.

-

Is airSlate SignNow secure for handling sensitive iht407 documents?

Absolutely! airSlate SignNow employs advanced security measures to protect your iht407 documents. With encryption and secure cloud storage, you can trust that your sensitive information is safe from unauthorized access.

-

How can I get started with airSlate SignNow for iht407?

Getting started with airSlate SignNow for iht407 is simple. You can sign up for a free trial to explore the platform's features and see how it can benefit your business before committing to a subscription.

Get more for Iht407

- Request for hearing miami dade county 2018 2019 form

- 12 943 2015 2019 form

- I hereby grant authorization to form

- Instructions for florida supreme court approved family law forms 12931a notice of production from nonparty and 12931b subpoena

- Forms packet counterpetition florida 2015 2019

- No administration necessary 2016 2019 form

- Ils prob 48a request for net worth statement and financial records form

- Landlord tenant and michigan courts form

Find out other Iht407

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself